USDCHF under pressure ahead of US inflation data

The USDCHF rate is slightly correcting but remains within a descending channel. Discover more in our analysis for 10 September 2024.

USDCHF forecast: key trading points

- Traders’ focus remains on crucial US inflation data due on Wednesday and Thursday

- A potential interest rate cut at the upcoming Federal Reserve meeting will depend on incoming economic data

- According to CME FedWatch, 71% of traders expect a 25-basis-point interest rate cut, while 29% await a 50-basis-point cut

- USDCHF forecast for 10 September 2024: 0.8575

Fundamental analysis

The USDCHF rate is declining after strong growth on Monday due to the expectation of crucial US inflation data, which may provide insights into the Federal Reserve’s further actions on interest rate cuts.

This week, investors are focused on the August consumer price index data scheduled for release on Wednesday and producer price index data due on Thursday. These indicators will play a pivotal role in determining the Federal Reserve’s policy at the upcoming meeting and, according to today’s USDCHF forecast, may increase pressure on the US dollar.

Member of the Federal Reserve Board of Governors Christopher Waller emphasised last week that the time has come for interest rate cuts and expressed his willingness to support a significant reduction, if necessary.

Federal Reserve Bank of New York President John Williams added that future decisions will depend on incoming economic data.

According to CME FedWatch, traders currently estimate the likelihood of a 25-basis-point interest rate cut at 71%, while the possibility of a more significant 50-basis-point interest rate reduction is 29%.

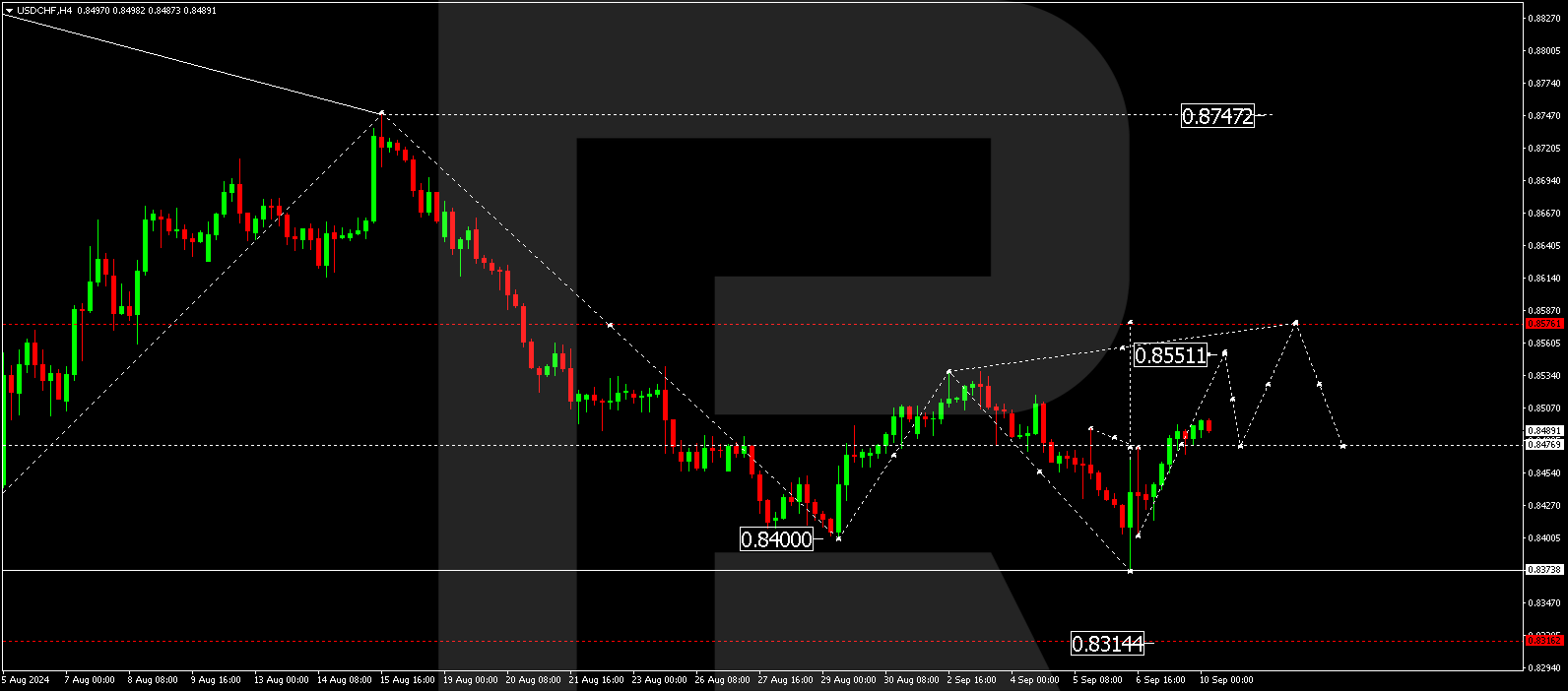

USDCHF technical analysis

The USDCHF H4 chart shows that the market is forming a consolidation range around 0.8477. The price could break above the 0.8500 level today, 10 September 2024. Breaking above the 0.8500 mark may be considered a signal for a further upward movement, opening the potential for a growth wave towards 0.8555. Once the price reaches this level, a correction could follow, aiming for 0.8484. Subsequently, the price might rise to 0.8575, the first target.

Summary

The USDCHF currency pair is under pressure due to expectations of crucial US inflation data, which may impact the Federal Reserve’s decision to cut interest rates. If indicators worsen, the likelihood of the US dollar weakening will increase. Technical indicators in today’s USDCHF forecast suggest potential further growth to 0.8575.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.