EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 23-27 September 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 23-27 September 2024.

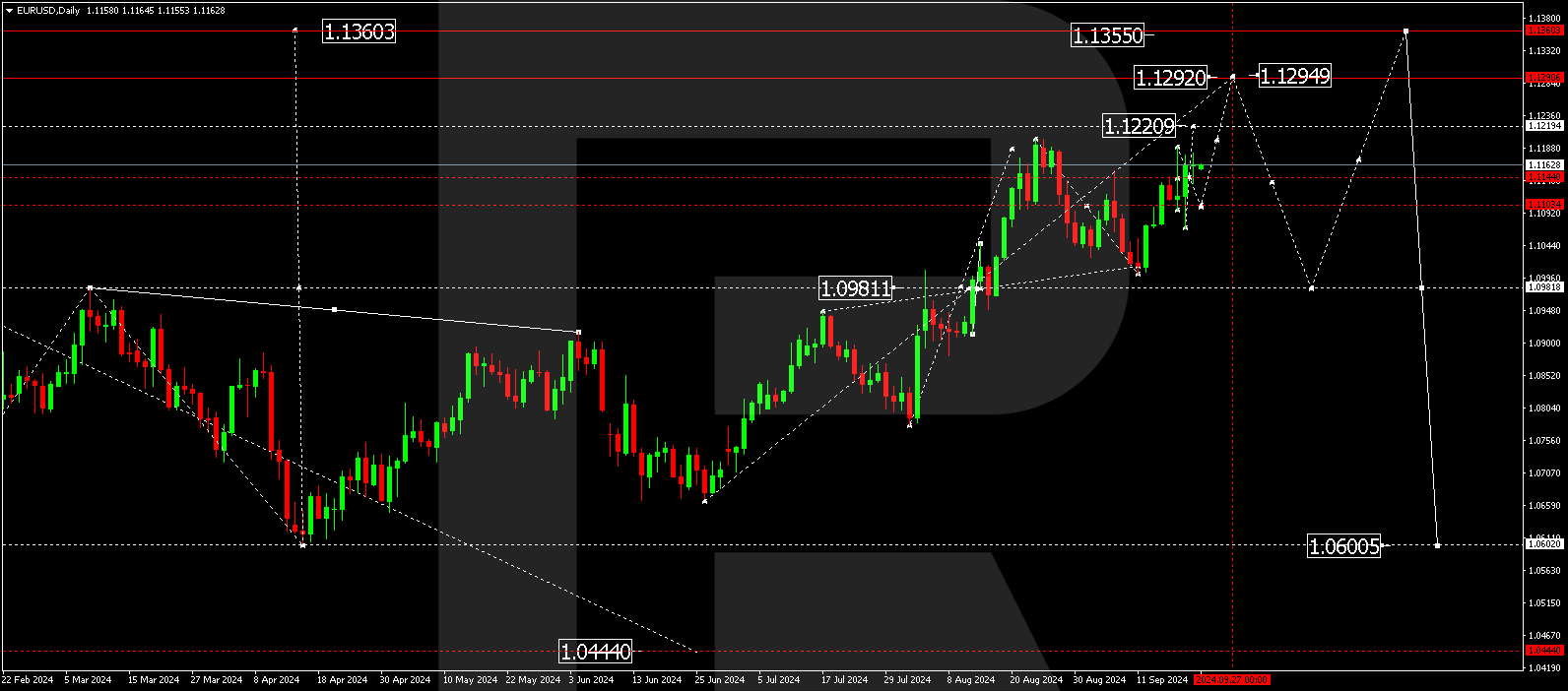

EURUSD forecast

The EURUSD pair has performed a growth impulse to 1.1188 and a correction to 1.1068. The market has executed a growth wave to the 1.1144 level and is forming a consolidation range around it. Based on the forecast, the EURUSD outlook suggests that an upward breakout from this range could lead to further growth towards 1.1220, with the potential for the trend to extend to 1.1290. However, this growth target is local, as we predict a subsequent correction back to 1.0980. After this correction phase, the outlook indicates a potential new growth wave that may push the pair to 1.1350.

