USDCAD: Canada’s inflation rate slows, but not for all goods and services

The USDCAD rate is slightly declining as part of a correction, targeting 1.3862. Discover more in our analysis for 16 October 2024.

USDCAD forecast: key trading points

- Canada’s consumer inflation (CPI) reached 1.6% y/y, below the expected 1.8%

- Consumer inflation fell by 0.4% m/m

- Canada’s core CPI rose by 1.6%, exceeding expectations of 1.5%

- USDCAD forecast for 16 October 2024: 1.3737 and 1.3705

Fundamental analysis

The USDCAD rate continues to correct after reaching 1.3674. The Canadian dollar fell to an eight-week low amid expectations of tighter Federal Reserve monetary policy, increasing pressure on the USDCAD pair. However, the latest US inflation data raised doubts about the Fed’s determination to tighten monetary policy.

The 1.6% year-on-year rise in inflation shows a slowdown from the previous 2.0%, signalling that inflationary pressures in Canada are easing due to the central bank’s policy. The 0.4% fall in consumer inflation in September indicates slower price growth for goods and services in the short term. This larger-than-expected decline (-0.2%) suggests a significant decrease in consumer demand and a substantial reduction in prices for core goods.

USDCAD technical analysis

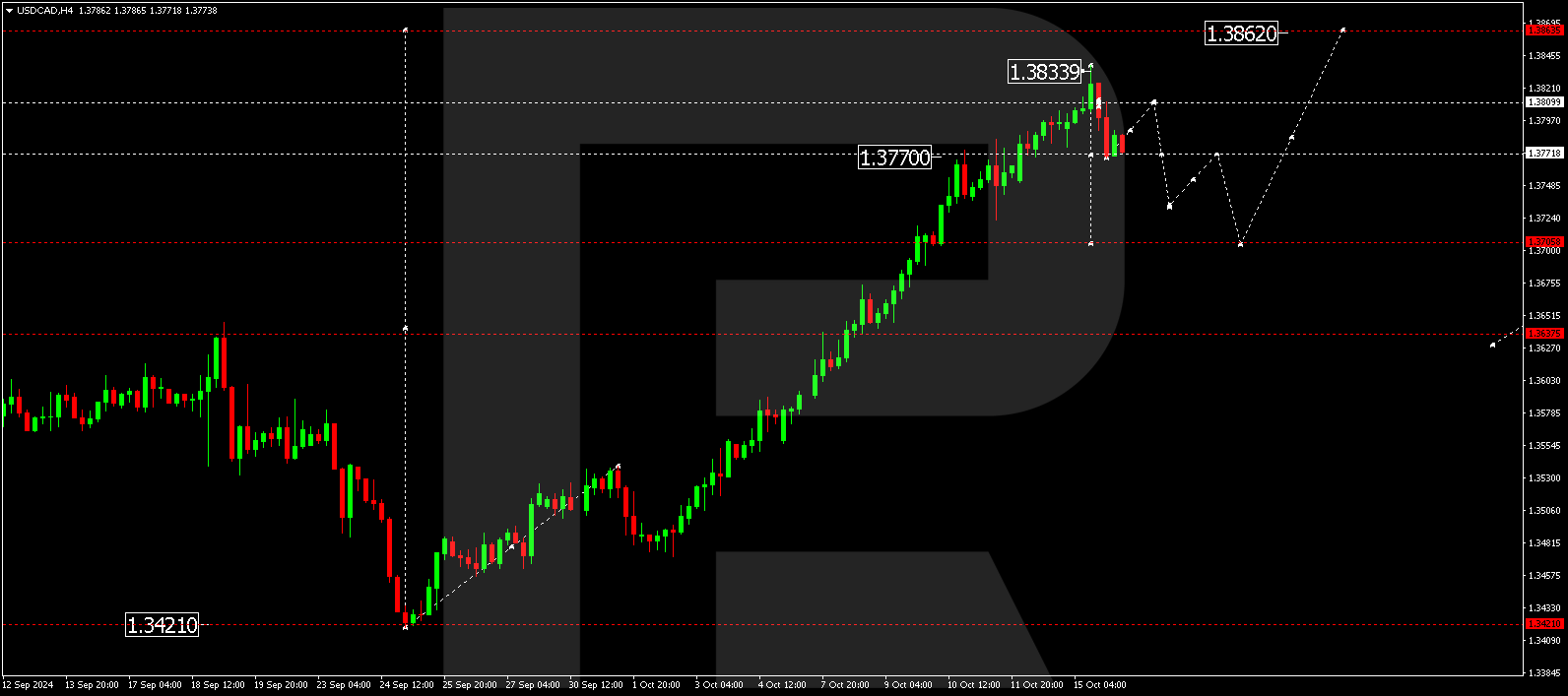

The USDCAD H4 chart shows that the market has declined to 1.3770. A correction is expected today, 16 October 2024, aiming for 1.3809 (testing from below). A consolidation range has formed within these levels. With a downward breakout, a corrective wave could continue towards 1.3705. Subsequently, another growth wave in the USDCAD rate might develop, targeting 1.3862. An upward breakout will open the potential for continuing the trend towards 1.3862, the first target.

Summary

Technical indicators in today’s USDCAD forecast suggest a possible correction towards the 1.3737 and 1.3705 levels. Canada’s inflation is easing due to the policy pursued by the country’s central bank. However, this may signal a potential economic recession overall.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.