USDCAD hits four-week low amid positive Chinese economic news

The USDCAD pair continues its downward trajectory, currently sitting at a four-week low, influenced by recent economic developments in China. Read more in our analysis for 25 September 2024.

USDCAD forecast: key trading points

- Continued weakness in USDCAD: the pair continues to decline, driven by external factors such as Chinese economic stimulus and recovering oil prices, both of which favour the Canadian dollar

- Support from China’s news: China’s recent stimulus measures have boosted the Canadian dollar, as they are likely to increase energy demand, particularly for oil, a major Canadian export

- USDCAD forecast for 25 September 2024: 1.3535 and 1.3311

Fundamental analysis

As of today, the USDCAD rate has dropped to 1.3428. This drop aligns with news from China, where stimulus measures positively affect risk sentiment and commodity prices, particularly oil, one of Canada’s primary exports. This has strengthened the CAD and overshadowed the softer outlook from the Bank of Canada (BoC).

The BoC’s recent signals of potential interest rate cuts add complexity. With inflation dropping to the 2% target, further rate reductions may be on the horizon, which would typically weaken the CAD. However, China’s economic measures appear to offset this, at least in the short term, keeping the CAD relatively strong.

The USDCAD forecast leans bearish, with buyers facing a challenging environment due to these macroeconomic factors.

USDCAD technical analysis

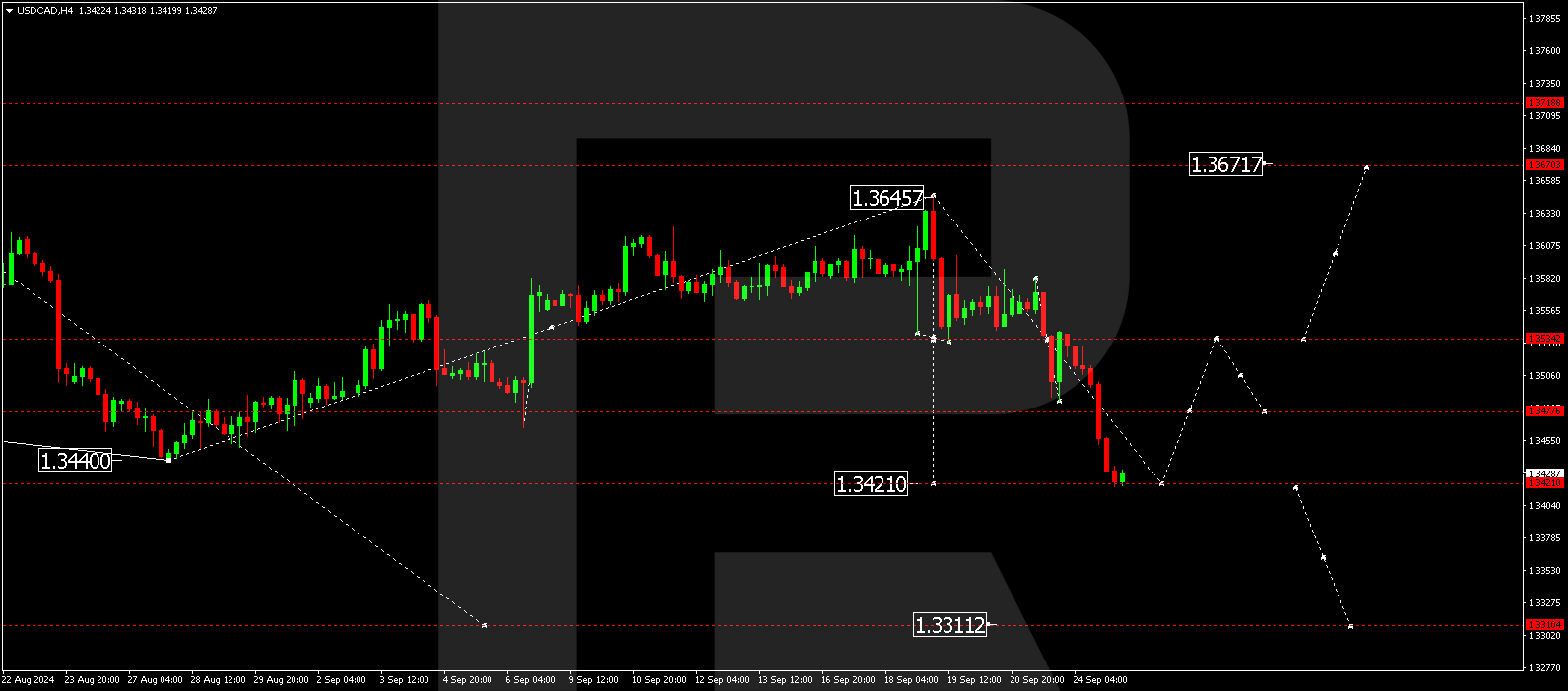

On the H4 chart of the USDCAD currency pair, the market has formed a consolidation range around the 1.3535 level and continues to develop a wave down to the 1.3421 level. The target is local. Today, 25 September 2024, we expect the market to reach this level and for a new consolidation range to form around it.

In the event of an upward breakout from this range, we will consider the probability of a correction towards 1.3535 (testing from below). If the range breaks to the downside, it opens the potential for a further downward wave towards 1.3311.

Summary

The USDCAD pair remains under pressure, having hit a four-week low. Today’s USDCAD forecast suggests a potential corrective move towards 1.3535, followed by a possible drop to 1.3311. Traders should monitor technical signals closely, as the pair’s direction remains heavily influenced by external news, including updates from China and any changes in the Bank of Canada’s interest rate policy.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.