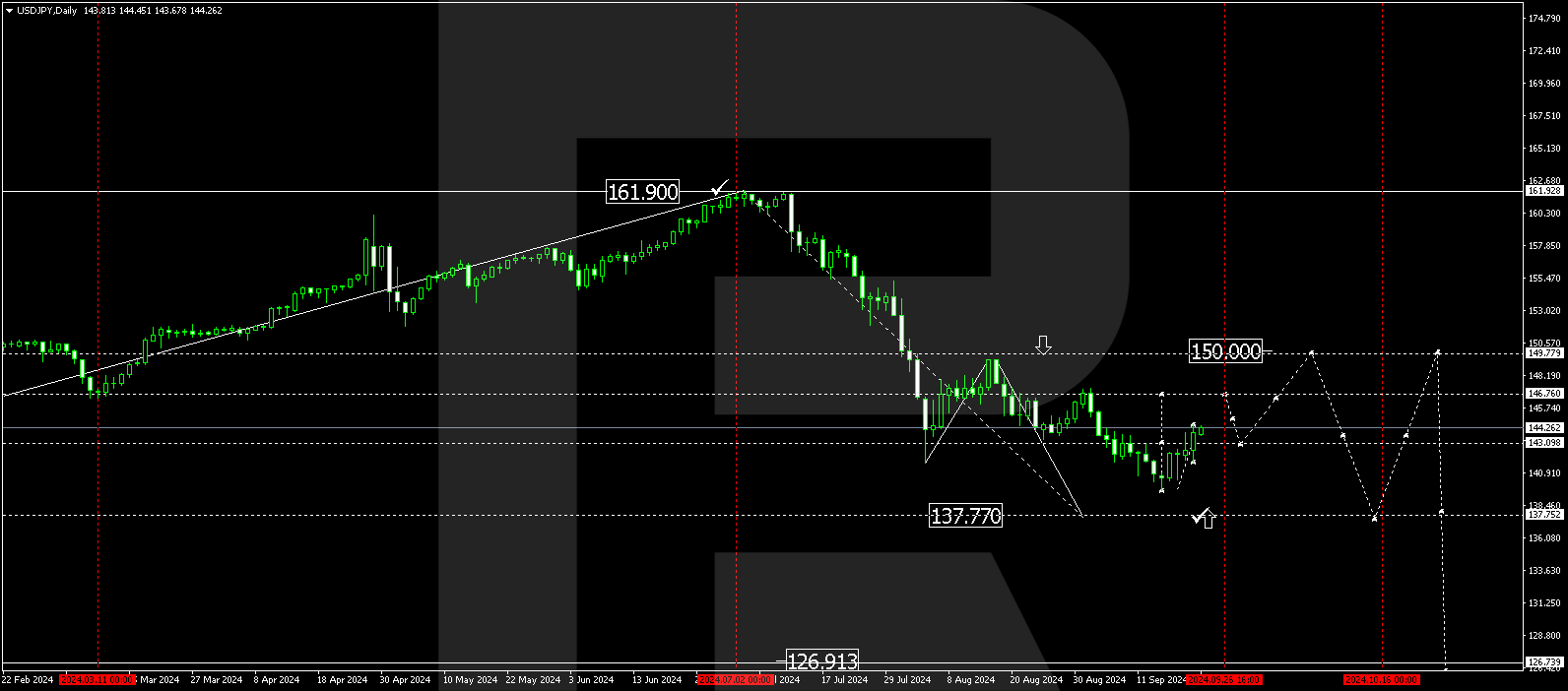

USDJPY forecast

The USDJPY pair is currently consolidating around the 143.00 level. Our outlook anticipates a potential upward movement to 146.76. Upon reaching this level, a pullback to retest 143.00 from above is not ruled out. Following this correction, we predict another growth wave, potentially reaching 150.00. After achieving this high, the USDJPY forecast points to the beginning of a new decline, possibly bringing the pair down to 137.77.

