EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 2-6 September 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 2-6 September 2024.

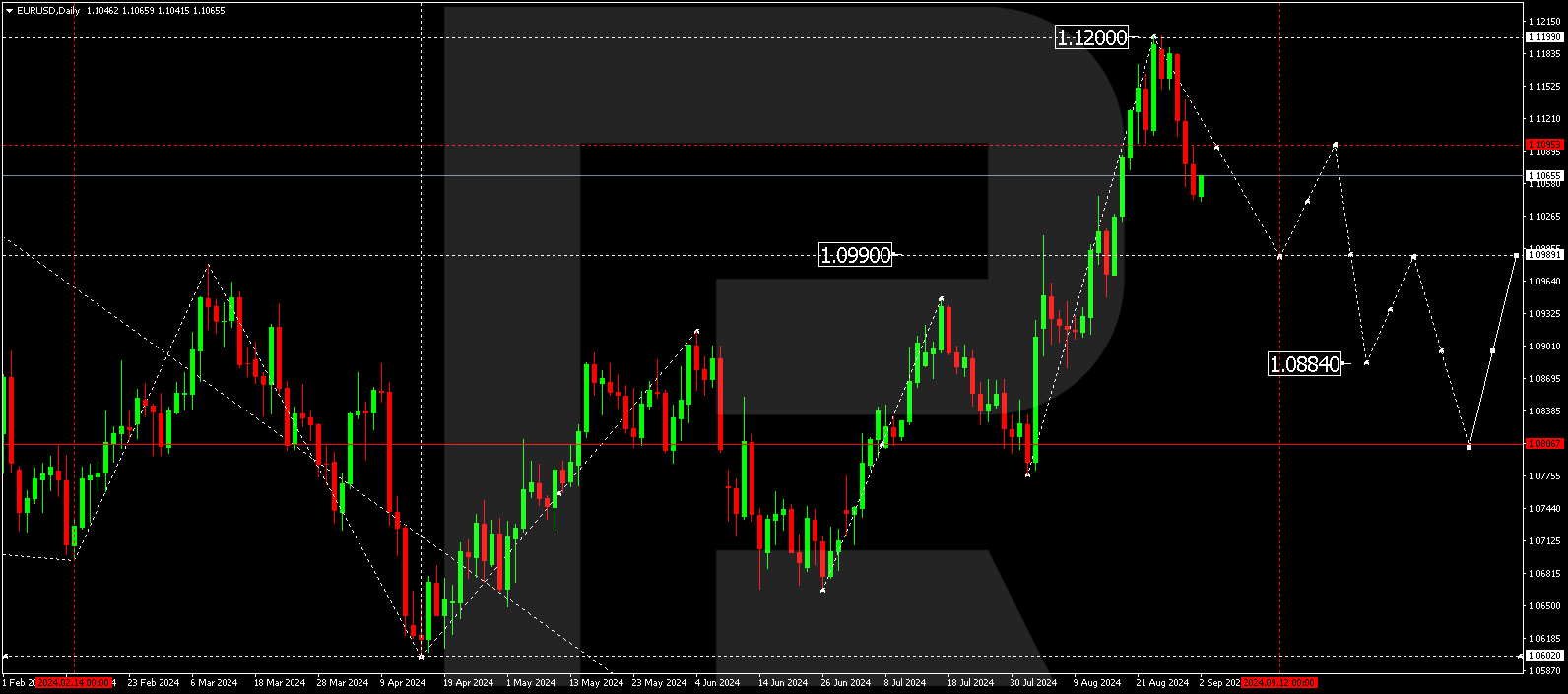

EURUSD forecast

The EURUSD pair continues to develop the first downward wave, with a target at 1.0990. This week, the price is expected to reach this target. Subsequently, it could undergo a correction to 1.1095 (testing from below). Once the correction is complete, a further downward structure is expected, aiming for 1.0990. A breakout below this level may be interpreted as a signal for continuing the trend towards 1.0884, potentially extending to 1.0808.

