EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 9-13 September 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 9-13 September 2024.

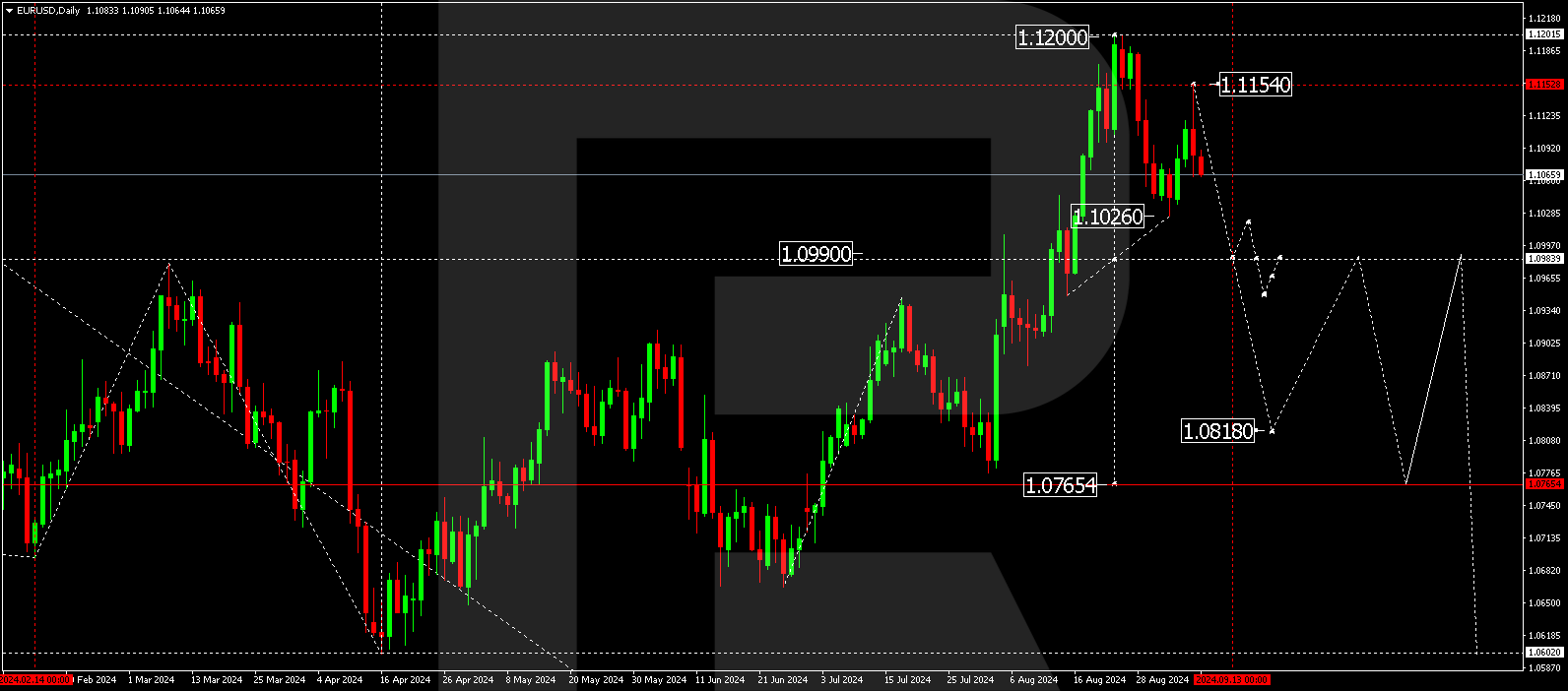

EURUSD forecast

The EURUSD pair continues its downward trajectory, with the target at 1.0990. The price is expected to reach the target this week. Subsequently, it will be essential to consider the development of a consolidation range around this level. With an upward breakout, a correction may follow, aiming for 1.1060. If the price falls and breaks below the 1.0950 level, this will open the potential for further development of the third wave. This decline could be a signal for continuing the trend to the 1.0818 level, with the wave potentially developing towards 1.0765.

