EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 24 December 2024

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 24 December 2024.

EURUSD forecast

On the EURUSD H4 chart, the market is forming a downward wave structure towards the 1.0380 level. Today, 24 December 2024, the price will likely reach this target level. Subsequently, a correction for this downward wave is anticipated, with a target at 1.0410. Once completed, a new downward wave may begin, aiming towards 1.0350, with the trend potentially continuing to 1.0323.

The Elliott Wave structure and correction matrix, with a pivot point at 1.0380, technically validate this scenario. This level is considered crucial for this downward wave in the EURUSD rate. Currently, the market has rebounded downwards from the central line of the price envelope at 1.0446 and continues its downward momentum towards the envelope’s lower boundary at 1.0323.

Technical indicators for today’s EURUSD forecast suggest a potential decline towards the 1.0380, 1.0350, and 1.0323 levels.

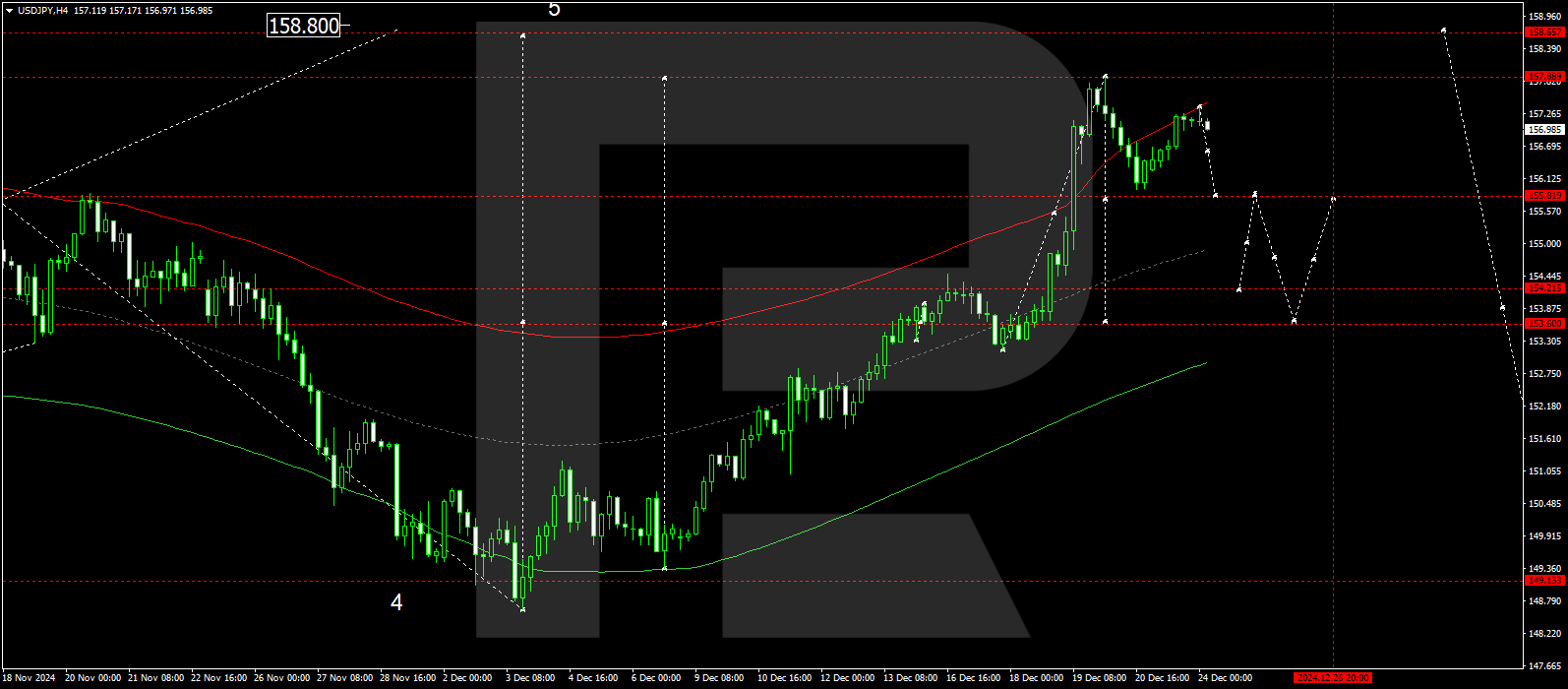

USDJPY forecast

On the USDJPY H4 chart, the market has completed a corrective wave, reaching 157.38. Today, 24 December 2024, a downward wave towards 155.81 is projected, followed by the formation of a narrow consolidation range. If the range breaks downward, the wave could extend to 154.22, potentially continuing to 153.60.