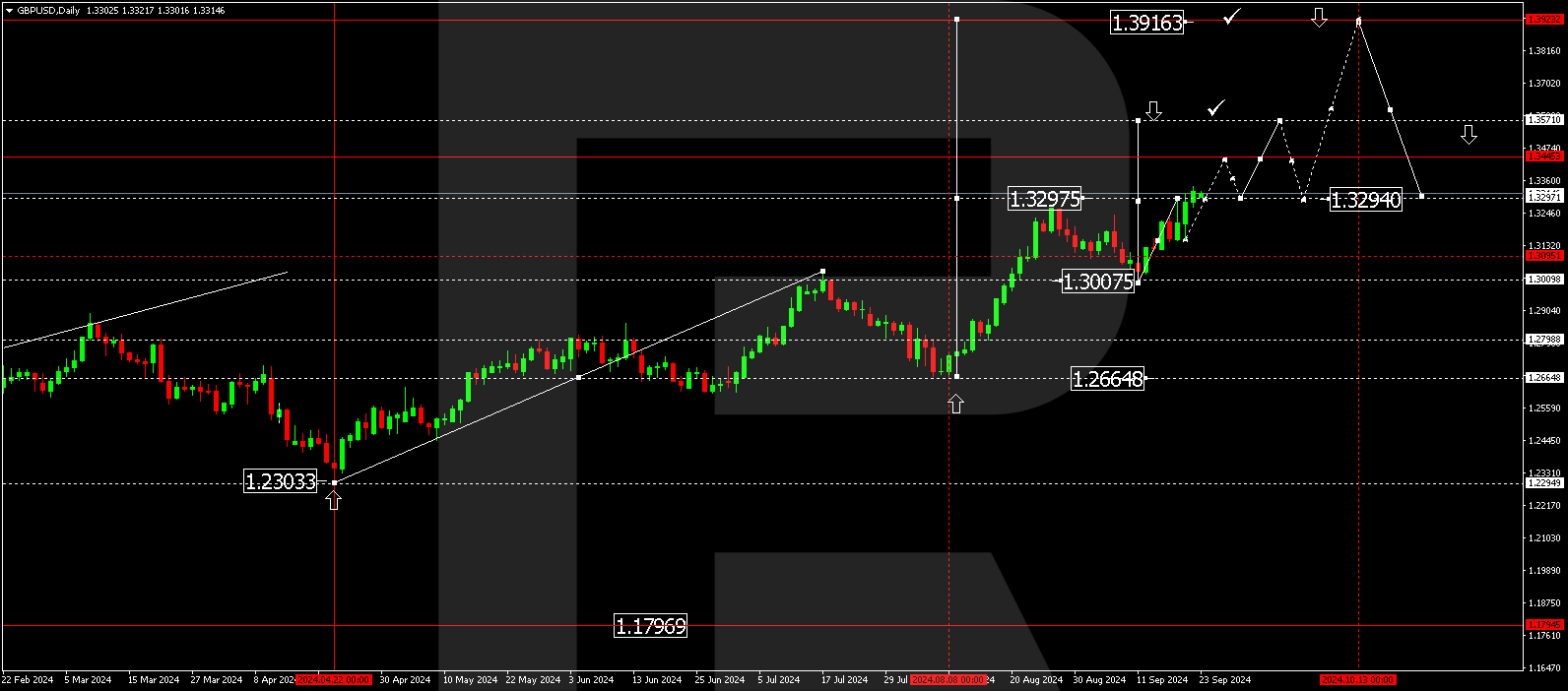

GBPUSD forecast

The GBPUSD pair has completed its initial growth wave to 1.3290. Our prediction for this week suggests consolidation around this level. An upside breakout from the consolidation range could open up the potential for further growth to 1.3444, with the prospect of the trend continuing towards 1.3570. After reaching these targets, a corrective move back to 1.3290 is anticipated before a potential new growth wave pushes the pair towards the 1.3915 level.

