EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 4 - 8 November 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 4 - 8 November 2024.

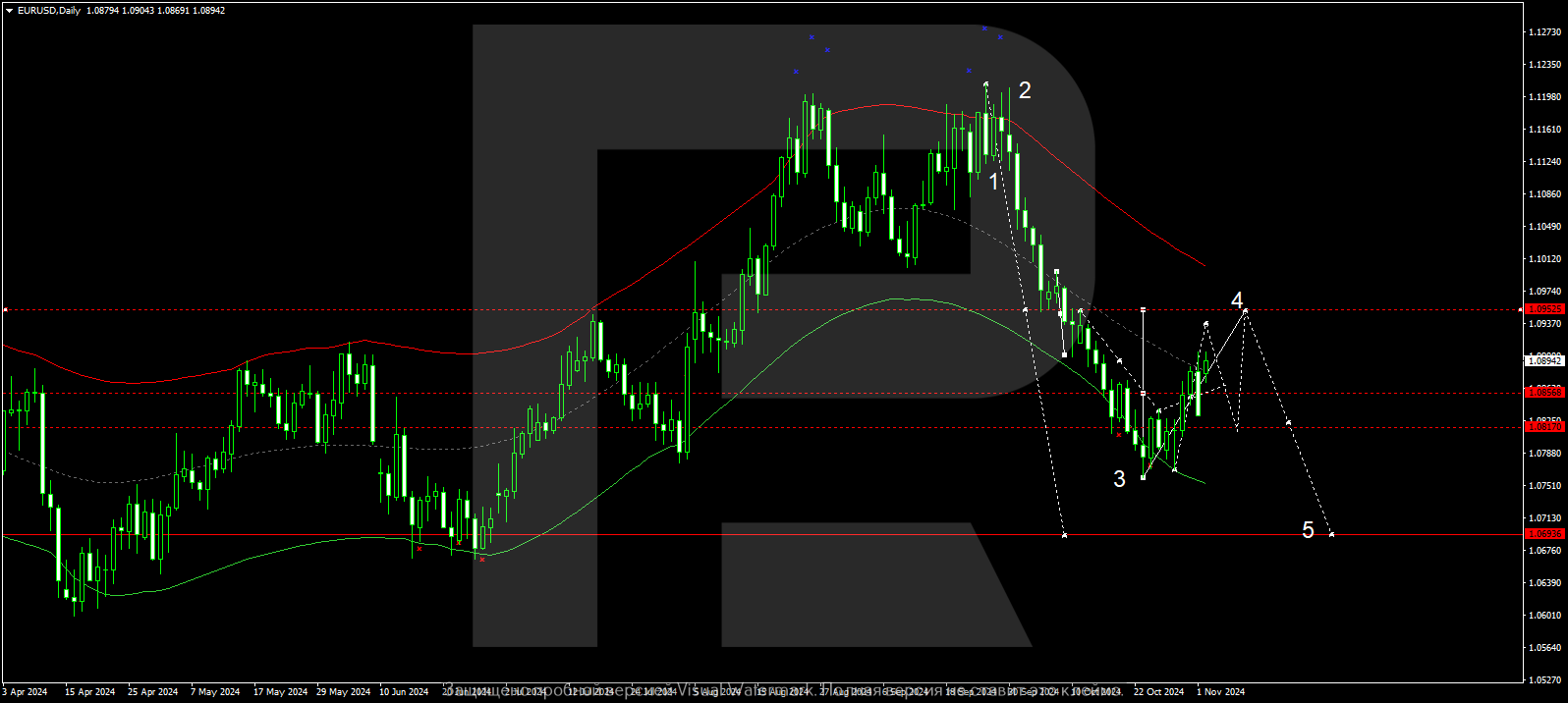

EURUSD forecast

The EURUSD pair has completed a downward wave, reaching 1.0760. After the price hit this level, the third growth wave began to form, aiming for 1.0933. This could be followed by a downward structure towards 1.0855 (testing from above). An extensive consolidation range will form around the 1.0855 level. Subsequently, another growth wave may follow, aiming for 1.0950 as the local target.