The Elliott Wave structure and growth wave matrix, with a pivot point at 153.53, technically support this scenario for the USDJPY rate. The market is currently near the upper boundary of the price envelope. A downward wave towards its central line at 155.81 could follow. If this level is breached, further declines towards the envelope’s lower boundary at 153.60 appear likely.

Technical indicators for today’s USDJPY forecast suggest a potential decline to the 155.81 and 154.22 levels.

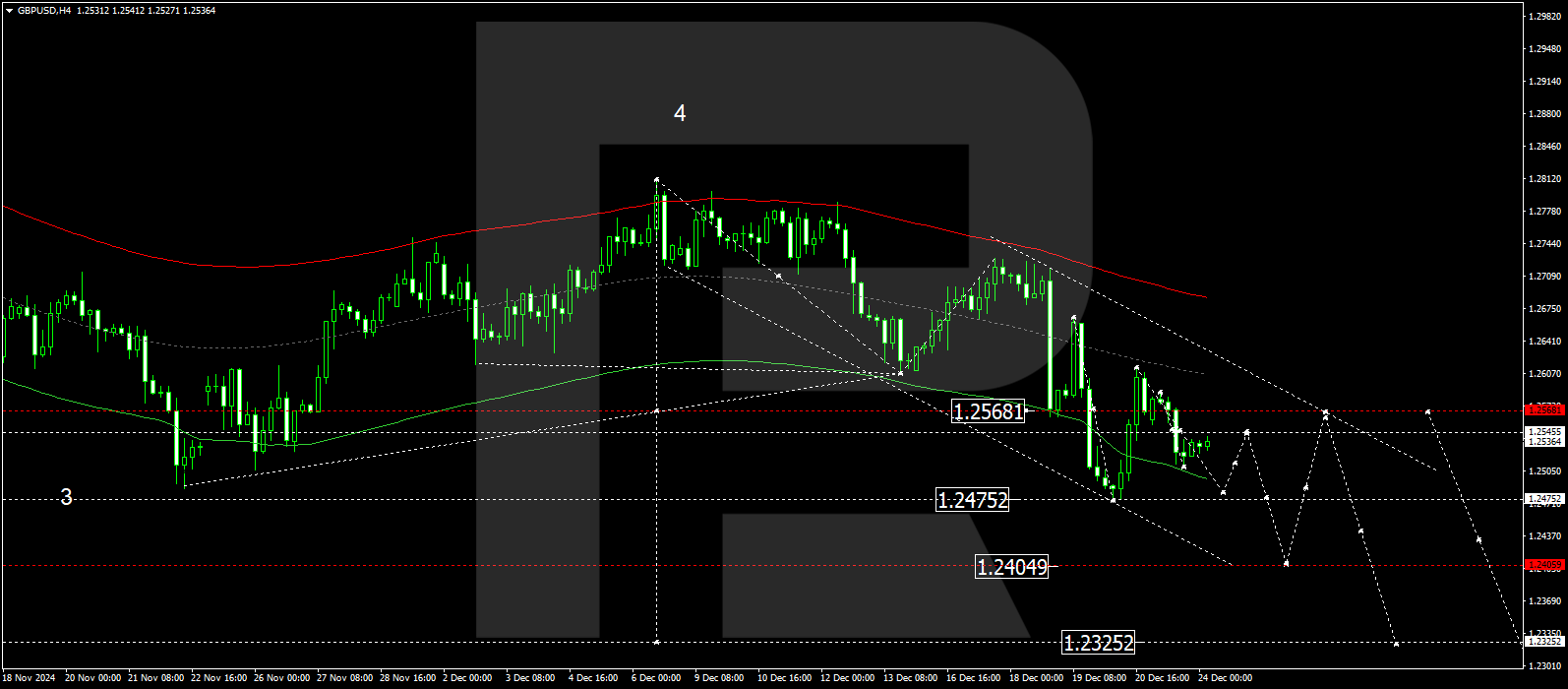

GBPUSD forecast

On the GBPUSD H4 chart, the market is forming a downward wave towards the 1.2484 level. The price could reach this target today, 24 December 2024. Subsequently, a correction towards 1.2545 (testing from below) may occur, followed by a new downward wave towards the local target of 1.2405.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2565, technically support this scenario for the GBPUSD rate. The market has rebounded from the central line of the envelope at 1.2606 and continues its downward trajectory towards the envelope’s lower boundary at 1.2405, the local target. The downward trend could continue towards the primary target of 1.2325.