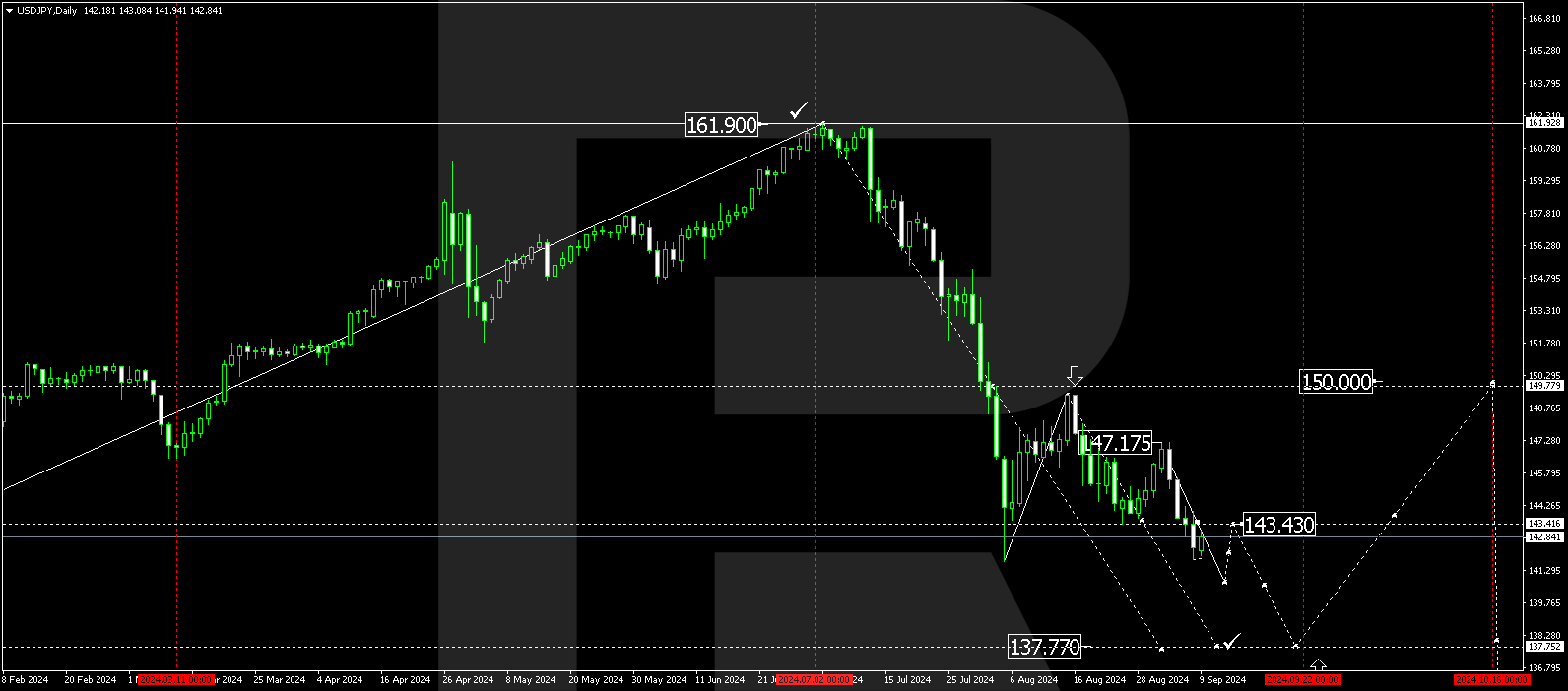

USDJPY forecast

The USDJPY pair has broken below the 143.43 level and continues to develop a consolidation range below it. The market expanded the range down to 141.76. This week, the price could rise to 143.43 (testing from below). With an upward breakout, a correction may follow, aiming for 145.55. A decline to 141.70 and a breakout below this level will open the potential for a wave towards 140.70. A breakout below the 141.70 level could be considered a signal for continuing the trend to the 140.70 target to form a downward wave aiming for 137.77 as the primary target.

