USDJPY declines amid increased investments in Japan

The USDJPY rate is undergoing a correction after rising for four trading sessions. Find out more in our analysis dated 3 September 2024.

USDJPY forecast: key trading points

- The market focuses on the upcoming US employment report

- US nonfarm payrolls are projected to rise by 160,000, and the unemployment rate is expected to decrease to 4.2%

- Japanese companies increased their capital spending by 7.4% in Q2 2024

- Japan’s investment indicator has been growing for the 13th consecutive month

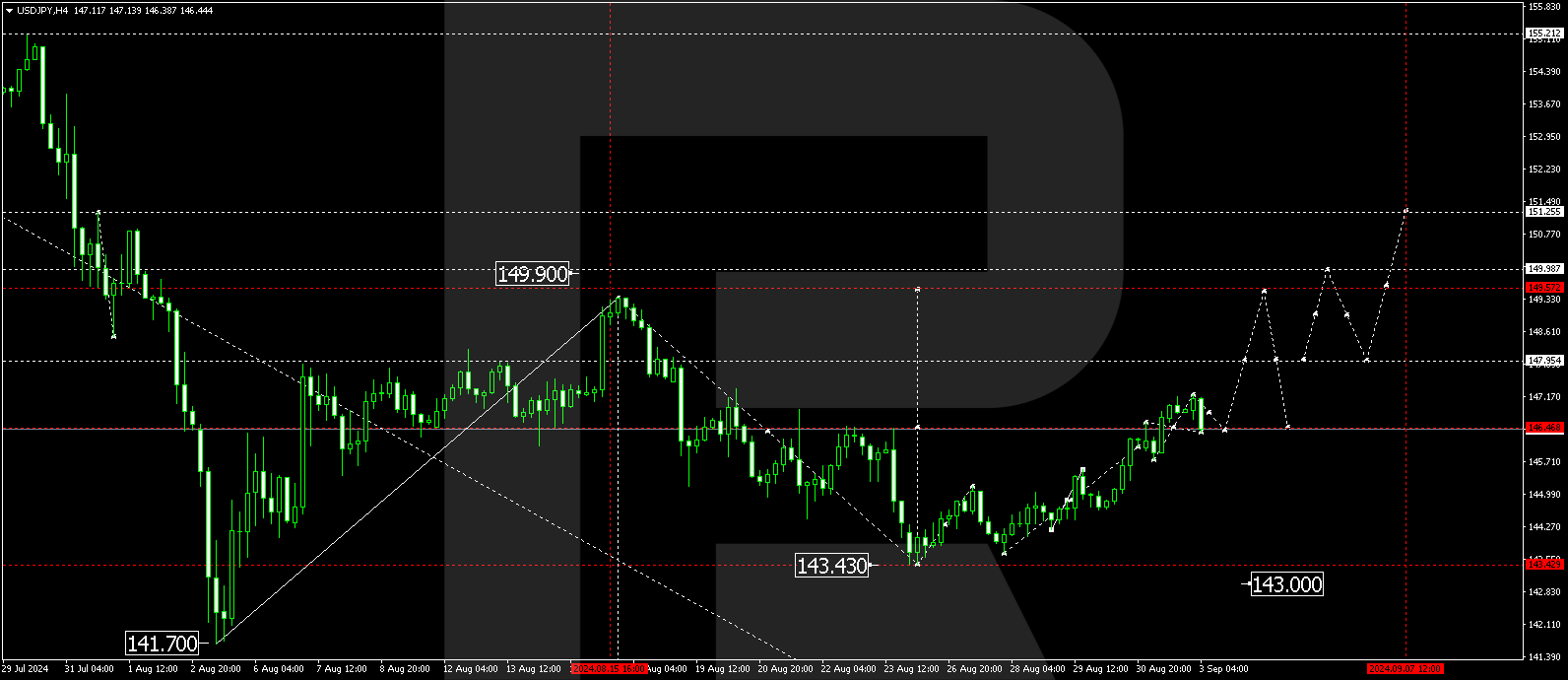

- USDJPY forecast for 3 September 2024: 143.00 and 140.50

Fundamental analysis

The USDJPY rate is hovering at 146.32. Driven by US inflation data, the pair had previously reached a weekly high, prompting traders to revise their expectations regarding the pace of the Federal Reserve’s interest rate cuts.

Markets are currently focused on the upcoming monthly US employment report, due on Friday. The Federal Reserve is increasingly shifting its focus from inflation to the employment market. Analysts predict that nonfarm payrolls will increase by 160,000 and the unemployment rate will decline to 4.2%.

If employment market expectations are met, the likelihood of a 25-basis-point interest rate cut will increase. However, if the employment data is weak (mainly if the NFP indicator falls below 130,000 and the unemployment rate grows concurrently), the market’s view may shift to a 50-basis-point reduction. According to today’s USDJPY forecast, a significant decrease in the US employment indicator may cause another wave of weakness in the currency pair.

Meanwhile, Japanese investors are analysing data on a 7.4% increase in capital spending by Japanese companies in Q2 2024. The indicator has been increasing for the 13th consecutive month. The au Jibun Bank manufacturing PMI also grew in August, reaching 49.8 points, up from 49.1 points a month ago. Monetary policy expectations remain unchanged: BoJ officials recently stated their readiness to raise interest rates if economic forecasts are realised. Such statements continue to support the Japanese yen.

USDJPY technical analysis

On the USDJPY H4 chart, the market has risen to 146.46. A consolidation range has formed around this level today, 3 September 2024. With a downward breakout of the range, the wave could continue to 144.87. A breakout below this level may signal a continuation of the trend towards the 143.00 and 140.50 levels. A breakout above the range will open the potential for a correction in the USDJPY rate towards 149.52. Once the correction is complete, a new downward wave could start, aiming for 137.77.

Summary

The USDJPY rate movements will depend on US employment data this week, with robust indicators able to strengthen the currency pair and weak ones able to push it further down. Steady investment growth in Japan and the possibility of a BoJ interest rate hike continue to provide additional support for the yen. Technical indicators in today’s USDJPY forecast suggest a potential decline to the 143.00 and 140.50 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.