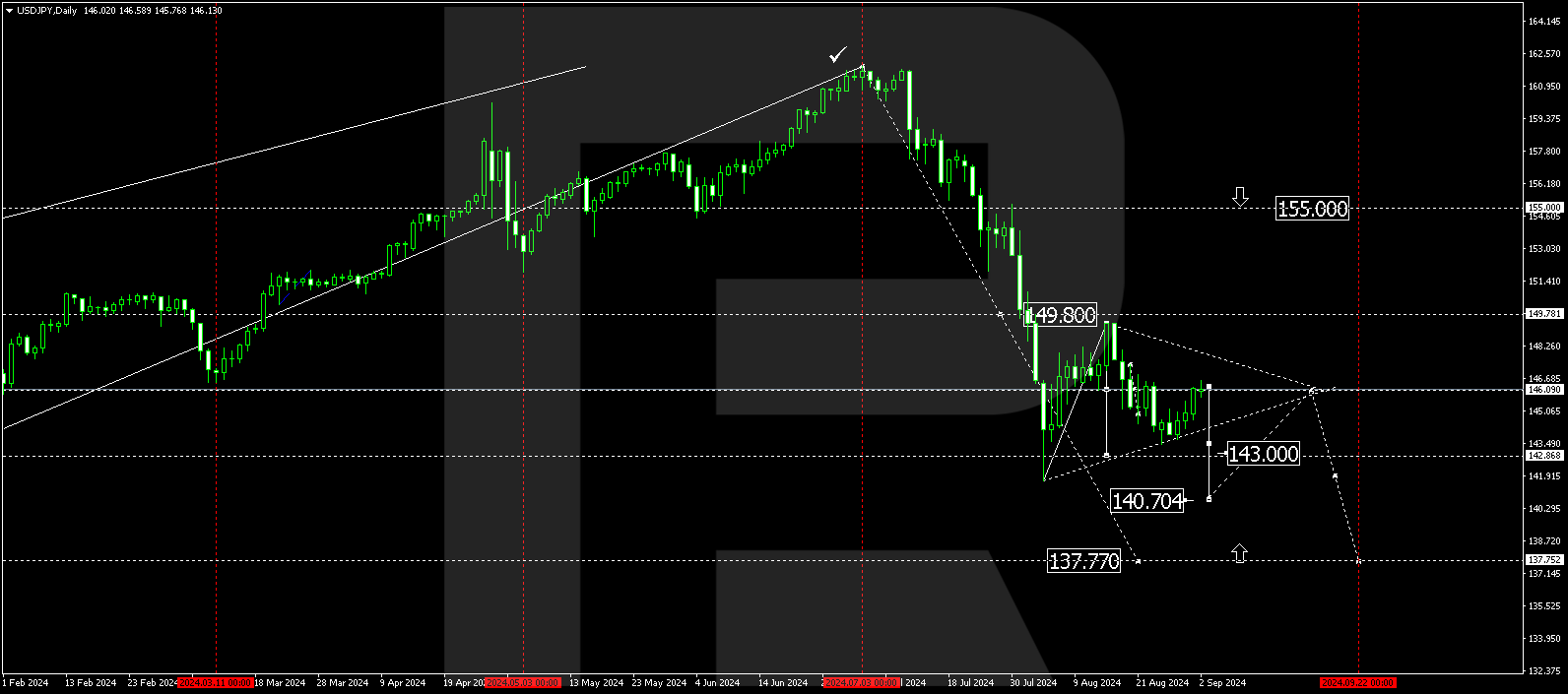

USDJPY forecast

The USDJPY pair continues to develop a consolidation range around 146.10. The market has extended the range to 143.43. A rise to 147.70 is possible this week. A correction could follow with an upward breakout from this range, aiming for 149.80. A decline to the 143.40 level and a breakout below this level will open the potential for a movement towards 140.70. A breakout below the 143.40 level may be considered a signal for continuing the trend, with targets at 140.70 and 137.77.