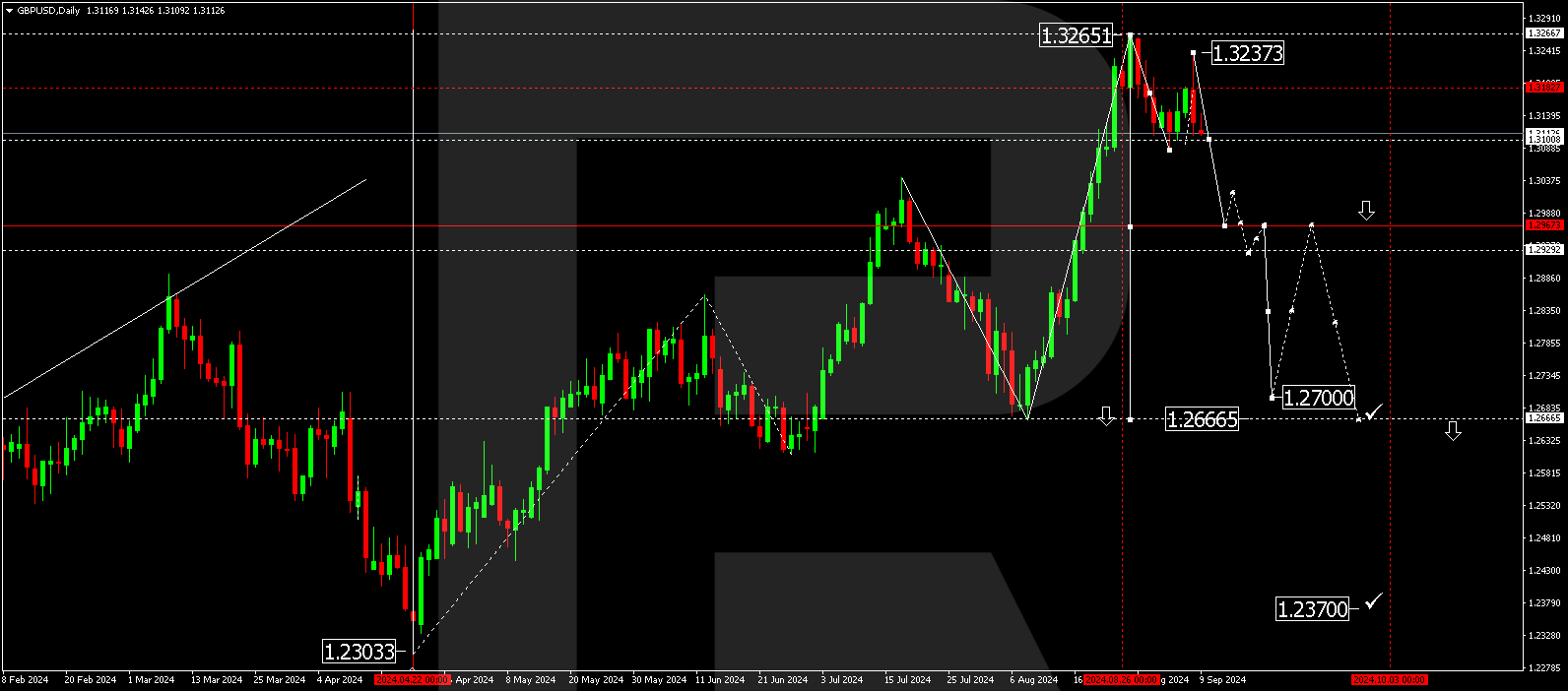

GBPUSD forecast

The GBPUSD pair has completed a downward wave, reaching 1.3100. A consolidation range is expected to form around this level this week. An upward breakout would enable a correction towards 1.3180, while a downward breakout would open the potential for a wave towards 1.2967. A breakout below the 1.3090 level could signal the third downward wave to develop further to 1.2700, potentially continuing to the 1.2660 level.