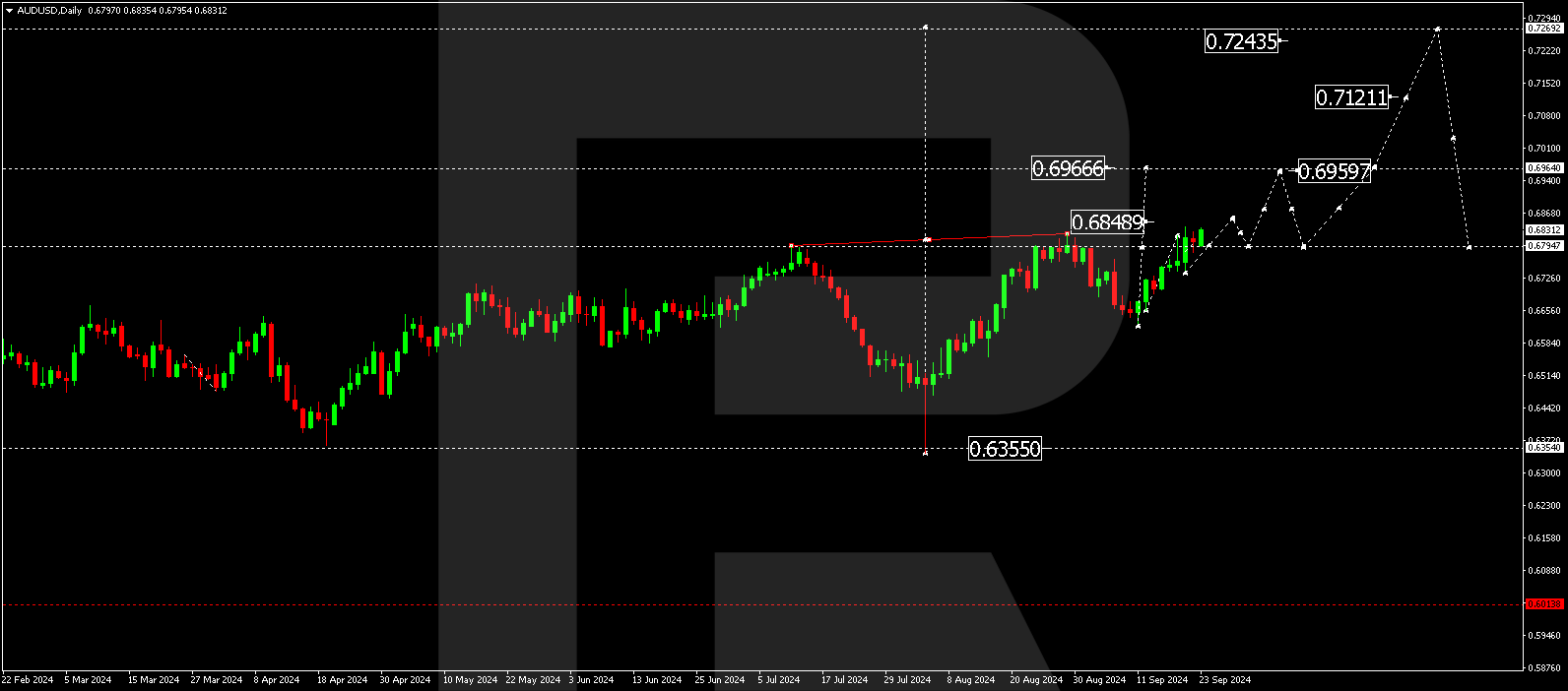

AUDUSD forecast

The AUDUSD pair has completed its first growth wave, reaching 0.6818. This week’s forecast points to the development of a consolidation range around this level. Should the pair break out upwards, the outlook suggests a potential rise towards 0.6880, with the trend likely extending to 0.6966. These targets are local, and a correction to 0.6797 is predicted after they are achieved. Following the correction, the AUDUSD outlook signals the potential for a new wave of growth that could bring the pair to 0.7260.

