Bearish scenario for USDJPY: the market poised for a Wedge pattern breakout

The USDJPY rate is edging lower, but buyers are not retreating from the 151.75 resistance level. Find out more in our analysis for 28 March 2025.

USDJPY forecast: key trading points

- Tokyo inflation accelerated to 2.4%, exceeding the BoJ’s target for the fifth consecutive month

- Kazuo Ueda confirmed the possibility of further interest rate hikes

- The formation of a Wedge reversal pattern could trigger yen strengthening

- USDJPY forecast for 28 March 2025: 149.05

Fundamental analysis

The USDJPY rate has slightly declined following the release of the Bank of Japan’s March meeting minutes. The regulator reiterated its commitment to a flexible approach to monetary policy, reinforcing expectations for further rate hikes. This supports the yen and, according to the USDJPY forecast, may prevent a breakout above the key 151.75 resistance level.

At the same time, Tokyo’s inflation rose to 2.4%, adding to pressure on the BoJ. This marks the fifth consecutive month that core inflation has exceeded the Bank of Japan’s 2.0% target, strengthening expectations for continued monetary policy normalisation.

Nevertheless, earlier this week, BoJ Governor Kazuo Ueda signalled that further rate hikes remain on the table if economic conditions align with the central bank’s outlook.

USDJPY technical analysis

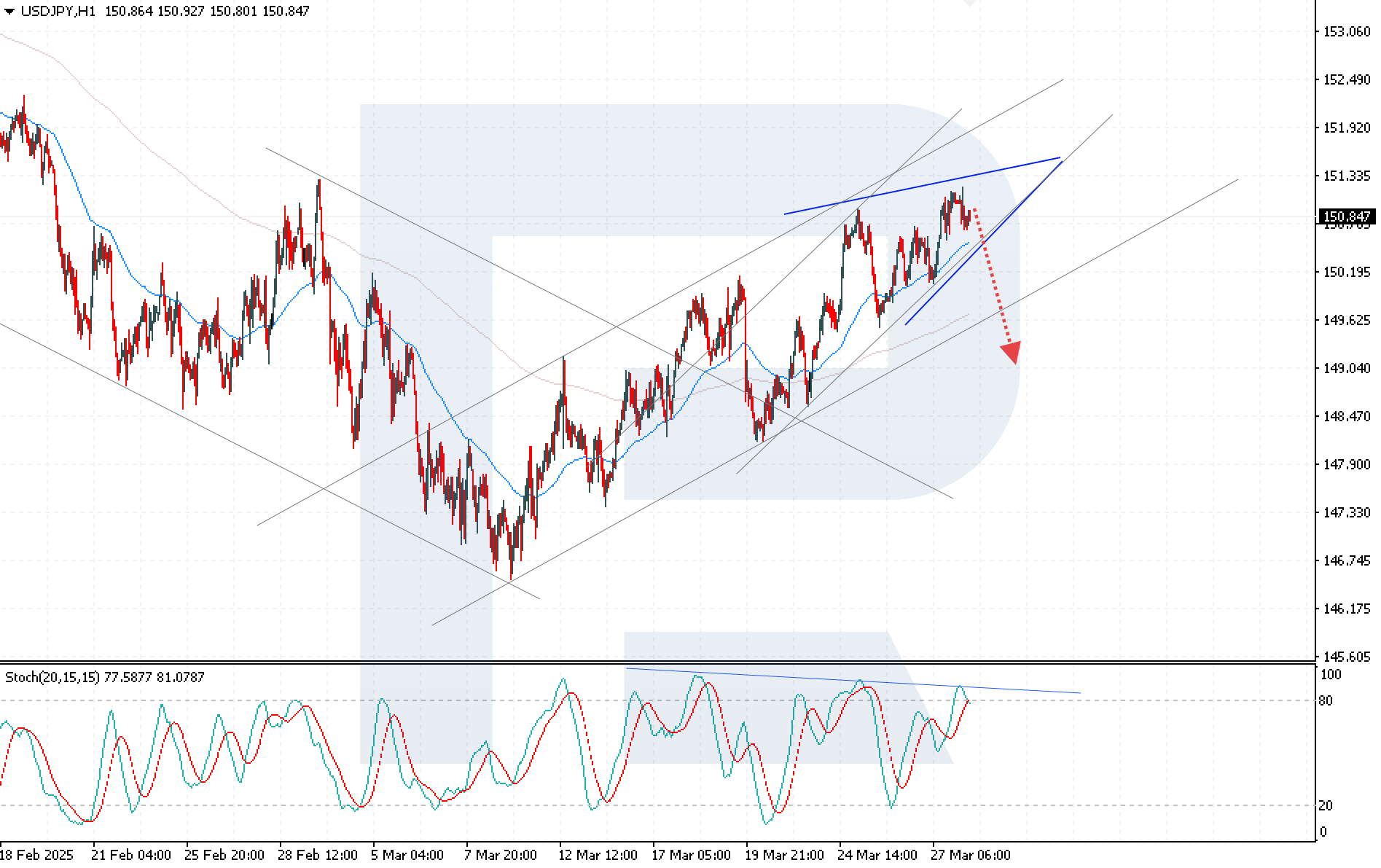

Despite bullish momentum, the USDJPY pair is squeezed within a Wedge pattern. Today’s USDJPY forecast expects a bearish scenario to unfold, with the price breaking below the lower boundary of the reversal pattern and falling to 149.05. The Stochastic Oscillator confirms the potential decline, showing a bearish divergence that signals potential weakness in upward momentum. A breakout below the lower boundary of the Wedge pattern will confirm the bearish outlook, with the price consolidating below 150.15.

Summary

The Japanese yen is gaining support amid expectations of BoJ policy tightening. The USDJPY technical analysis points to a likely bearish scenario, with the price breaking below the lower boundary of the Wedge pattern and targeting 149.05.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.