USDJPY remains in a consolidation phase: the market is conserving strength

The USDJPY pair has remained within a sideways range for the fourth consecutive session. Investors have adopted a waiting mode as there has been no significant news. Find out more in our analysis dated 29 August 2024.

USDJPY forecast: key trading points

- The USDJPY pair has entered the boundaries of a sideways channel

- Investors are conserving strength until significant statistics are released

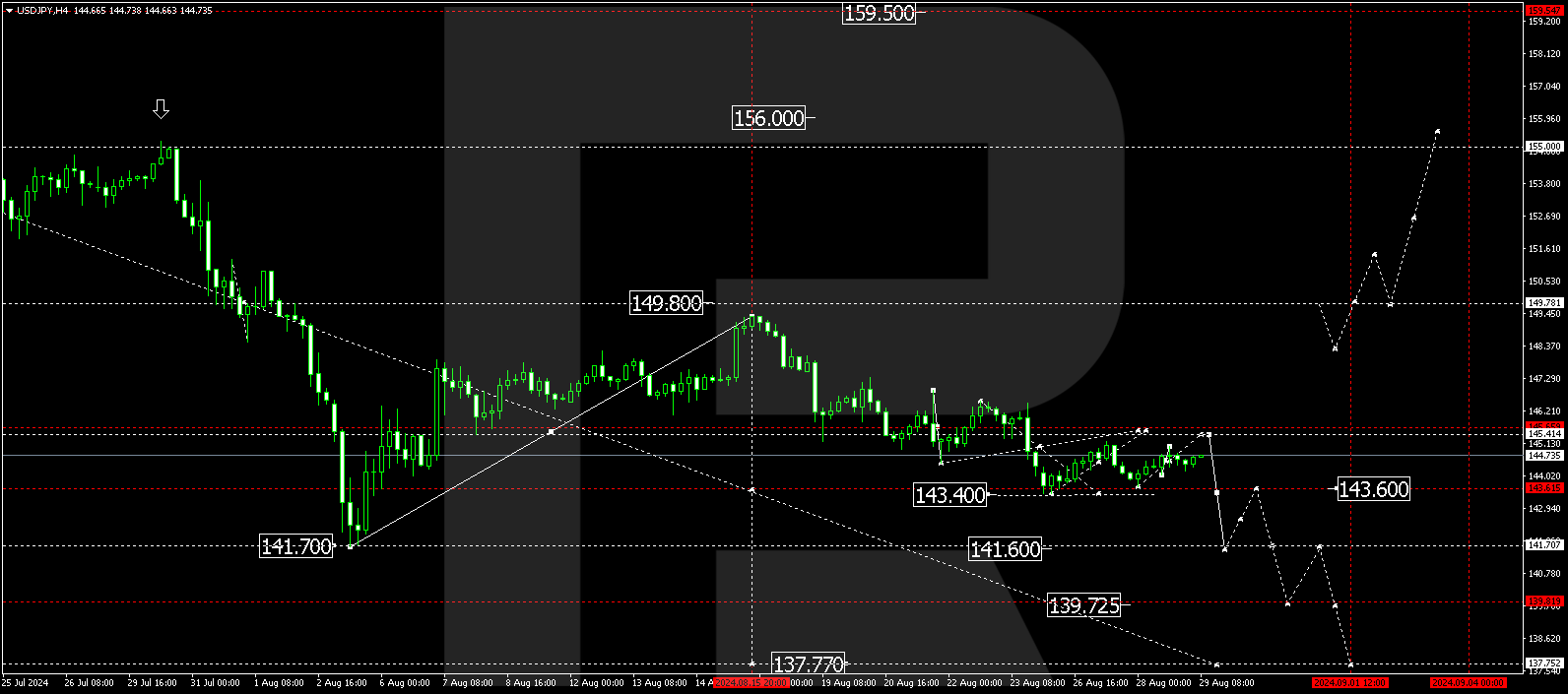

- USDJPY forecast for 29 August 2024: 141.60, 139.70 and 137.77

Fundamental analysis

The USDJPY rate is holding within a sideways channel near 144.68 on Thursday.

Market participants mostly believe that the yen’s strengthening trend will persist as the Bank of Japan seeks to raise interest rates. This will likely happen even before the end of the year.

Volatility in the USDJPY pair may resume next week due to an expected increase in information flow after the US holiday. The market will closely watch the August release of US employment sector reports. The baseline scenario suggests that nonfarm payrolls will increase by 163,000 while the unemployment rate will decrease to 4.2%.

However, before that, there are other factors to monitor. This Friday, the US will publish data on Americans’ income and spending and the core PCE index. The indicator is the Federal Reserve’s preferred gauge for the price environment in the country’s economy.

The USDJPY forecast indicates that the sideways trend will persist until tomorrow.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues developing a consolidated range around 145.70 without establishing a clear trend. The price could rise to 145.45 today, 29 August 2024. Subsequently, the range is expected to expand to 143.40. The market will remain within the given range. A breakout below the range could signal a downward wave continuing towards 141.60. A breakout below 143.40 may signal a continuation of the trend to the 141.60, 139.70, and 137.77 targets, with the latter remaining the main downtrend target for the USDJPY rate.

Summary

The USDJPY pair is consolidating while the news stream is limited, and the macroeconomic calendar is empty. Technical indicators in today’s USDJPY forecast suggest a potential decline to the 141.60, 139.70, and 137.77 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.