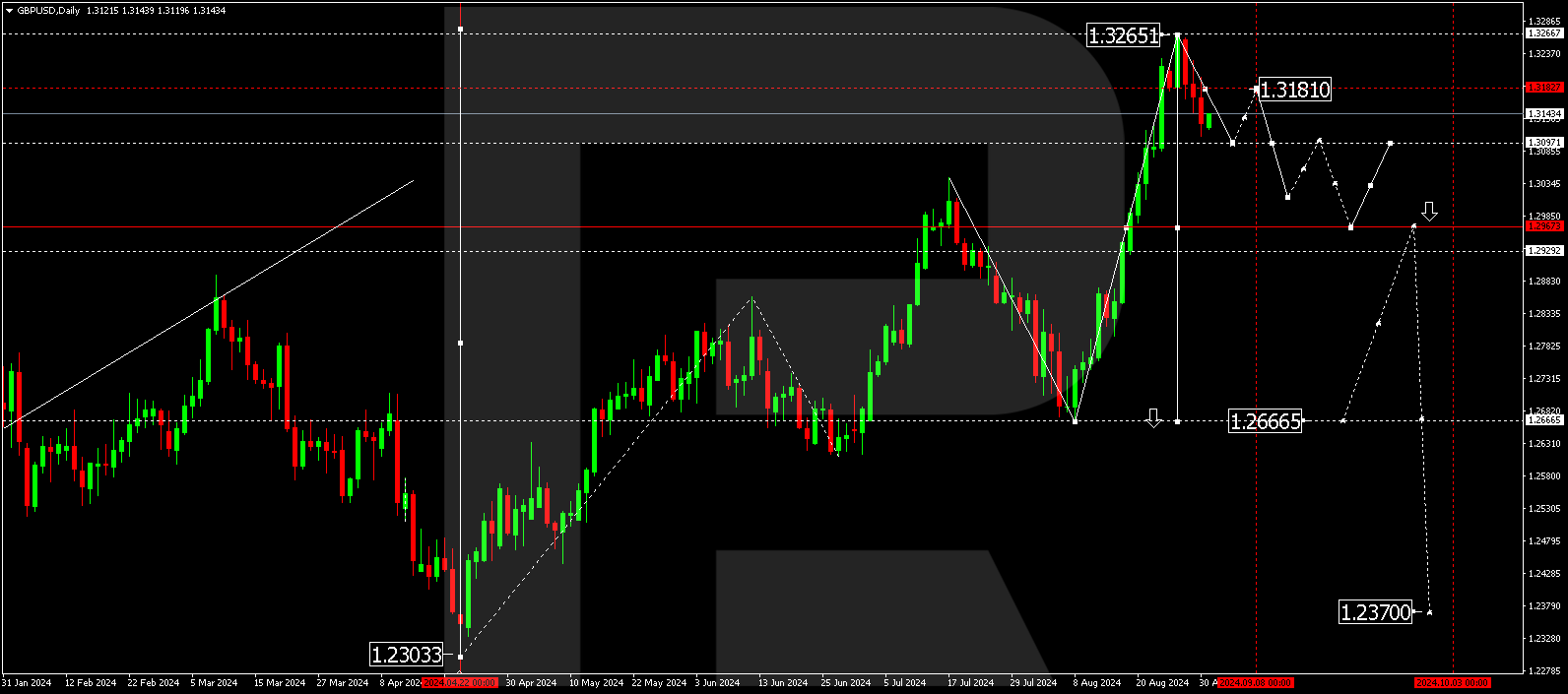

GBPUSD forecast

The GBPUSD pair is forming a downward wave towards 1.3100. This week, the price is expected to reach this level, with corrections starting at 1.3181. A consolidation range has formed at the top of the growth wave at these levels. Subsequently, a downward wave could develop towards 1.3100. A breakout of this level may be considered a signal for continuing the trend towards the 1.3014 and 1.2966 levels, with the latter being the first target.