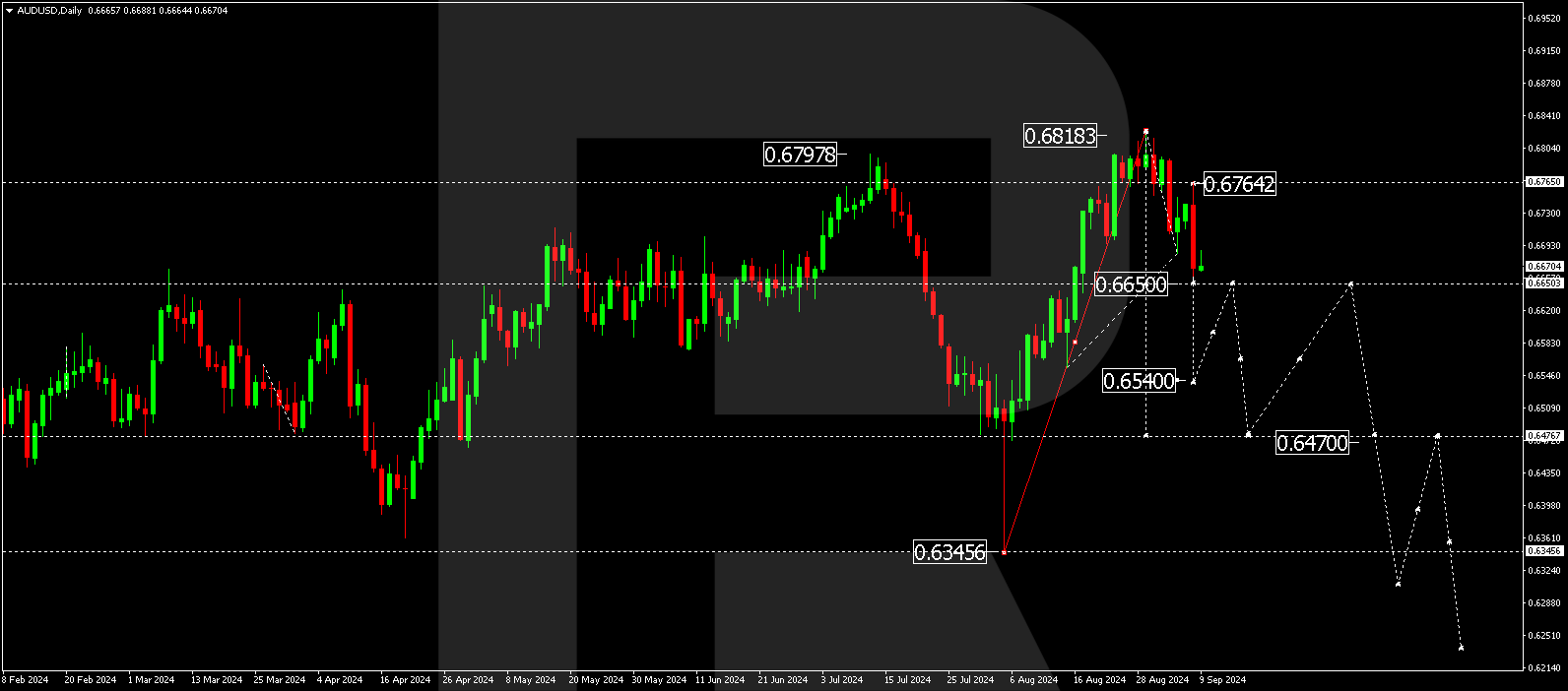

AUDUSD forecast

The AUDUSD pair is forming a downward wave structure towards 0.6650. The price is expected to reach this level and form a consolidation range around it this week. A correction could follow with a breakout above the range, targeting 0.6700. Breaking below the range will open the potential for a downward wave towards 0.6540. A breakout below the 0.6640 level could be considered a signal for continuing the trend to the 0.6540 level, with the wave potentially expanding to the 0.6470 level.