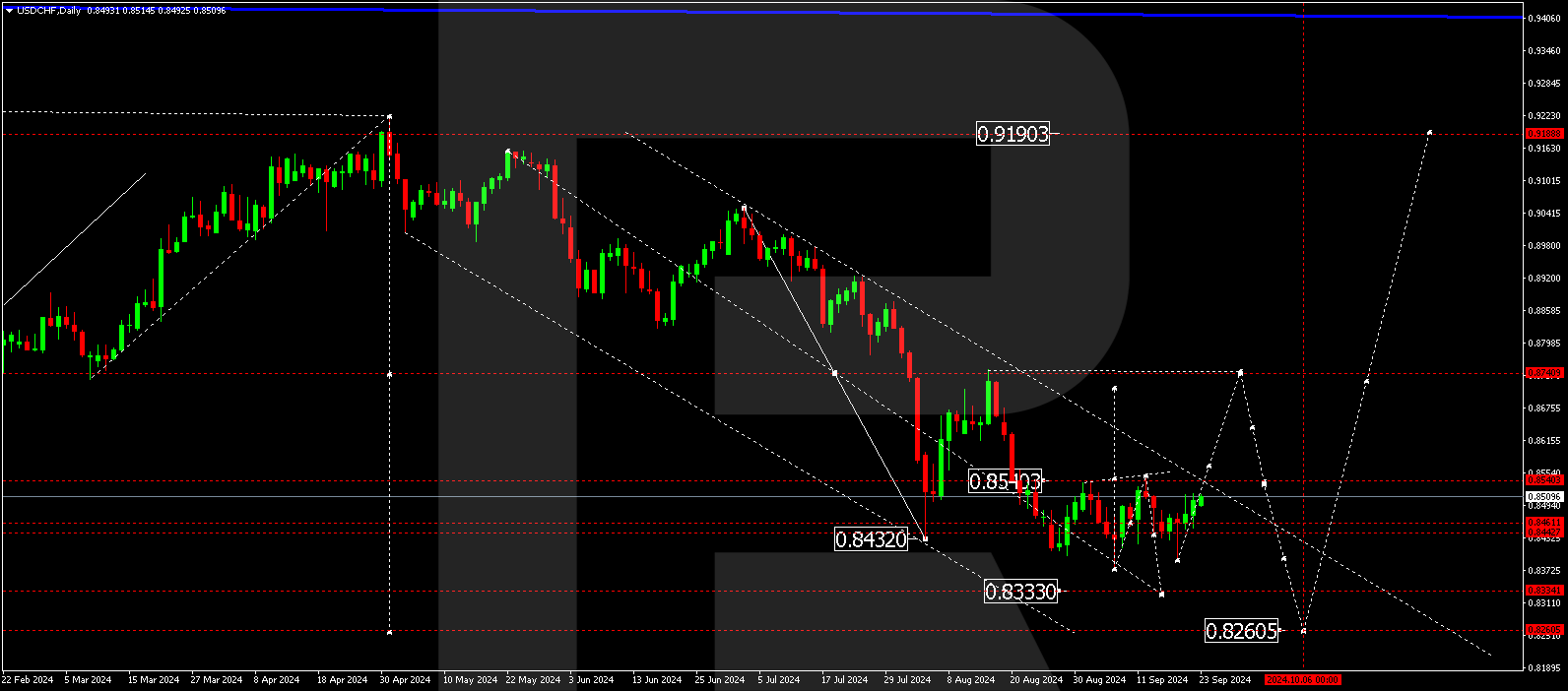

USDCHF forecast

The USDCHF pair is forming a growth wave aimed at 0.8540. After reaching this level, we predict a consolidation range around it. If the pair breaks upwards from this range, the USDCHF forecast suggests further growth towards 0.8700, possibly extending to 0.8750. Conversely, a downward breakout from the consolidation range could lead to continued downside action towards 0.8333.