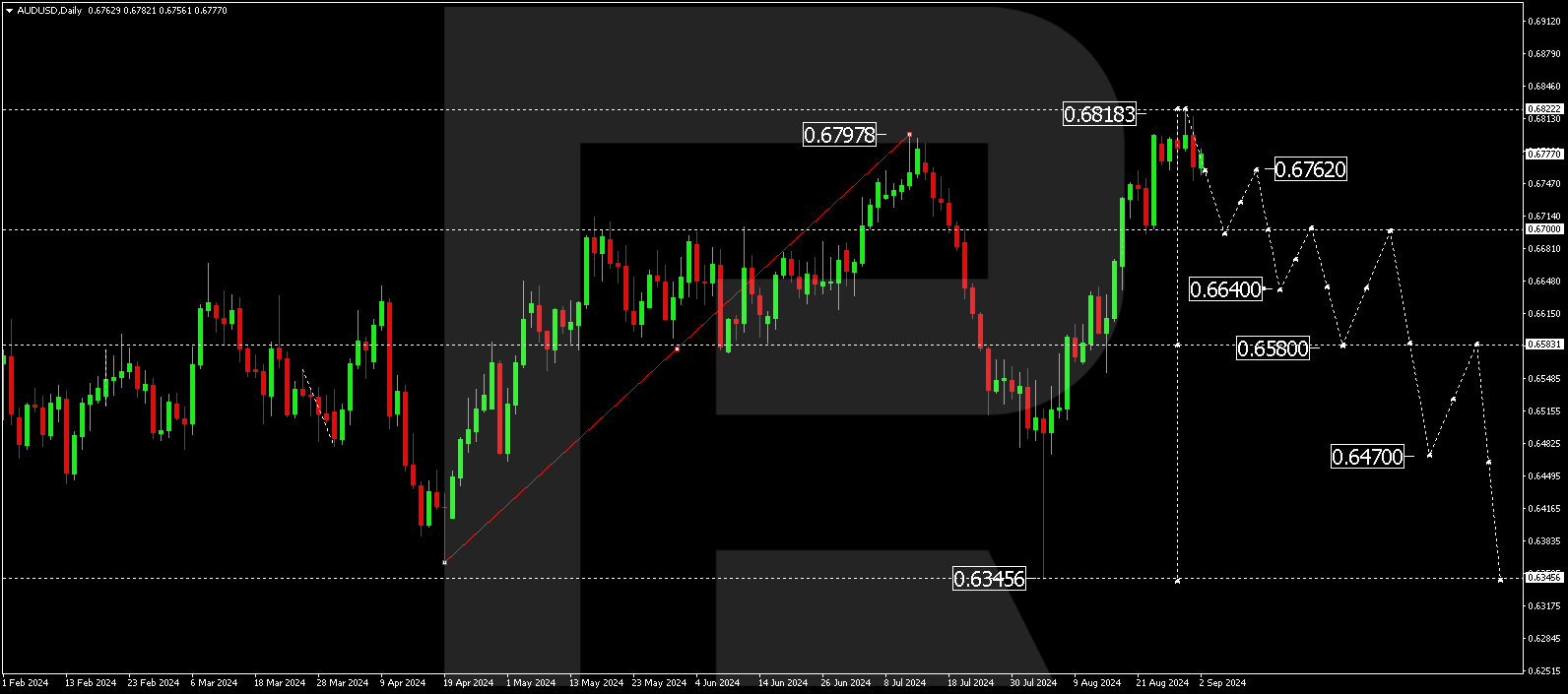

AUDUSD forecast

The AUDUSD pair is forming a downward wave towards 0.6720. This week, the price is expected to reach this level, with corrections beginning at 0.6780. Once the correction is complete, the price could decline to 0.6716. A breakout below this level may be considered a signal for continuing the trend towards the 0.6640 and 0.6580 levels.

