USDCAD rebounds from five-month low: declining oil prices may hurt Canada’s economy

The USDCAD pair has been on an upward trend. The Canadian dollar is pressured by weak forecasts for commodity exports and currency inflows. Discover more in our analysis for 4 September 2024.

USDCAD forecast: key trading points

- The USDCAD pair has strengthened markedly

- Falling Brent oil prices may negatively impact the Canadian economy

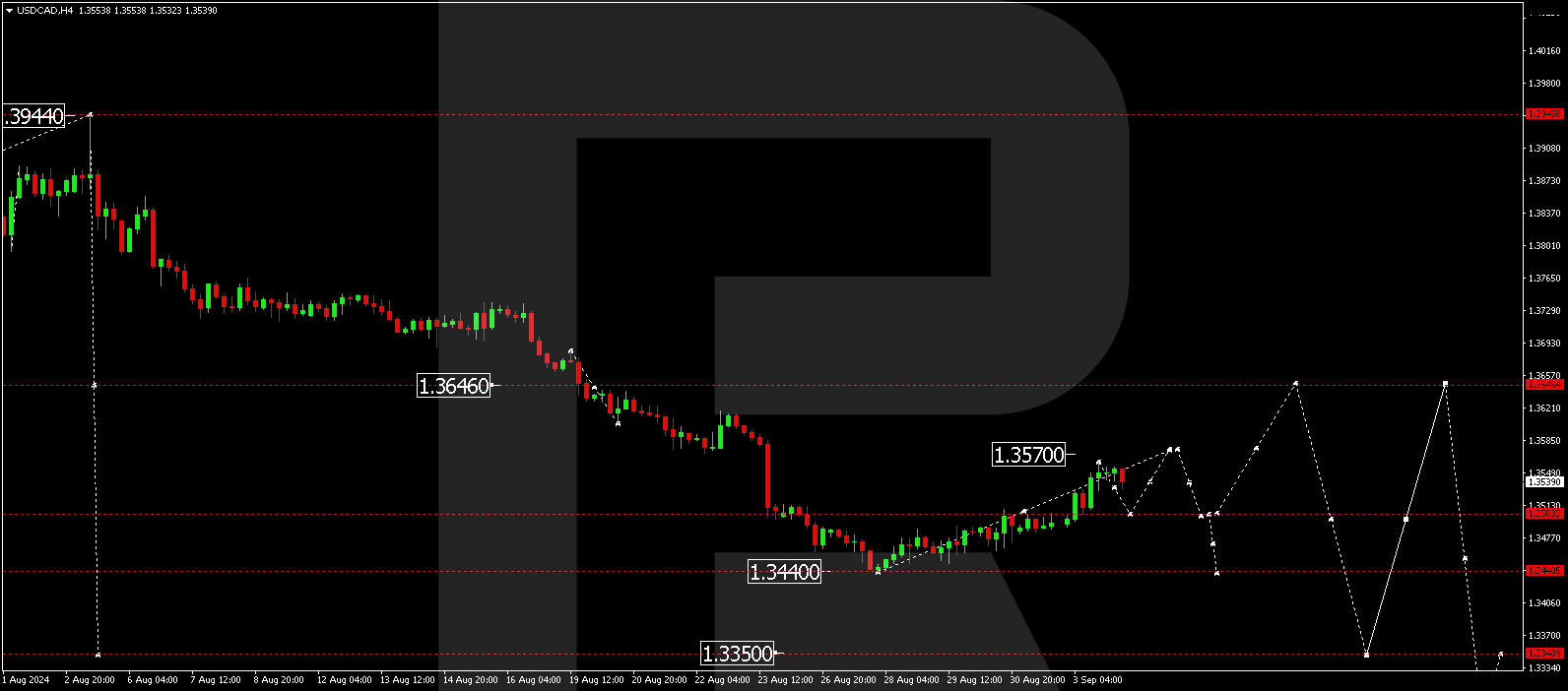

- USDCAD forecast for 4 September 2024: 1.3570 and 1.3350

Fundamental analysis

The USDCAD rate is consolidating near the 1.3540 level after a series of rises. The local rally in the US dollar has paused, with investors searching for new catalysts.

The CAD retreated from the five-month peak it had reached earlier. This came amid a worsening outlook for foreign currency inflows into the Canadian economy, alongside the US dollar rally. At the same time, investors are closely watching the Bank of Canada’s monetary policy outlook, with interest rates likely to be lowered in the foreseeable future.

The latest data showed Canadian GDP growth of 2.1% y/y in Q2 2024, marking the highest rate of economic expansion since the beginning of 2023. Such data appears better than expected and reduces the likelihood that the regulator will ease fiscal conditions aggressively.

The USDCAD forecast appears optimistic and does not favour the loonie, as market participants are greatly concerned about the impact of oil prices. Brent barrel plummeted below 74.00 USD. With Canada’s exports primarily focusing on commodities, such news negatively affects the country’s economy and the CAD rate.

USDCAD technical analysis

The USDCAD H4 chart shows that the market has reached the downward wave’s local target of 1.3400. A correction is forming towards the 1.3570 level and is expected to be completed today, 4 September 2024. Subsequently, the downward wave could continue towards 1.3350, the first target. Once the USDCAD rate reaches this level, a wave could begin, aiming for 1.3646 as the second target.

Summary

The USDCAD pair has strengthened its position. The market took advantage of worsening oil market conditions and supported the US dollar position. Technical indicators in today’s USDCAD forecast suggest a potential correction to 1.3570, followed by a downward move to 1.3350.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.