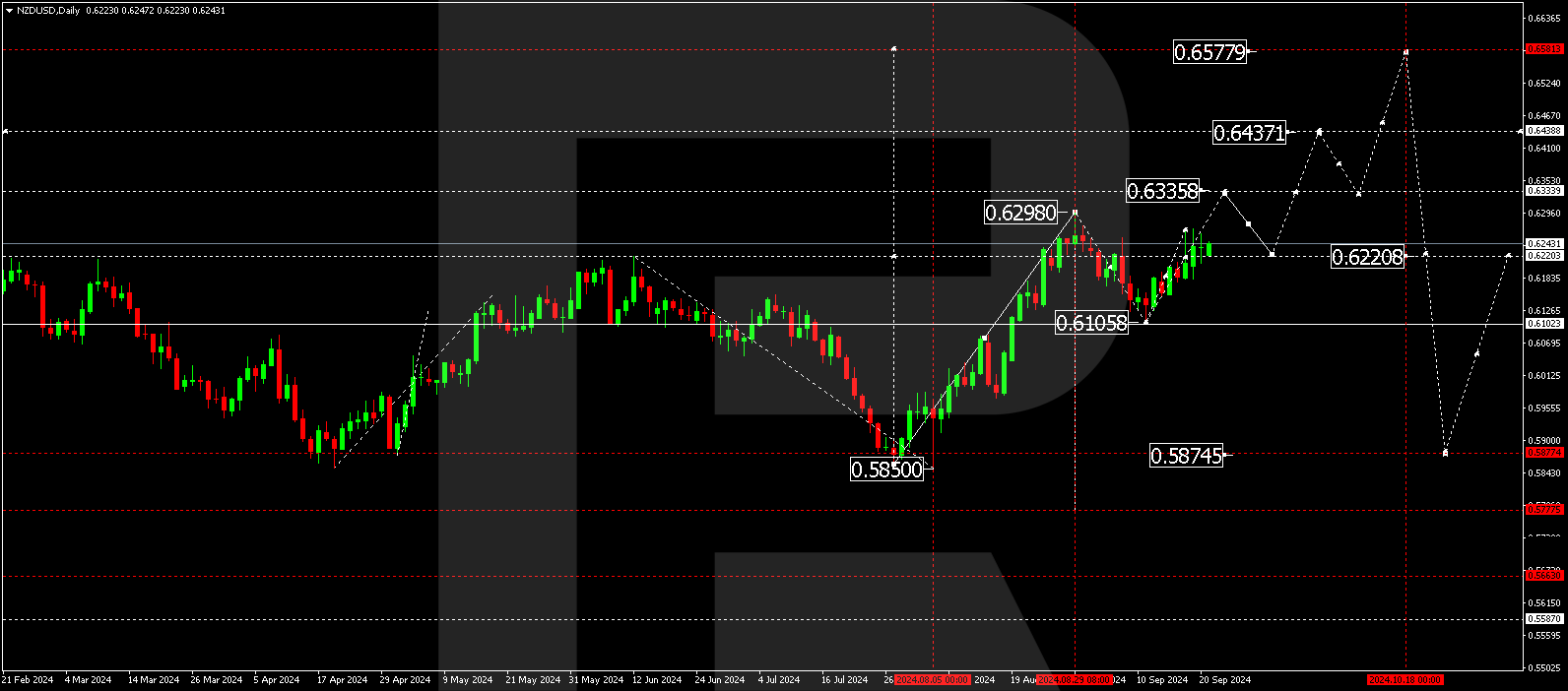

NZDUSD forecast

The NZDUSD pair has completed its first growth wave to 0.6222 and is currently consolidating around this level. The forecast indicates that an upward breakout from this consolidation range could lead to further growth, with the pair potentially reaching 0.6333 and 0.6434. These levels represent local targets, and after achieving them, a corrective move back to 0.6222 is possible. However, the longer-term NZDUSD forecast suggests that the pair may resume its upward trajectory, potentially reaching 0.6577.