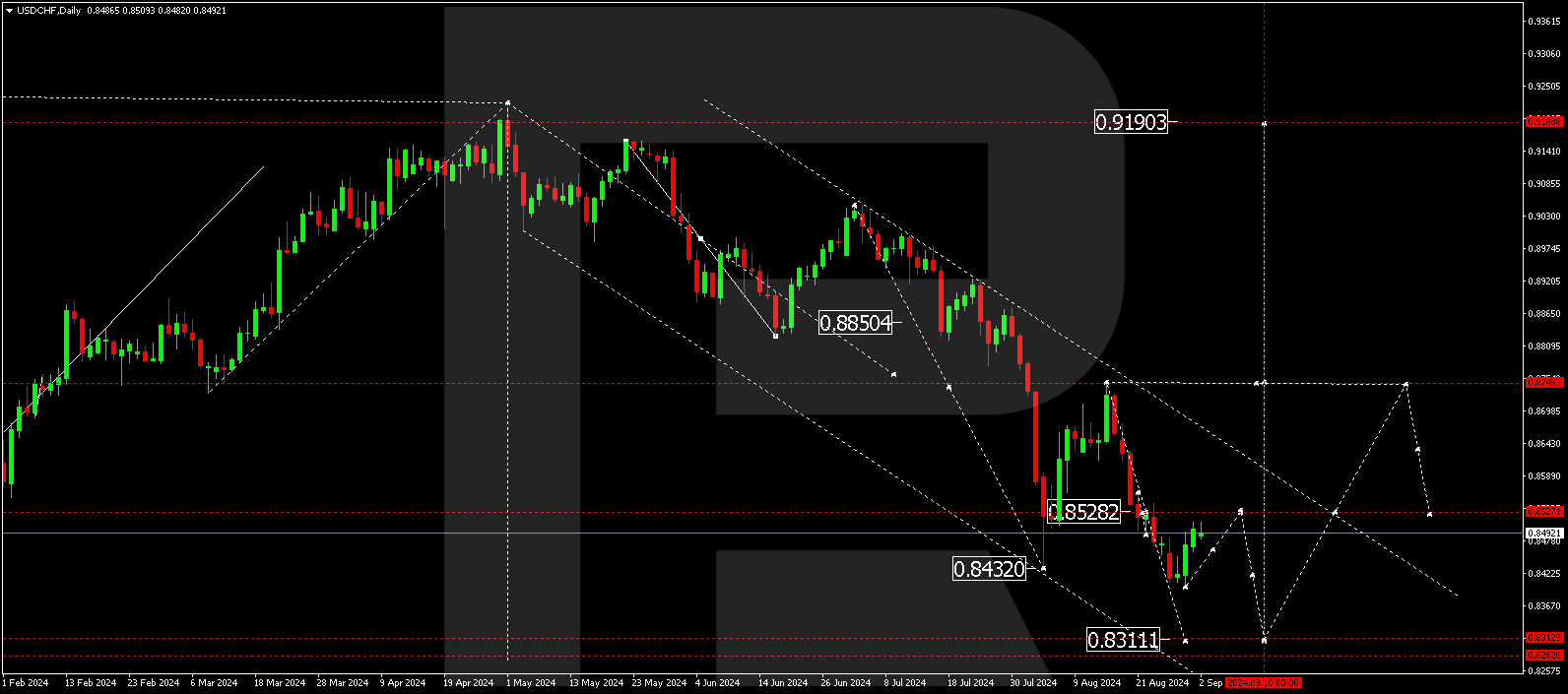

USDCHF forecast

The USDCHF pair has completed a downward wave, reaching 0.8400. A growth structure is now forming, targeting 0.8585 (testing from below). This week, the price could reach this level and start declining towards 0.8450. A breakout below this level will open the potential for a downward wave towards 0.8311. After reaching this level, a growth wave is expected to start, aiming for 0.8525. A breakout above this level may signal a continuation of the trend towards 0.8745, potentially extending to 0.8855.