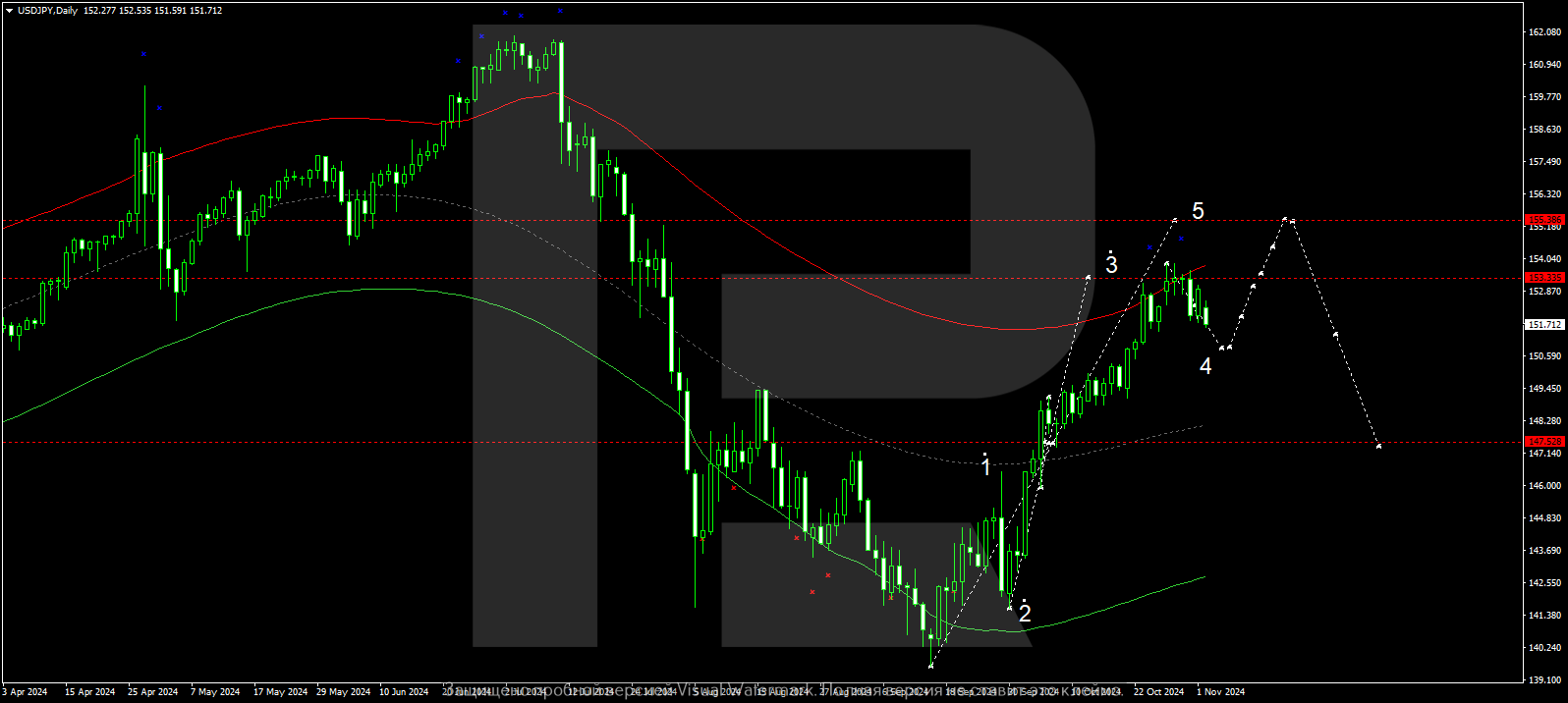

USDJPY forecast

The USDJPY pair has reached the local target of a growth wave and is forming a downward structure towards the 150.85 level. After reaching this level, the price could rise to 153.33. The growth wave might continue towards 155.33 if a breakout occurs above this level. A new downward wave could then begin, targeting 150.00. The entire growth structure is considered a corrective wave within the previous downward wave towards 139.70. Once the price reaches 155.33l, the downtrend may continue towards 137.77, with the initial target for decline at 147.47.

