USDJPY: Japan’s PMI stuns the market — what is next for the yen

Japan’s PMI strengthened the yen, and the USDJPY pair continues to decline, with the potential target at the 146.00 support level. Find more details in our analysis for 3 April 2025.

USDJPY forecast: key trading points

- Japan services PMI: previously at 53.7, currently at 50.0

- US initial jobless claims: previously at 224 thousand, projected at 225 thousand

- USDJPY forecast for 3 April 2025: 147.50 and 146.00

Fundamental analysis

Japan’s services PMI covers various industries, including transport and communications, financial intermediation, business and personal services, information technology, and the hospitality and restaurant sectors.

The fundamental outlook for 3 April 2025 is optimistic for the Japanese yen. While the PMI dropped to 50.0 from the previous 53.7, it still came in above expectations, which could strengthen the yen. With the index at the neutral 50.0 level, sentiment has improved in favour of the Japanese currency.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment.

The previous figure was 224 thousand. The forecast for 3 April 2025 is not very optimistic, suggesting an increase to 225 thousand. While the expected increase is minor, any significant deviation from the forecast could noticeably impact the USDJPY rate.

USDJPY technical analysis

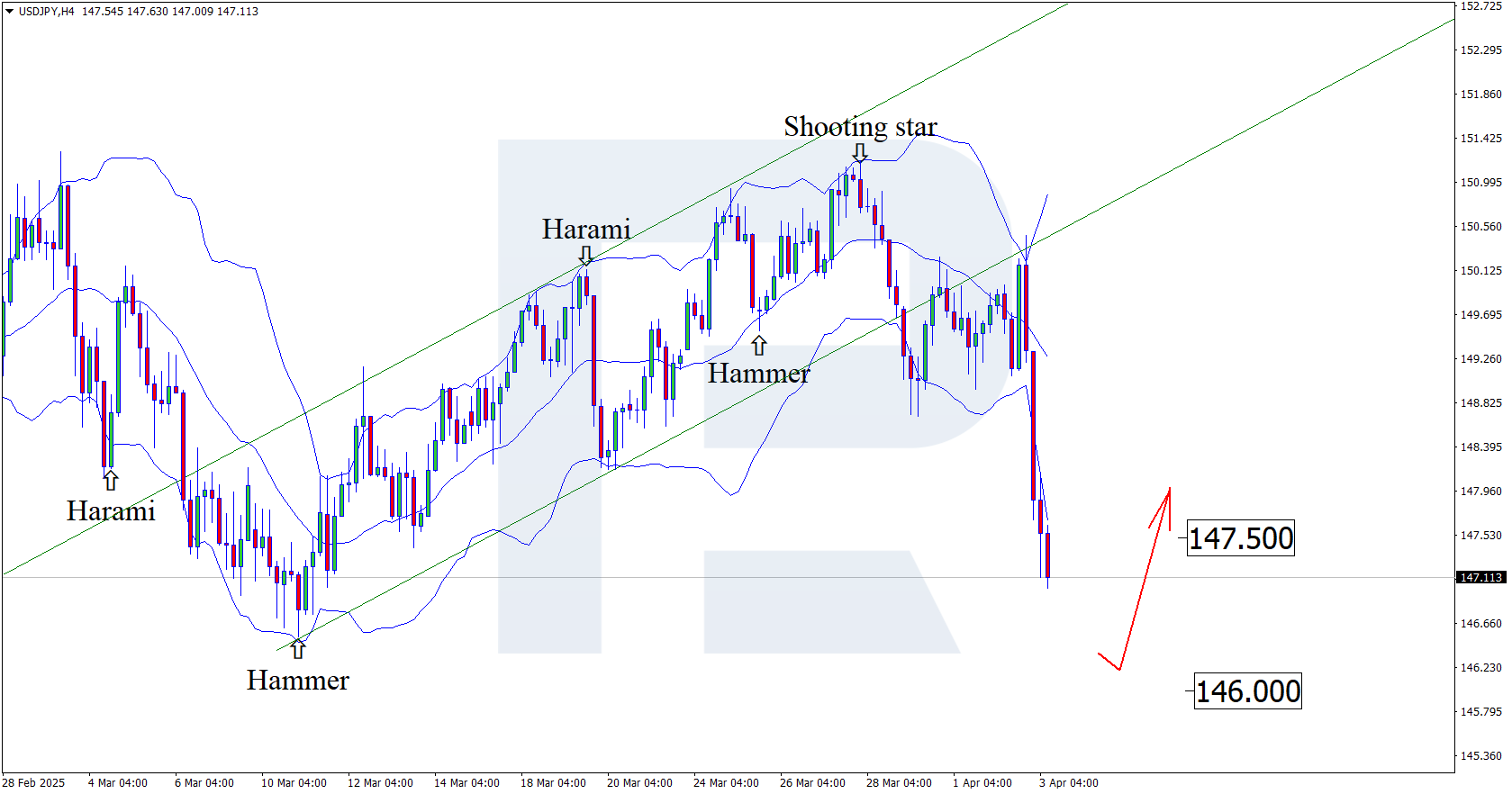

Having tested the upper Bollinger band, the USDJPY price has formed a Shooting Star reversal pattern on the H4 chart. At this stage, it continues its downward trajectory following the pattern signal. The price has earlier broken below the ascending channel’s lower boundary and is now heading towards the support level.

The downside target is 146.00.

However, the USDJPY forecast for today also includes an alternative scenario, with the price correcting towards 147.50 before maintaining its downward momentum.

Summary

Japan’s services PMI fell to 50.0 but exceeded expectations, which supported the yen. At the same time, a projected rise in US jobless claims could put additional pressure on the US dollar. These factors, along with the USDJPY technical analysis, suggest a further decline to 146.00 in the near term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.