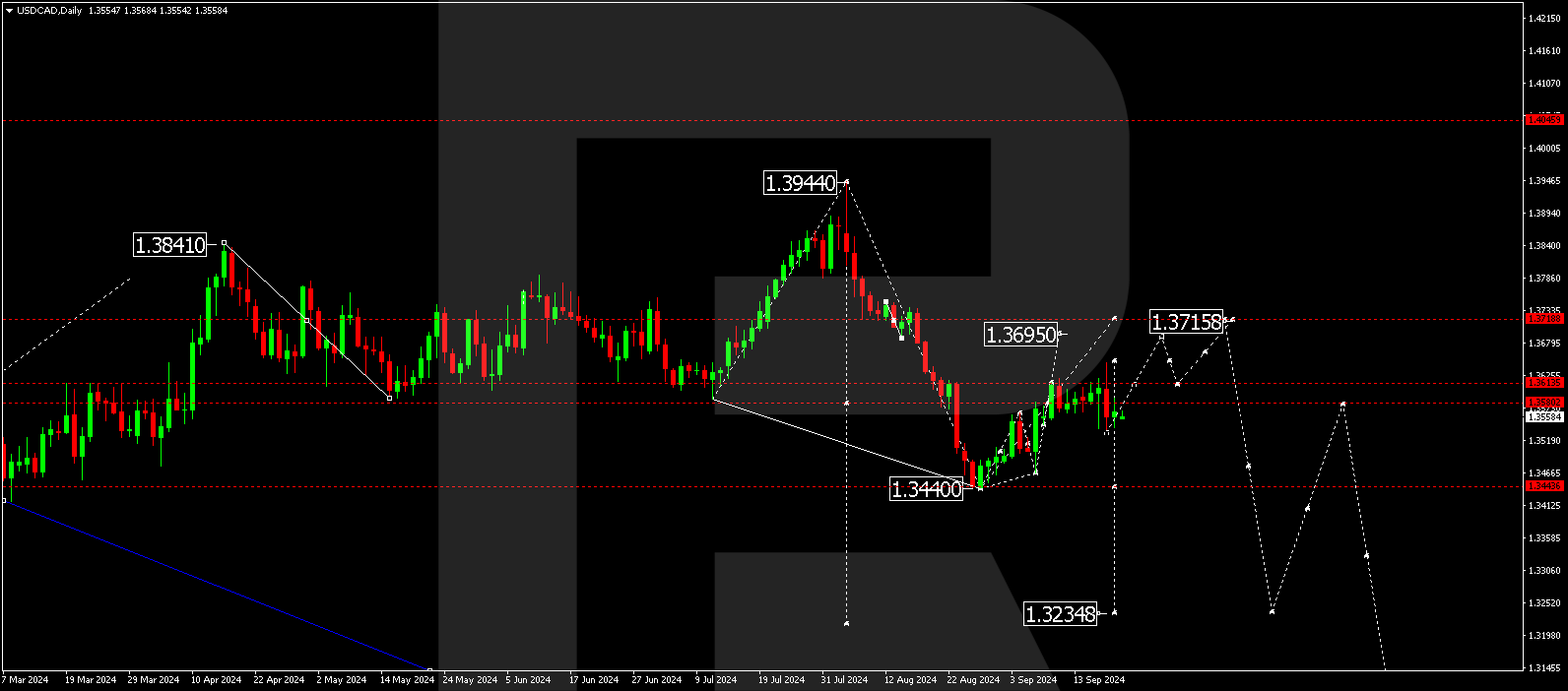

USDCAD forecast

The USDCAD pair is currently consolidating around the 1.3580 level. Our USDCAD forecast predicts that a breakout to the upside could open the potential for growth to 1.3695, with the trend likely extending to 1.3715. After reaching these levels, we predict a downside move towards 1.3440. If the pair breaks down from the consolidation range, a decline to 1.3440 is expected, with the prospect of the trend continuing downward to 1.3232.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.