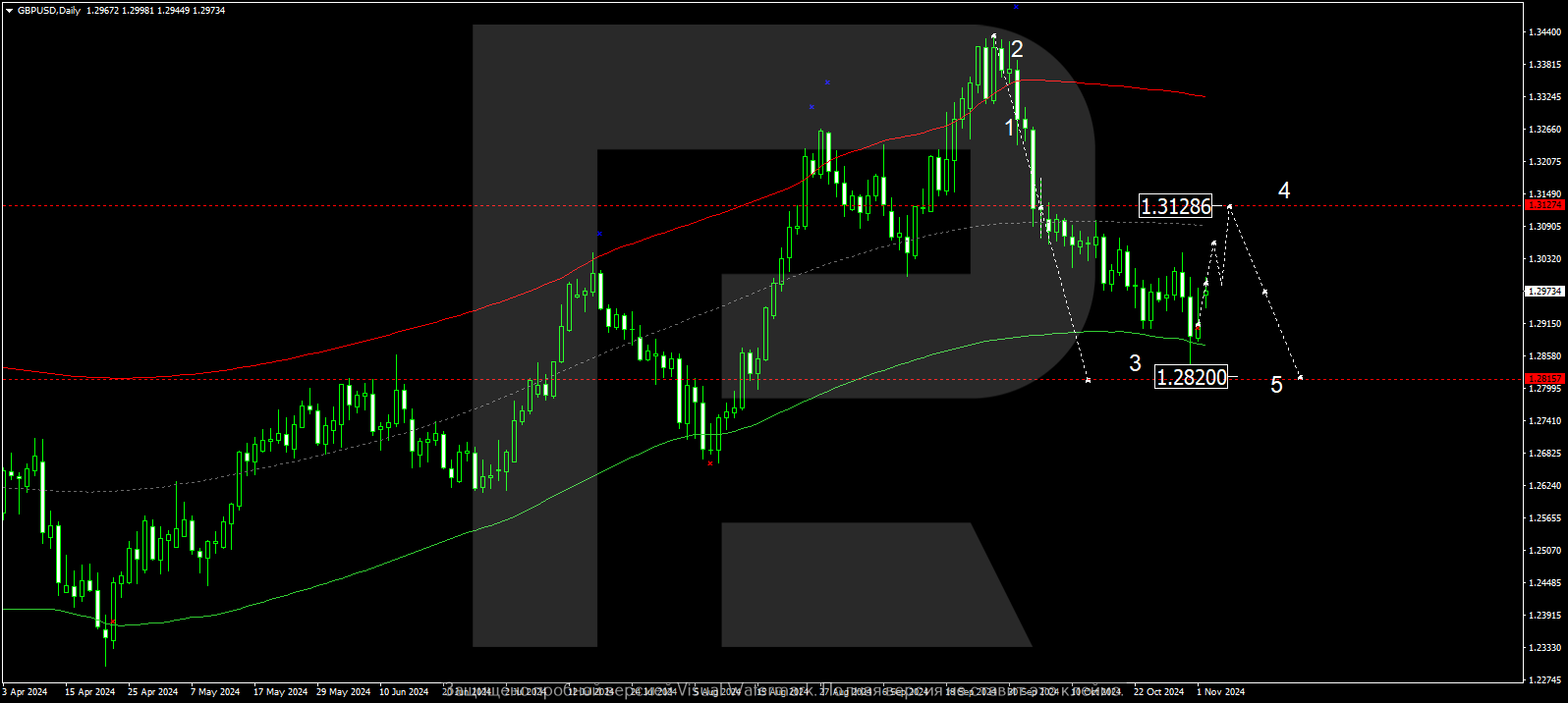

GBPUSD forecast

The GBPUSD pair is forming a growth wave structure towards 1.3128. The structure leading to 1.2890 is complete. The price is expected to break above this level and develop a growth structure towards 1.3050. Once this level is reached, another downward wave towards 1.2890 could develop, followed by growth towards 1.3128. A new downward wave might begin after the price hits this level, aiming for 1.2970 as the initial target for the next downward wave. The primary target for the downward wave is 1.2820.