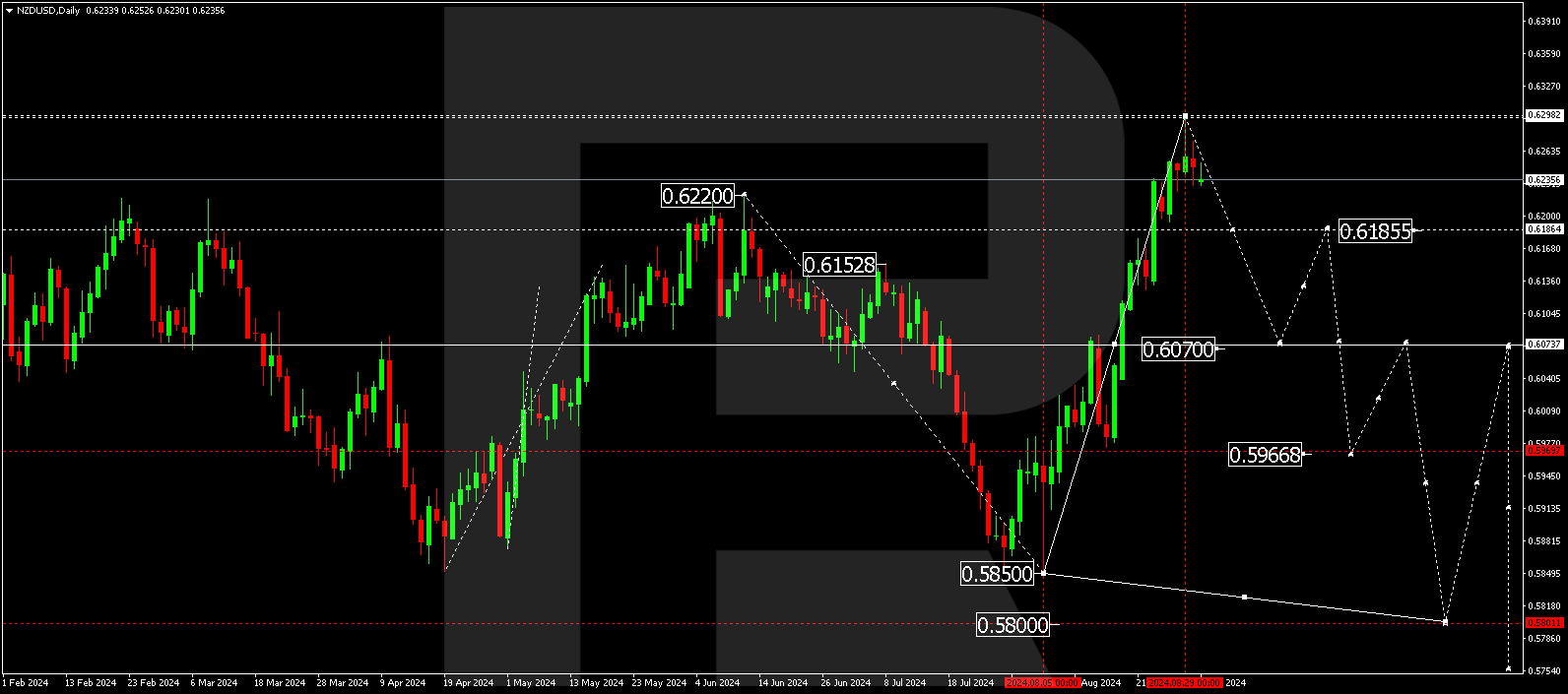

NZDUSD forecast

The NZDUSD pair is forming a downward wave, aiming for 0.6185. A breakout below this level may be interpreted as a signal for continuing the trend towards 0.6070, with this being the first target. This week, the price is expected to reach this level, with corrections beginning at 0.6180 (testing from below). Subsequently, a downward wave is expected, aiming for 0.5966 as the local target.

