NZDUSD rises, with the market recouping previous losses

The NZDUSD pair is rising, and investors are buying the Kiwi at lows. Discover more in our analysis for 11 October 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair begins its ascent

- Following a protracted decline, the NZD rate appears attractive to investors

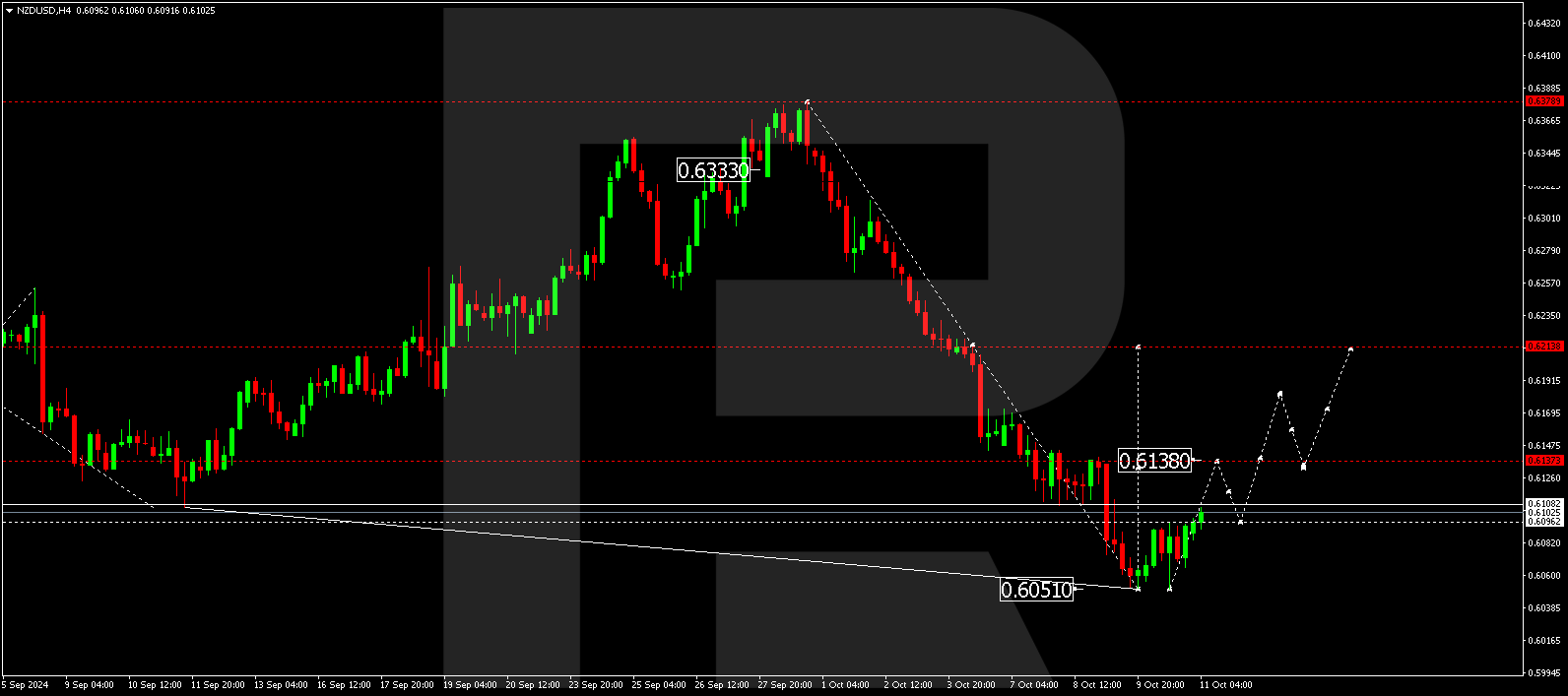

- NZDUSD forecast for 11 October 2024: 0.6138, 0.6182, and 0.6214

Fundamental analysis

The NZDUSD rate recovered, reaching 0.6102, with a positive correction underway for the second consecutive day.

Annual inflation in New Zealand rose to 1.2% in September from 0.4% in August. This is a mixed signal just after the Federal Bank of New Zealand’s 50-basis-point rate cut this week. The RBNZ might use the price argument next to pause an overly aggressive monetary policy easing.

At the same time, the baseline scenario suggests another 50-basis-point rate cut in November, supported by statistics. Sentiment in the manufacturing sector improved to 46.9 points in September from 46.1 in August. However, it has remained below the crucial level of 50.0 points, which separates contraction from growth, for 19 months.

The NZDUSD forecast suggests that a correction could continue.

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market has completed a downward wave, reaching 0.6051. A consolidation range has formed above this level. It is worth considering a breakout above the range towards the first target of 0.6138 today, 11 October 2024. A correction is developing following the recent downward wave. After reaching this level, the price could decline to 0.6096 (testing from above). Subsequently, a growth wave is expected to start, targeting 0.6182, with the NZDUSD rate potentially correcting towards 0.6214.

Summary

The NZDUSD pair is poised for a recovery after a sell-off phase. Technical indicators in today’s NZDUSD forecast suggest a correction towards the 0.6138, 0.6182, and 0.6214 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.