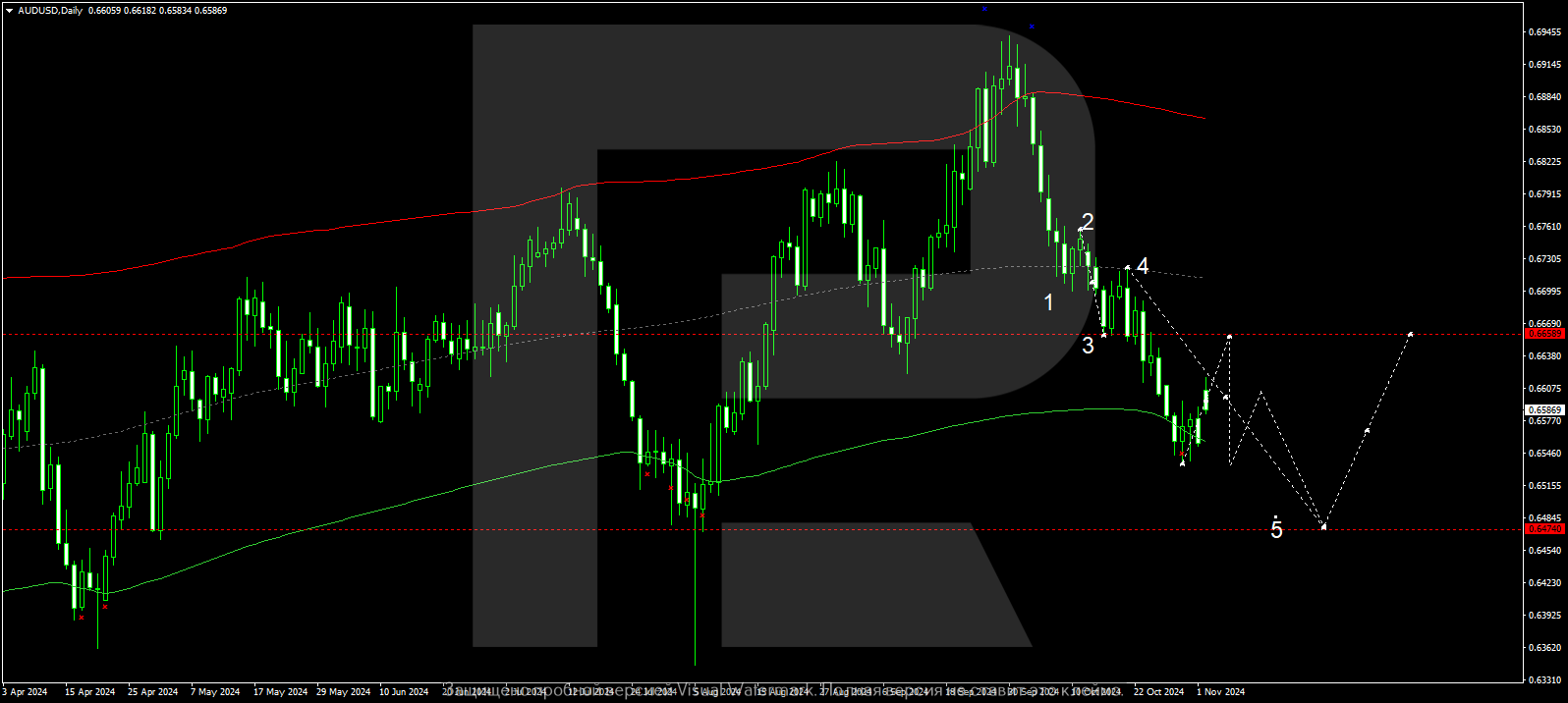

AUDUSD forecast

The AUDUSD pair has completed a downward wave, reaching 0.6536. Today, a growth wave could develop, targeting 0.6660. After reaching this level, a new downward wave could start, targeting 0.6540 and potentially continuing to 0.6470. Once this wave is complete, the price could rise to 0.6660.

