NZDUSD: downward course or will the kiwi stand its ground

Decreased unemployment and rising US nonfarm payrolls may temporarily strengthen the US currency against the New Zealand dollar. Find out more in our analysis for 6 September 2024.

NZDUSD forecast: key trading points

- US nonfarm payrolls: previously at 114,000, projected at 164,000

- US unemployment rate: previously at 4.3%, projected at 4.2%

- CFTC NZD speculative net positions: previously at -8.3 thousand

- NZDUSD forecast for 6 September 2024: 0.6150 and 0.6070

Fundamental analysis

US nonfarm payrolls account for about 80% of employees who produce GDP output. ADP projects the number of employed people to increase to 164,000; the last report missed expectations, with nonfarm payrolls coming in at 114,000. It is advisable not to have high expectations for an increase above the forecast in the upcoming report.

The US unemployment rate may decrease by 0.1% from the previous 4.3%. Analysis for 6 September 2024 shows that decreasing unemployment and rising US nonfarm payrolls may theoretically create conditions for strengthening the US dollar.

The weekly Commodity Futures Trading Commission (CFTC) report analyses the volume of non-commercial traders’ speculative positions in the US futures markets. It shows the difference between traders’ long and short NZD positions on the Chicago and New York futures markets. The CFTC report is published every Friday and covers data as of Tuesday of the current week.

The number of short open positions has decreased over the past four weeks, indicating that bulls are gradually gaining dominance in the market. The forecast for 6 September 2024 suggests that last week’s reading will remain flat at -8.3 thousand. This may be due to the upcoming Federal Reserve decision to change interest rates, with traders expecting significant movements in the NZDUSD rate, hoping for excess profit.

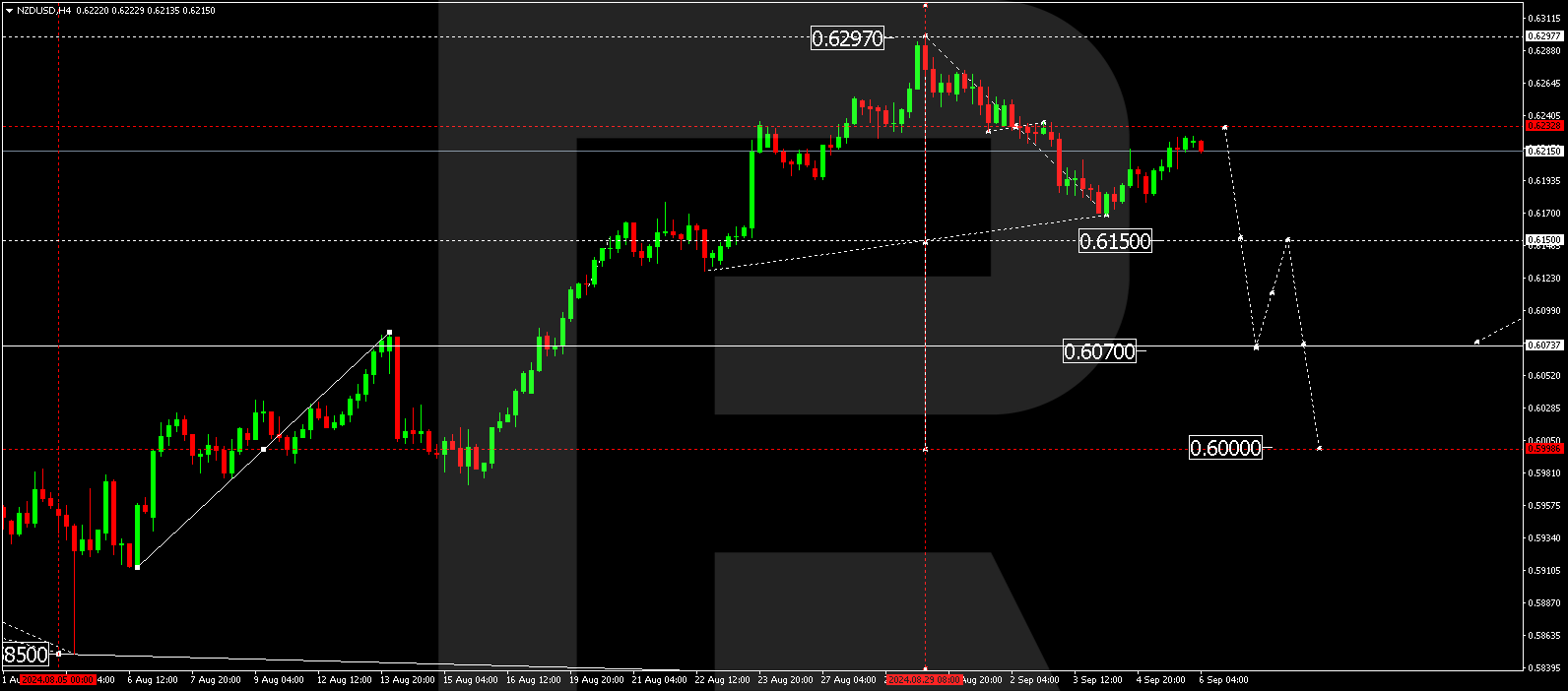

NZDUSD technical analysis

The NZDUSD H4 chart shows that the market has completed a downward wave, reaching 0.6169. A correction towards 0.6234 (testing from below) is expected today, 6 September 2024. The market will outline the boundaries of a consolidation range around 0.6234. With a decline to 0.6160 and a breakout below this level, it will be relevant to consider the beginning of a new downward wave in the NZDUSD rate, aiming for 0.6070 and potentially continuing to 0.6000. A breakout below the 0.6160 level may signal the start of a new downtrend.

Summary

Positive US fundamental data and the NZDUSD technical analysis in today’s NZDUSD forecast suggest that the correction could be complete, and the downtrend could begin, targeting the 0.6150 and 0.6070 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.