Technical indicators for today’s GBPUSD forecast suggest a potential continuation of the decline towards the 1.2484 and 1.2405 levels.

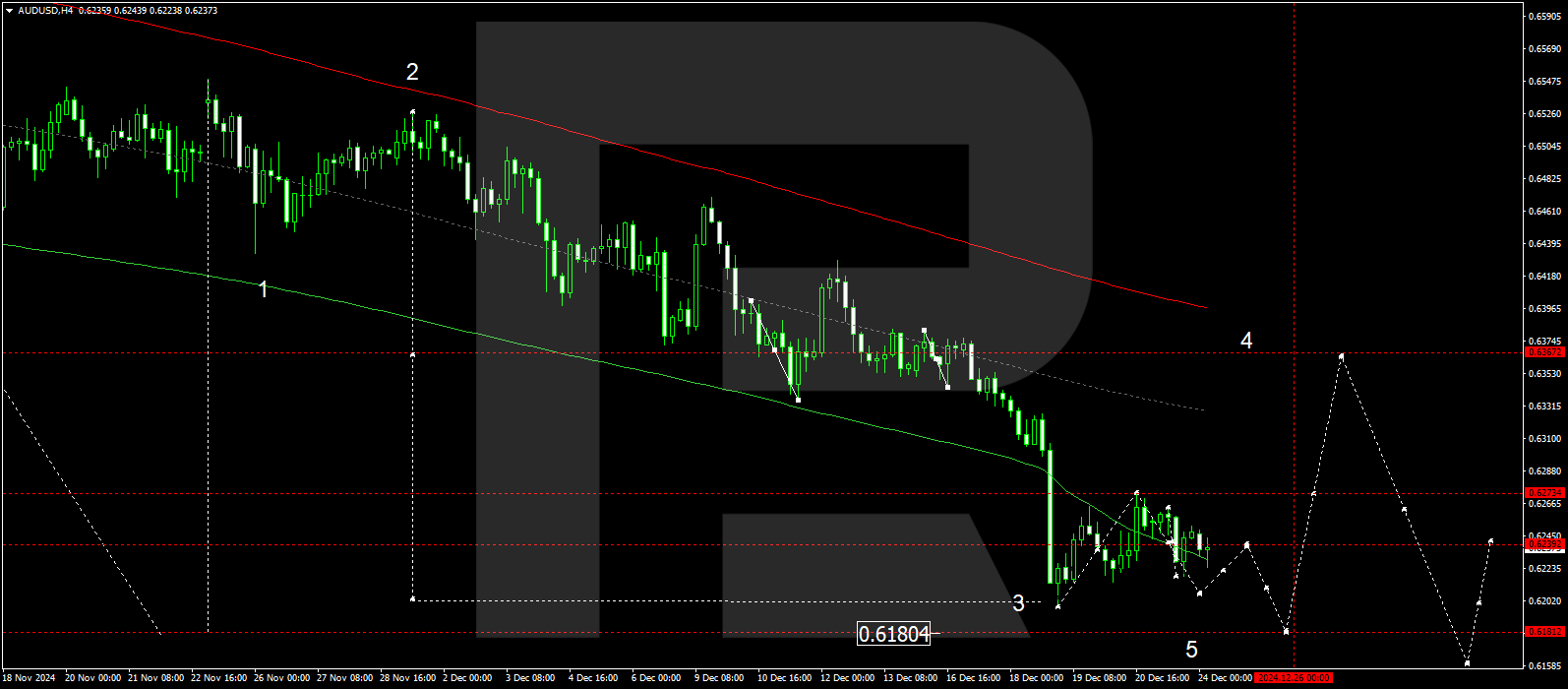

AUDUSD forecast

On the AUDUSD H4 chart, the market continues to consolidate around 0.6240. Today, 24 December 2024, the range may expand downwards towards 0.6206. A subsequent rise to 0.6240 (testing from below) may follow. If the range breaks upwards, a correction towards 0.6363 is likely. Conversely, a downward breakout could lead to further declines towards 0.6180, the primary target.

The Elliott Wave structure and downward wave matrix, with a pivot point at 0.6363, technically support this scenario for the AUDUSD rate. The market has already reached the local decline target of 0.6200 and continues to consolidate near the lower boundary of the price envelope. Today, a decline towards 0.6206 is possible, with the potential for further extension towards the envelope’s lower boundary at 0.6180.

Technical indicators for today’s AUDUSD forecast suggest a potential decline towards the 0.6206 and 0.6180 levels.