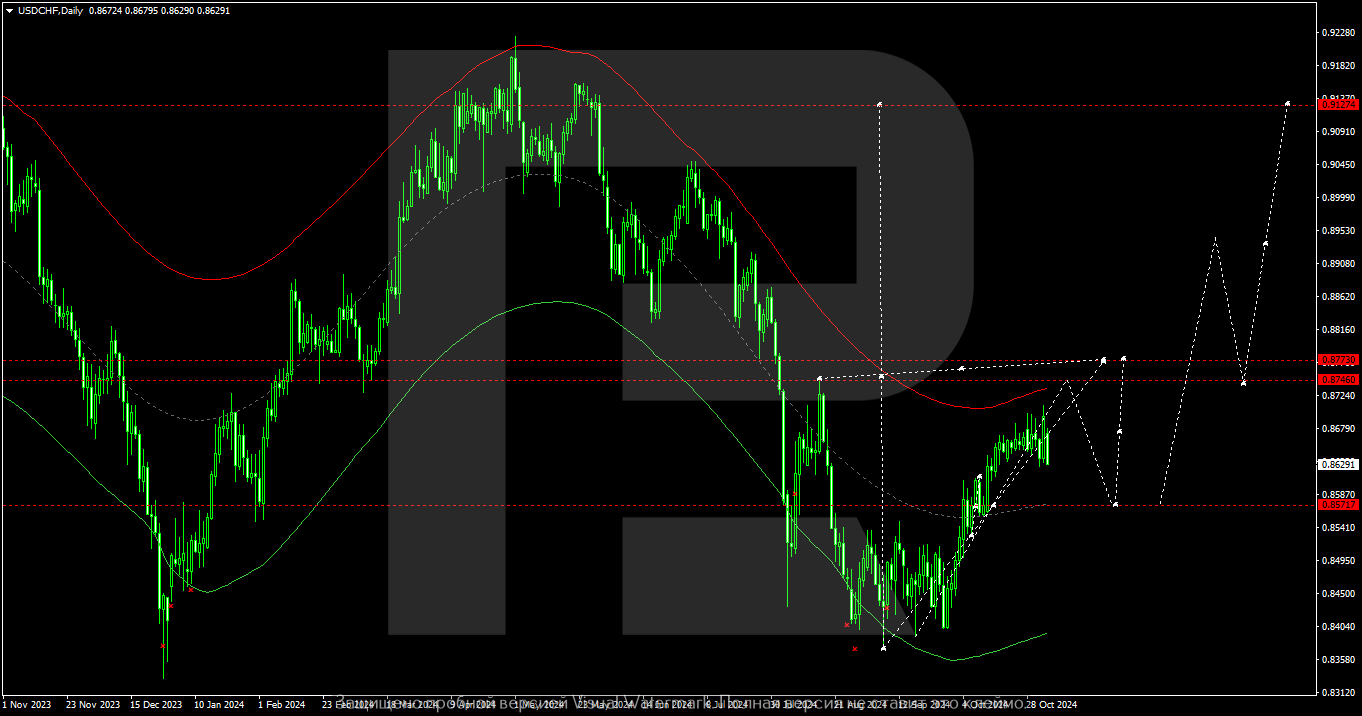

USDCHF forecast

After breaking above the 0.8520 level, the USDCHF pair maintains its upward momentum, aiming for 0.8745 as the local target. Once the price hits this level, a correction will start, targeting 0.8520 (testing from above). Subsequently, a new growth wave is expected to develop, aiming for 0.8730 as the main first target.

