USDCAD: all eyes are on the Bank of Canada’s interest rate decision

The Bank of Canada will release its monetary policy report and interest rate decision today. More details in our analysis for 23 October 2024.

USDCAD forecast: key trading points

- The release of the Bank of Canada monetary policy report

- The Bank of Canada interest rate decision: previously at 4.25%, projected at 3.75%

- The Bank of Canada management press conference

- USDCAD forecast for 23 October 2024: 1.3880

Fundamental analysis

Every quarter, the Bank of Canada provides its short-term monetary policy report, outlining the country’s current economic situation, describing a baseline inflation forecast and the outlook for the Canadian economy, and assessing risks associated with certain decisions on the country’s development. An optimistic Bank of Canada report typically has a positive but short-term impact on the USDCAD rate.

Fundamental analysis for 23 October 2024 suggests that the interest rate will be lowered to 3.75%. It has been gradually reduced over the past six months, so expectations are anticipated to align with the actual value.

Today’s USDCAD forecast suggests that the interest rate cut may not benefit the Canadian dollar, and the pair has every chance to rise further after a slight correction. The announcement of an interest rate decision may significantly increase volatility in the market.

Following the report release, the Bank of Canada management will hold a press conference to explain the factors that affected its decision, the future monetary policy directions, and the outlook for the Canadian economy.

USDCAD technical analysis

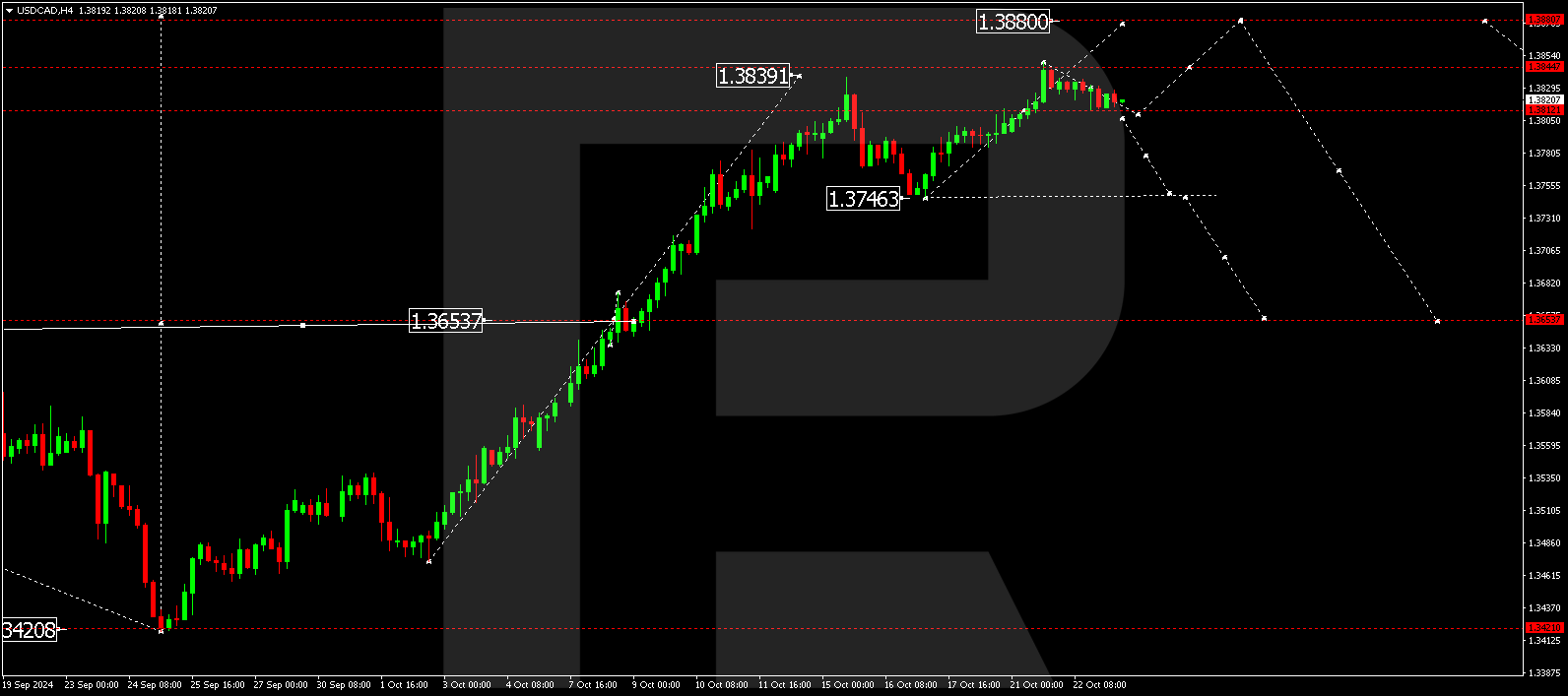

The USDCAD H4 chart shows that the market has completed a growth wave, reaching 1.3849. A correction towards 1.3812 (testing from above) has formed today, 23 October 2024, with a consolidation range formed around this level. The corrective wave could continue towards 1.3747 with a breakout below the range. Subsequently, another growth wave might develop, aiming for 1.3880. A breakout above the range will open the potential for continuing the trend towards 1.3880, the first target.

Summary

Coupled with the technical analysis for today’s USDCAD forecast, the Bank of Canada report and the value of the interest rate suggest that the growth wave could continue towards the 1.3880 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.