USDJPY is at a 12-week low: the sell-off is not over yet

The USDJPY pair is hovering around 149.70 on Tuesday. The market is expecting another rate hike by the Bank of Japan. Discover more in our analysis for 25 February 2025.

USDJPY forecast: key trading points

- The USDJPY pair hits a 12-week low

- The yen seeks support on expectations of new BoJ rate hikes and demand for safe-haven assets

- USDJPY forecast for 25 February 2025: 148.83

Fundamental analysis

The USDJPY rate is consolidating near 149.70 on Tuesday, the lowest level for the pair in 12 weeks.

The yen is bolstered by strong market expectations that the Bank of Japan will continue to raise interest rates this year following an unexpected uptick in inflation in Q4 2024.

Investors are now interested in a series of key economic reports set for release on Friday. They will provide data on industrial production, retail sales, and Tokyo inflation. Combined, these figures may give insight into the BoJ’s future monetary policy.

The yen is also in demand as a safe-haven asset amid ongoing geopolitical and trade uncertainties. On Monday, US President Donald Trump announced that tariffs on Canada and Mexico would be introduced after the postponement period ends next week.

The USDJPY forecast is neutral.

USDJPY technical analysis

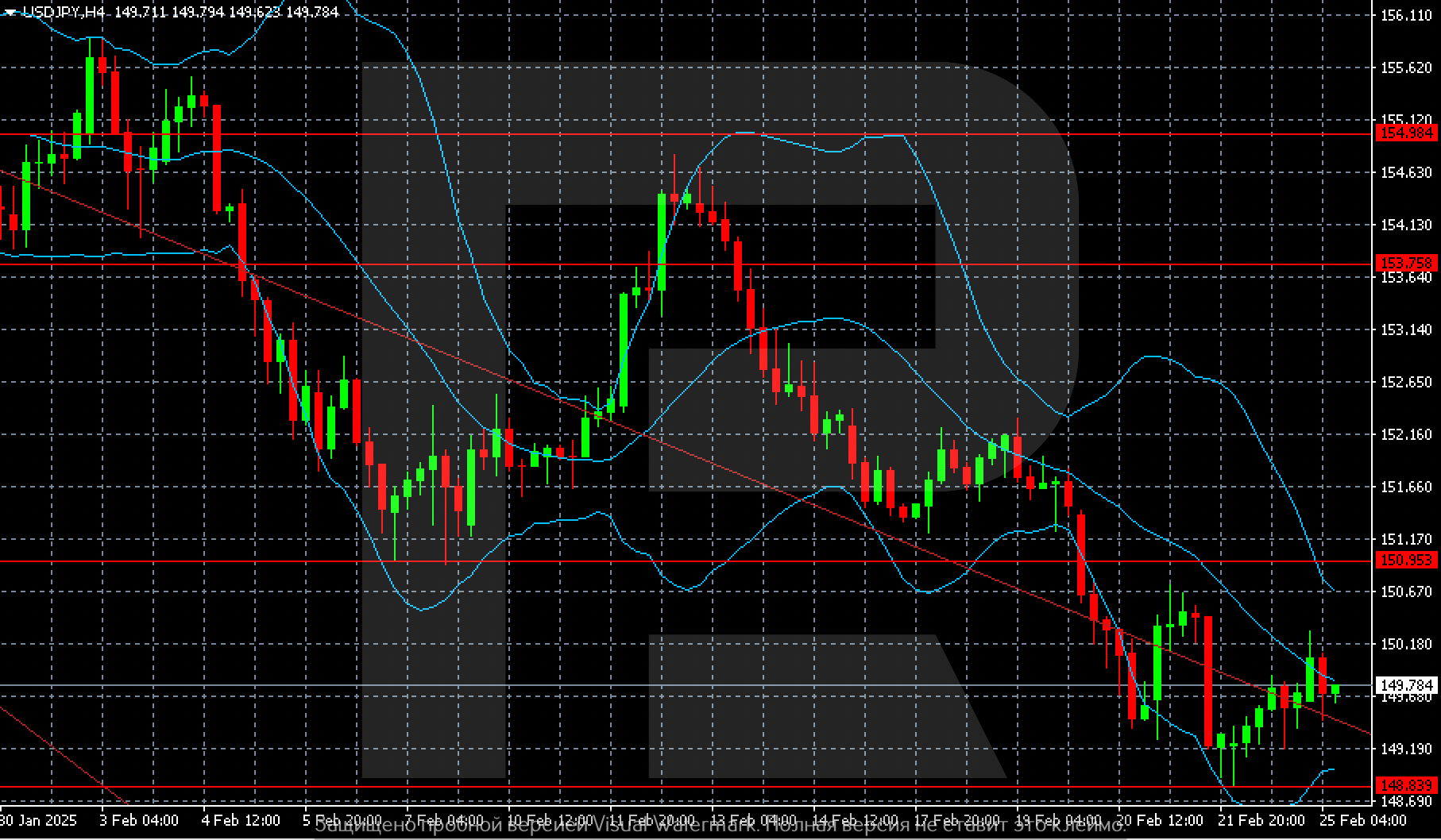

On the H4 chart, the USDJPY pair has grounds to move even lower to 148.83. At the same time, the pair is clearly going beyond the sideways trading channel between 148.83 and 150.95.

Summary

The USDJPY pair has fallen markedly recently, hovering now at a 12-week low. The USDJPY forecast for today, 25 February 2025, suggests further decline to the 148.83 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.