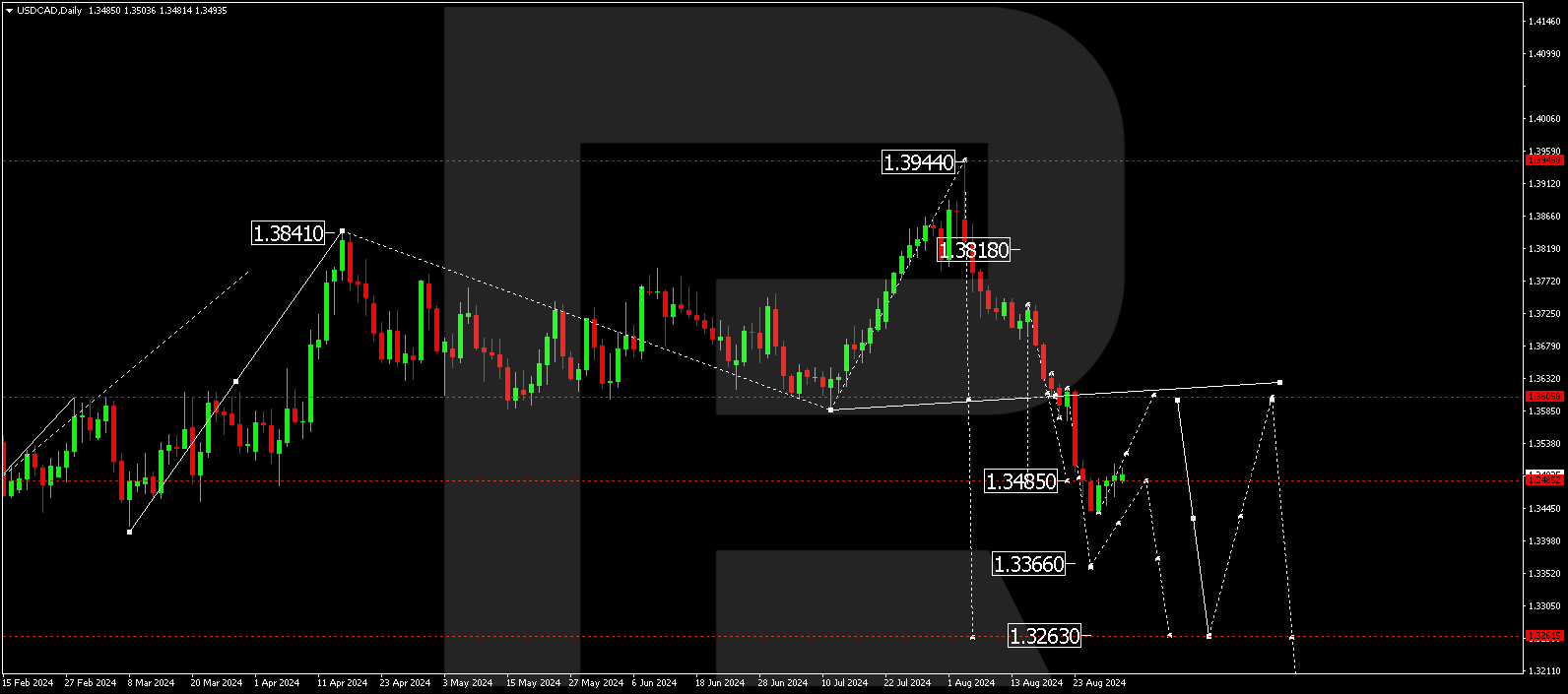

USDCAD forecast

The USDCAD pair has completed a downward wave, reaching 1.3440, with a consolidation range forming above this level. This week, the price could rise to 1.3606 (testing from below) before declining to 1.3366. A breakout below this level may be considered a signal for continuing the trend towards 1.3263 as the first target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.