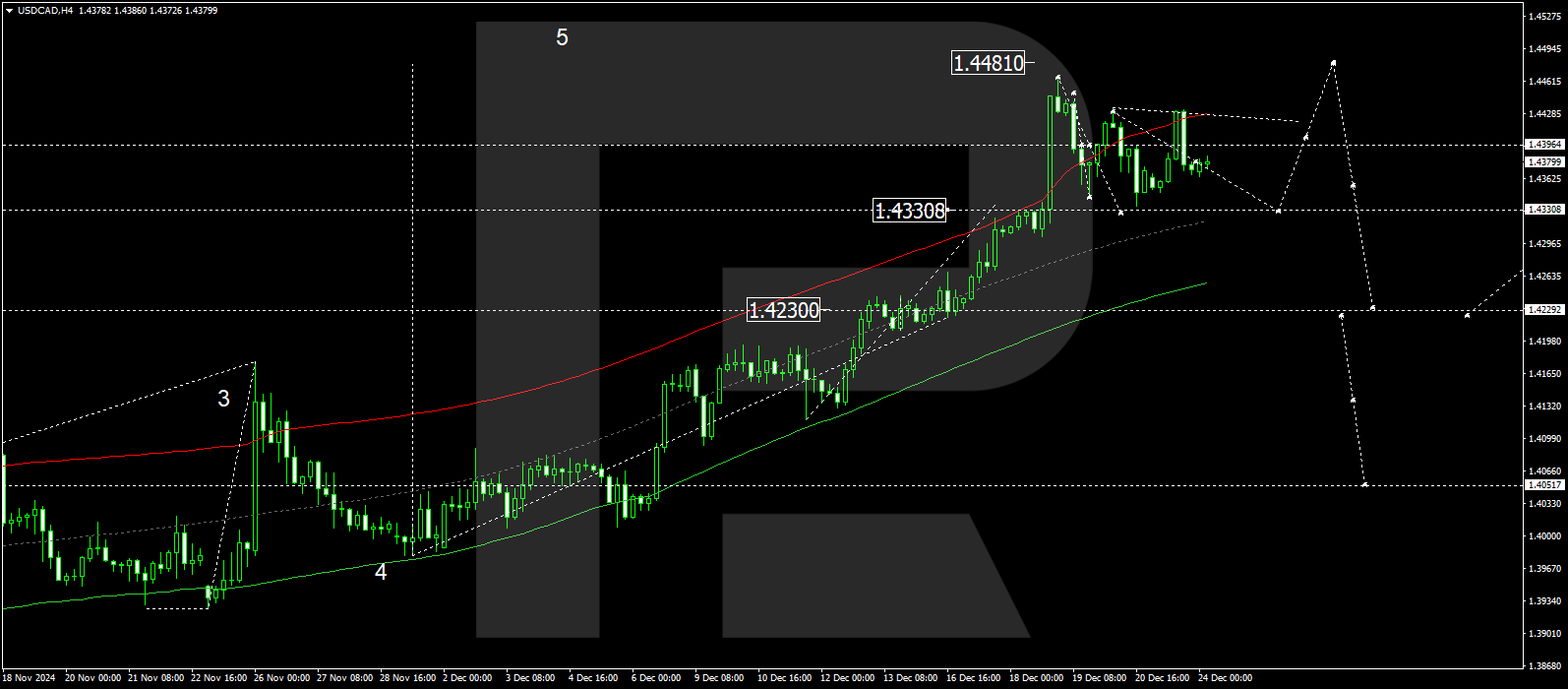

USDCAD forecast

On the USDCAD H4 chart, the market is forming a consolidation range around 1.4400, which is expected to expand downwards towards 1.4330 today, 24 December 2024. Subsequently, a rebound towards 1.4400 is likely. An upward breakout would increase the price’s potential to rise towards 1.4810. In contrast, a downward breakout could trigger a further correction towards 1.4300.

The Elliott Wave structure and wave matrix, with a pivot point at 1.4230, technically validate this scenario. This level is considered crucial for a growth wave in the USDCAD rate. The market is currently consolidating near the upper boundary of the price envelope. If this level is breached, a decline towards its central line at 1.4330 is anticipated, and a continuation towards the envelope’s lower boundary at 1.4230 becomes likely.

Technical indicators for today’s USDCAD forecast suggest a potential decline towards the 1.4330 level.