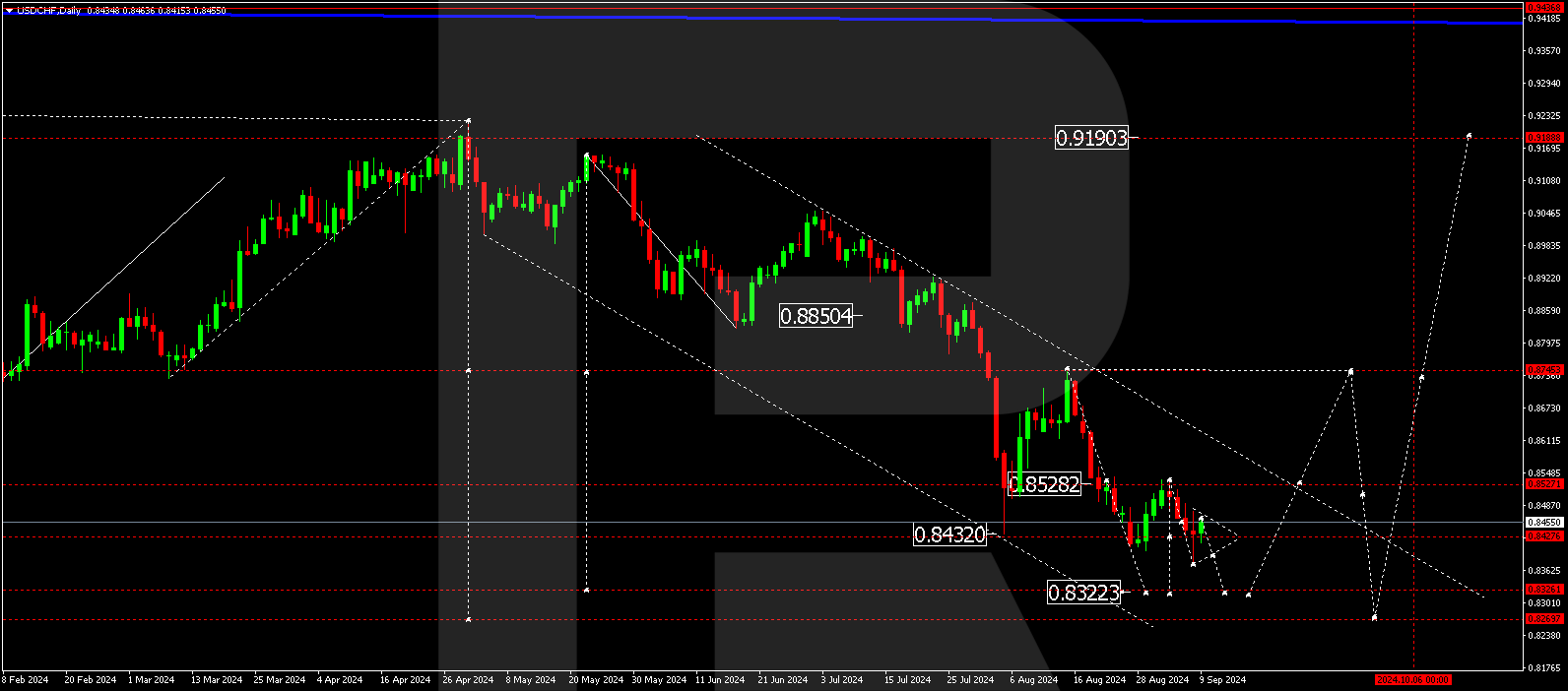

USDCHF forecast

The USDCHF pair has completed a downward wave, reaching 0.8374. A correction towards 0.8475 (testing from below) is currently forming. The price might hit this level and start declining to 0.8370 this week. A breakout below this level will open the potential for a decline to 0.8320. Once the price reaches this level, a growth wave could start, aiming for 0.8525. A breakout above this level could signal a continuation of the trend to 0.8745, with the wave potentially continuing to 0.8855.

