USDCAD forecast: the pair may continue to rise after consolidation

The Bank of Canada Deputy Governor’s speech may drive the USDCAD pair up to 1.4294. Discover more in our analysis for 24 February 2025.

USDCAD forecast: key trading points

- A speech by Bank of Canada Deputy Governor Toni Gravelle

- Dallas Fed Manufacturing Index: previously at 14.1

- USDCAD forecast for 24 February 2025: 1.4294 and 1.4150

Fundamental analysis

The USDCAD forecast for today, 24 February 2025, takes into several economic indicators that may impact the USDCAD rate. Bank of Canada Deputy Governor Toni Gravelle is expected to deliver a speech today. He was appointed to this position in October 2019 and has since played a key role in monetary policy decisions, including ensuring the stability of Canada’s financial system.

Although the agenda of today’s speech is yet to be released, given the current economic conditions, he will likely address the following issues:

- Monetary policy and comments on the current path of interest rates and future plans to change them

- Economic growth and inflation, analysis of current economic and inflation indicators, and short-term forecasts

- Global economic conditions and the impact of world economic trends on the Canadian economy

The Dallas Fed Manufacturing Index is an economic indicator showing the state of the manufacturing industry in the state of Texas. It is based on a survey of manufacturers and shows the dynamics of indicators such as output, employment, orders, and prices. A reading above zero signals growth in the sector, while a reading below zero indicates a downturn. The index is essential to assess the regional economy and may affect the USDCAD rate.

Fundamental analysis for 24 February 2025 takes into account the positive dynamics for the previous months, based on which the index in the current reporting period is expected to stand at or slightly exceed the previous 14.1.

USDCAD technical analysis

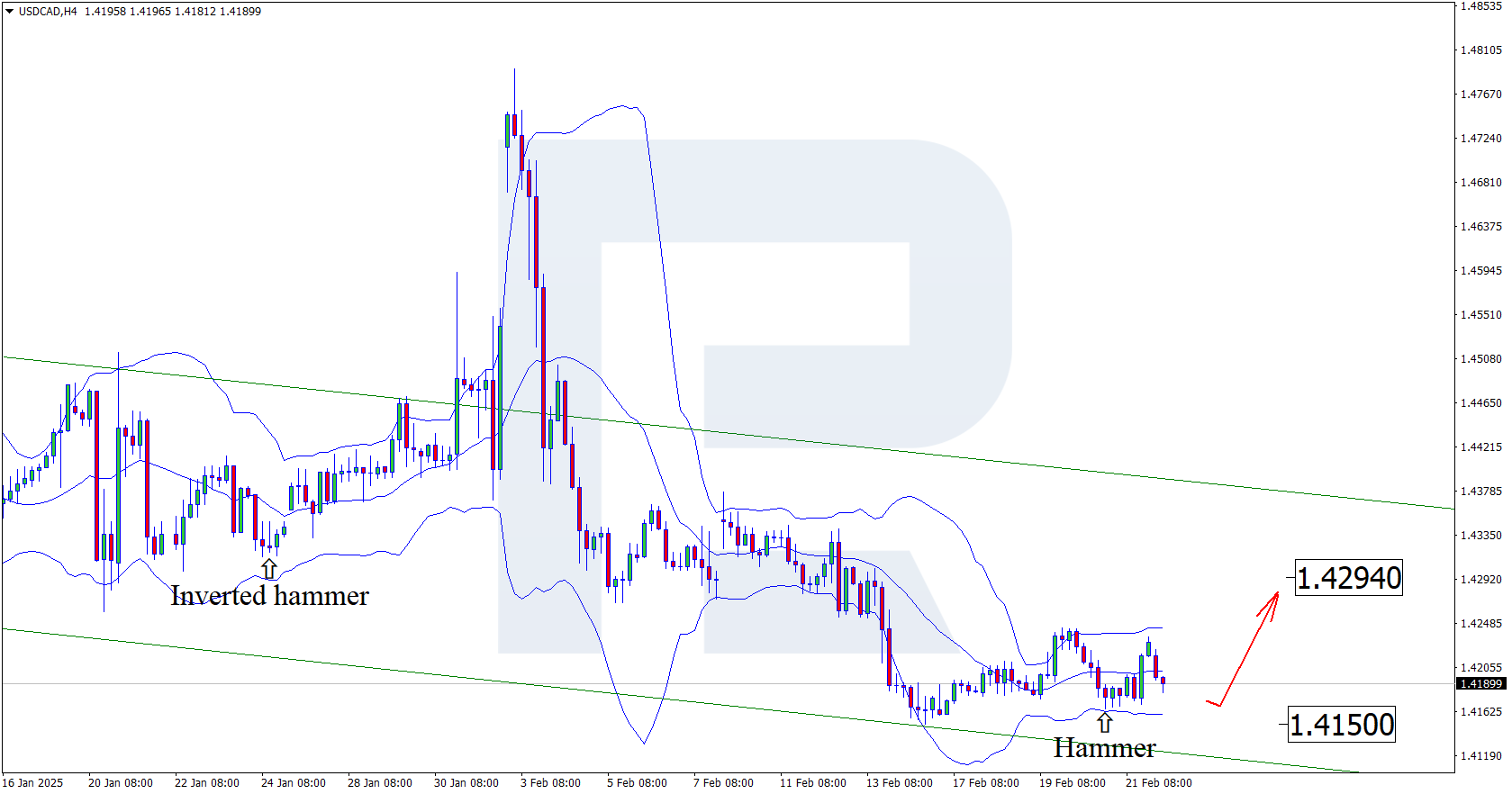

On the H4 chart, the USDCAD price formed a Hammer reversal pattern near the lower Bollinger band. At this stage, it attempts to rise following the signal received. The pair will likely climb to the nearest resistance level at 1.4294 as the price remains within the descending channel. A breakout above this level could pave the way for a more substantial upward movement.

However, the forecast for 24 February 2025 also suggests a scenario, where the price declines to 1.4150 and gains the downward momentum after testing the support level.

Summary

Along with the USDCAD technical analysis, the potential for improvement of US economic indicators suggests growth to 1.4294.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.