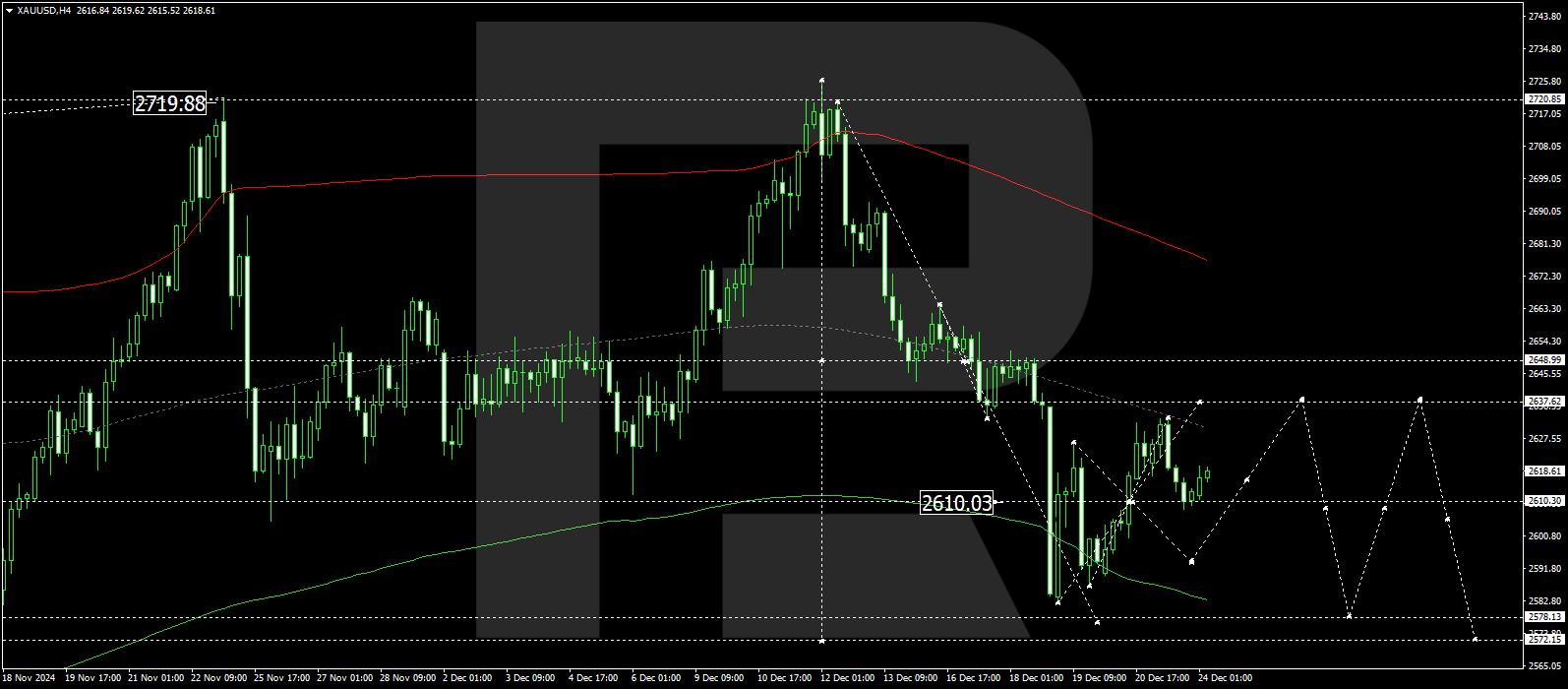

XAUUSD forecast

On the XAUUSD H4 chart, the market is forming a consolidation range around 2,610. Today, 24 December 2024, the price is expected to rise to 2,618 before declining to 2,610. If the range breaks upwards, a correction towards 2,637 is likely. If it breaks downwards, a downward wave towards 2,578 could follow.

The Elliott Wave structure and wave matrix, with a pivot point at 2,650, technically confirm this scenario. This level is considered crucial for the corrective downward wave in the XAUUSD rate. The wave is projected to extend towards the envelope’s central line at 2,637 before declining further towards the lower boundary of the envelope at 2,578.

Technical indicators for today’s XAUUSD forecast suggest potential growth towards 2,637, followed by a decline towards 2,578.

Brent forecast

On the Brent H4 chart, the market continues to consolidate around 72.54. Today, 24 December 2024, the range expanded downwards to 71.68. The market has returned to 72.62. A further decline towards 71.22 is possible. After reaching this level, the price is expected to rise to 73.00.

The Elliott Wave structure and wave matrix, with a pivot point at 72.54, technically support this scenario. This level is considered crucial for the Brent rate, as it is near the central line of the price envelope. Today, the downward wave could continue towards the envelope’s lower boundary at 71.22.

Technical indicators for today’s Brent forecast point to a potential decline towards the 71.22 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.