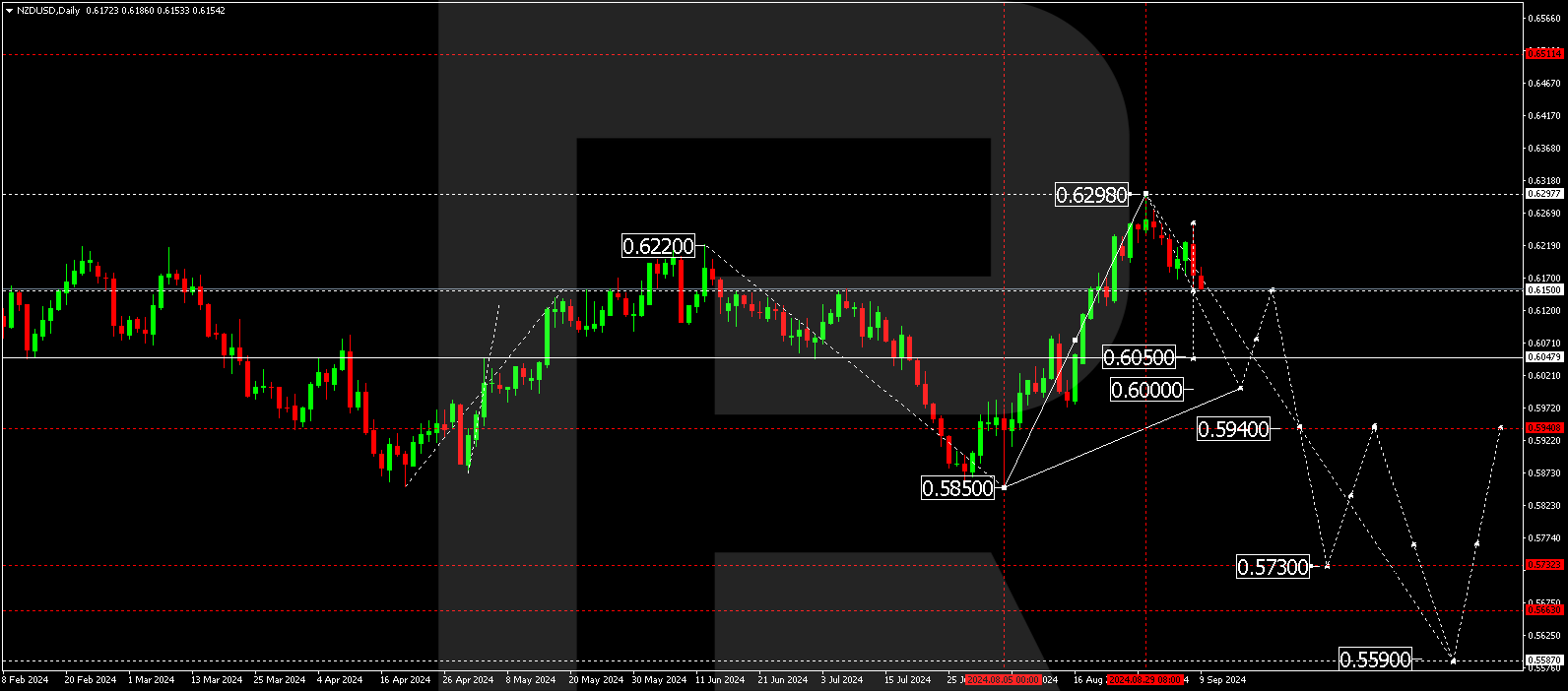

NZDUSD forecast

The NZDUSD pair is forming a downward wave, targeting 0.6050. After reaching this level, the price could correct towards 0.6150 (testing from below). Subsequently, the downward wave might continue towards 0.6000. A breakout below the 0.6150 level could be considered a signal for continuing the trend towards 0.6000, the first target. This week, the price is expected to reach this level and begin to correct towards 0.6150 (testing from below). Subsequently, a downward wave is expected to start, aiming for the local target of 0.5940.

