USDCHF: the US dollar awaits a chance to strengthen

The release of Switzerland’s CPI and GDP data and the US PMI data may help the US dollar strengthen its position. Find out more in our analysis dated 3 September 2024.

USDCHF forecast: key trading points

- Switzerland’s Consumer Price Index (m/m) for August: previously at -0.2%, projected at 0.1%

- Switzerland’s GDP (q/q): previously at 0.5%, projected at 0.5%

- US manufacturing PMI: previously at 49.6, projected at 48.0

- USDCHF forecast for 3 September 2024: 0.8572

Fundamental analysis

The Consumer Price Index reflects the dynamics of consumer prices for goods and services. Investors view a higher-than-expected reading as a positive factor for economic health, while a weaker-than-expected reading is considered negative.

For August, Switzerland’s Consumer Price Index (m/m) is projected to return to positive territory. The previous reading was -0.2%, while a forecast for 3 September 2024 is optimistic, suggesting 0.1%. A stronger-than-expected actual CPI reading may strengthen the Swiss franc.

GDP reflects the aggregate value of all goods and services produced in a country (only end products are considered, excluding the costs of raw materials). Switzerland releases quarterly GDP changes in percentage terms, demonstrating the economy’s comprehensive dynamics.

Analysis for 3 September 2024 suggests that the GDP reading may remain flat at 0.5%, and the actual figure will show whether expectations are realised. An increase in the indicator may help strengthen the Swiss franc against the US dollar, while a decrease in GDP will drive further growth in the USDCHF rate.

The US manufacturing PMI evaluates the activity of purchasing managers in the industrial sector, reflecting the state and the dynamics of industrial processes. According to a preliminary estimate, the index is expected to decrease to 48.0 points. Given that figures have been decreasing for the past several months, the actual reading in the current period may be equal to or below the projected value.

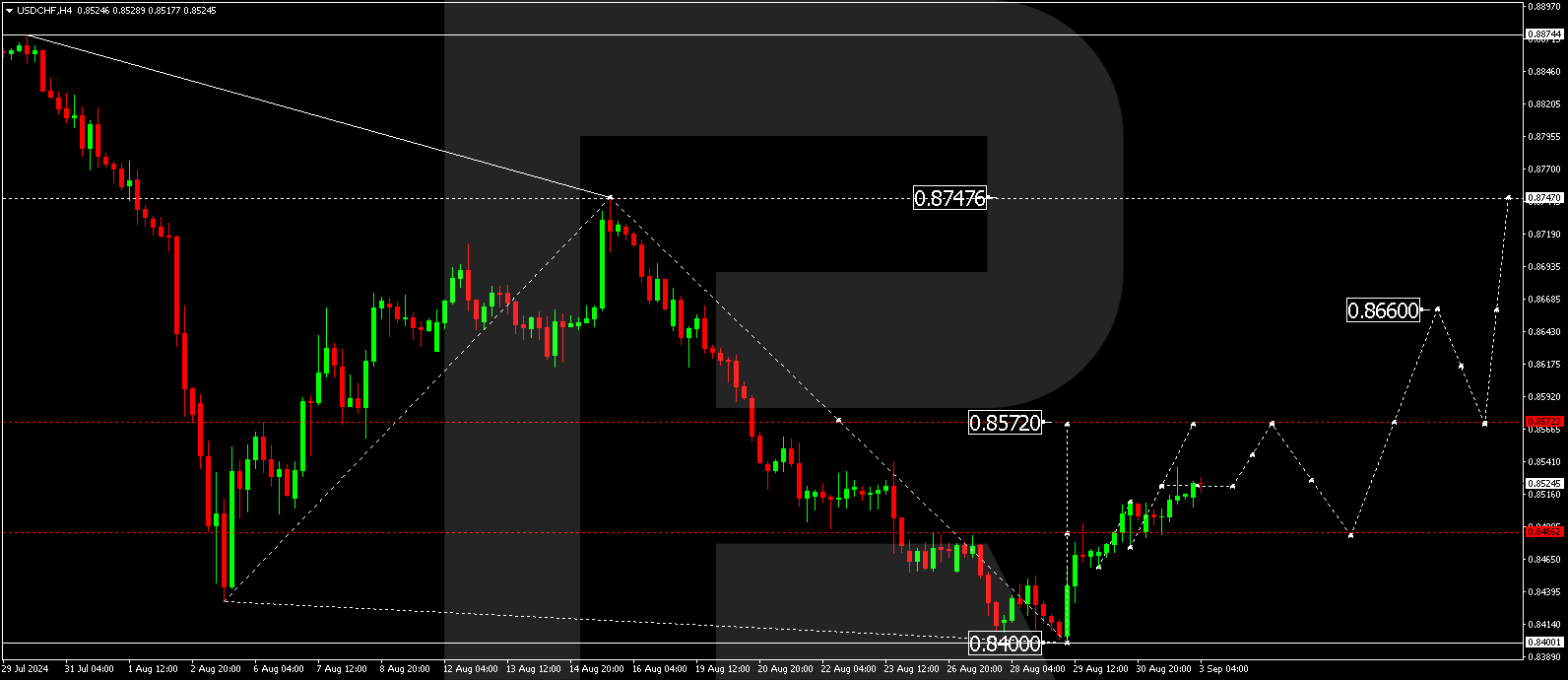

USDCHF technical analysis

The USDCHF H4 chart shows that the market has completed a growth impulse, reaching 0.8486. A consolidation range has formed around this level. The market broke above the range today, 3 September 2024. A breakout above the 0.8500 level may signal further growth. The potential for further movement towards the first target of 0.8572 is open. Once the price reaches this level, a corrective phase could follow, aiming for 0.8484 as the second target.

Summary

Fundamental data from Switzerland and the US (together with the USDCHF technical analysis in today’s USDCHF forecast) suggests that the growth wave could continue towards 0.8572.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.