USDCAD falls to a 5-month low; will the decline continue?

The USDCAD rate slipped below 1.3900, hitting a five-month low amid a pause in US trade tariffs and ongoing US dollar weakness. Discover more in our analysis for 14 April 2025.

USDCAD forecast: key trading points

- Market focus: Canadian inflation data is due on Tuesday, with the BoC rate decision scheduled for Wednesday

- Current trend: trending downwards

- USDCAD forecast for 14 April 2025: 1.3800 and 1.3930

Fundamental analysis

The USDCAD pair continues to decline under pressure from a weaker US dollar and improved trade policy sentiment. The 90-day pause in additional US tariffs – which lowered the base tariff rate to 10% for most countries, excluding China (with a 145% rate) – has eased pressure on Canadian exports and prompted investors to reallocate capital back into Canadian assets.

Additionally, recession concerns in the US, sparked by aggressive trade policies and uncertainty over future measures, have further undermined the US dollar’s safe-haven appeal.

Traders are now looking ahead to key Canadian economic events. On Tuesday, the Consumer Price Index (CPI) for March will be released, followed by the Bank of Canada’s interest rate decision on Wednesday. The rate is expected to remain unchanged at 2.75%.

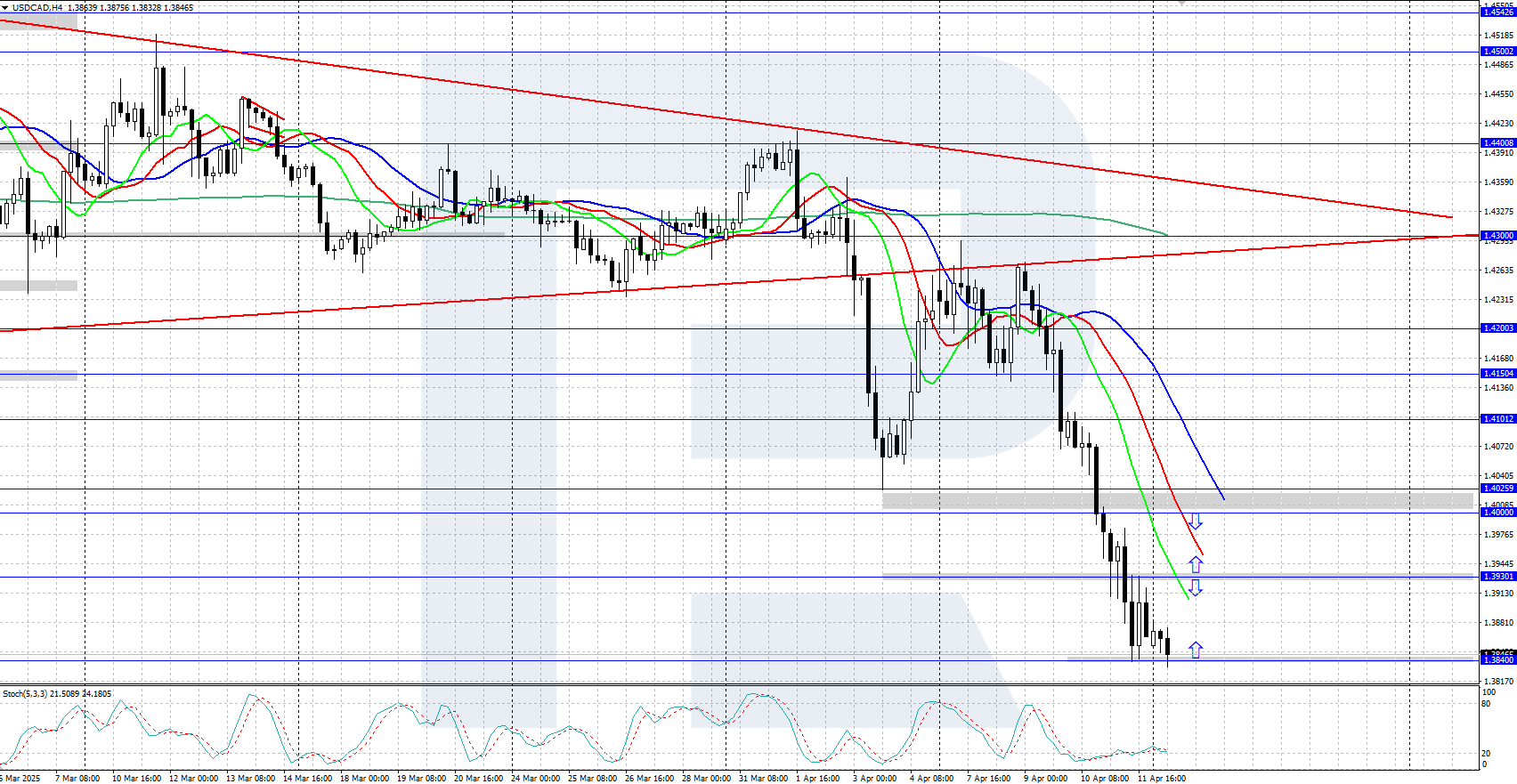

USDCAD technical analysis

On the H4 chart, the USDCAD pair is clearly in a downtrend, currently trading around the 1.3840 support level. The Alligator indicator confirms the bearish trend. However, the Stochastic Oscillator is in a deep oversold area, suggesting a possible upward correction.

The short-term USDCAD price forecast suggests that if bears gain a foothold below 1.3840, the decline could continue, with the price likely to reach 1.3800. Conversely, if bulls seize the initiative and reverse the quotes upwards, the price could undergo an upward correction towards 1.4000.

Summary

The USDCAD pair plunged below 1.3900 amid a 90-day tariff pause and the current USD weakness. The Bank of Canada’s interest rate decision is expected on Wednesday.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.