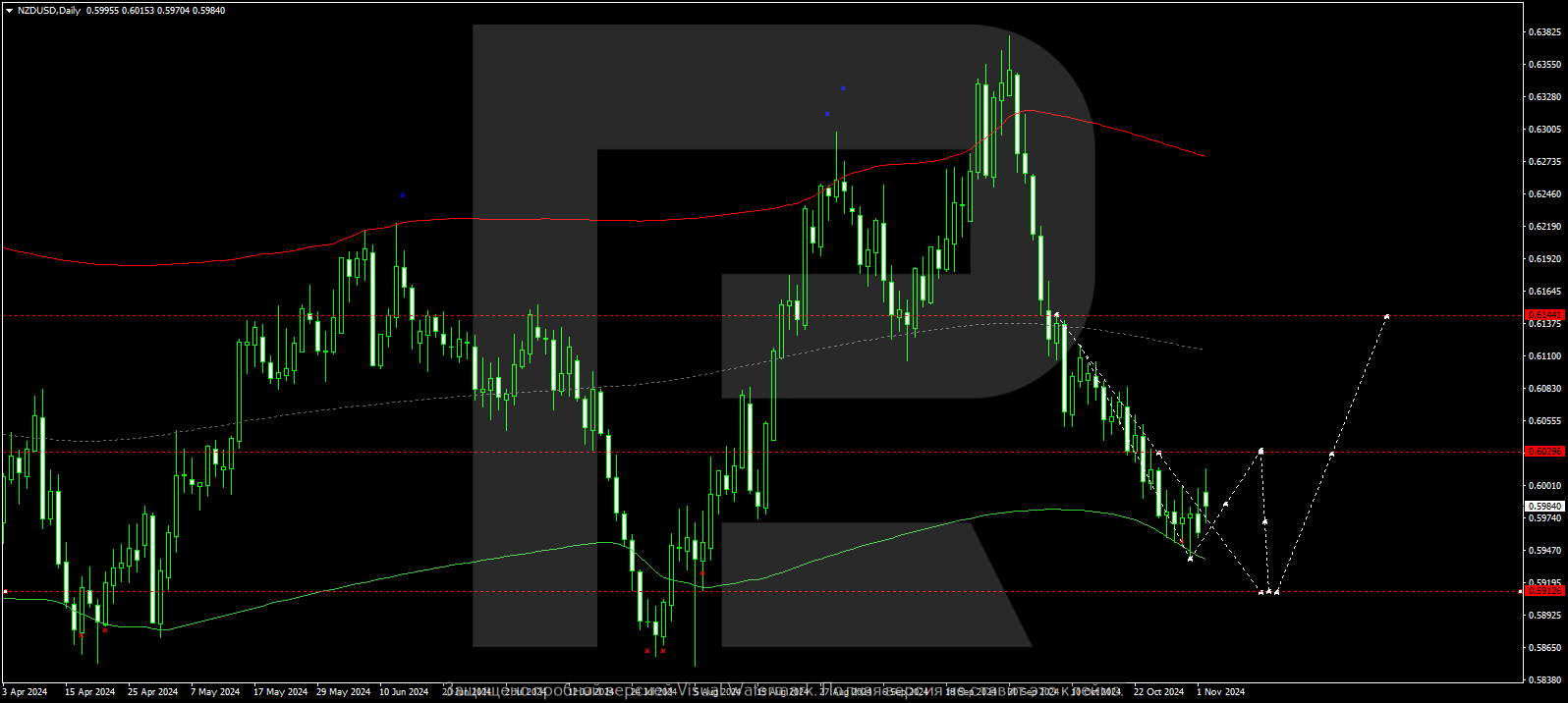

NZDUSD forecast

The NZDUSD pair has completed a downward wave, reaching 0.5940. A consolidation range is forming at the lows of a downward wave today. An upward breakout could initiate a correction, targeting 0.6030. Once the correction is complete, the price could decline to 0.5915, potentially continuing the trend towards the first target of 0.5900.

USDCAD forecast

The USDCAD pair has formed a consolidation range around 1.3830 and, with an upward breakout, could continue its upward trajectory towards 1.4242. After the price reaches this level, a correction towards 1.3830 may be worth considering as the initial target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.