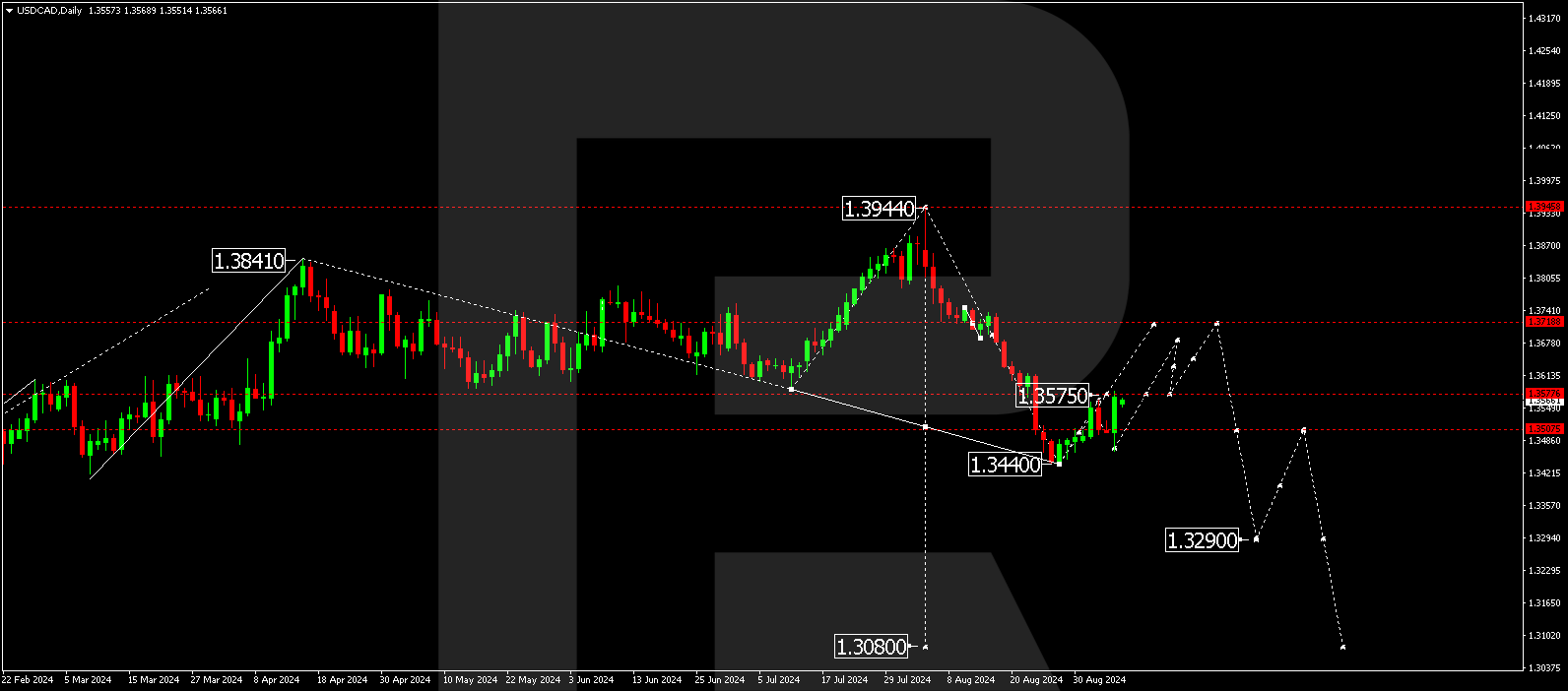

USDCAD forecast

The USDCAD pair has completed a downward wave, reaching 1.3575. A consolidation range is currently forming around this level. The price could break below the range this week, targeting 1.3535. With an upward breakout, the trend might continue to the 1.3680 level. Subsequently, a corrective decline to 1.3575 (testing from above) is expected. Once the correction is complete, a growth wave could develop, aiming for 1.3720 as the second target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.