The GBPUSD pair is poised for a rebound, but volatility is increasing

The GBPUSD pair rose, with the pound supported by the local weakness of the US dollar. More details in our analysis for 4 November 2024.

GBPUSD forecast: key trading points

- The GBPUSD pair has risen

- Investors will need safe-haven assets this week

- GBPUSD forecast for 4 November 2024: 1.3060 and 1.3128

Fundamental analysis

The GBPUSD rate strengthened, reaching 1.2990.

After several challenging days, the pair has recovered. The previously released weak data on wages in the UK economy may prompt the pound to retest the recent highs.

The closer we get to the US election on 5 November, the higher the market volatility.

The recent GBP weakness was due to pressure from the US dollar and specific features of the UK state budget, which includes higher taxes and spending cuts.

The Bank of England plans to lower the interest rate by nearly 100 basis points by the end of 2025. Investors are meticulously factoring these expectations into stock exchange prices.

The GBPUSD forecast looks favourable.

GBPUSD technical analysis

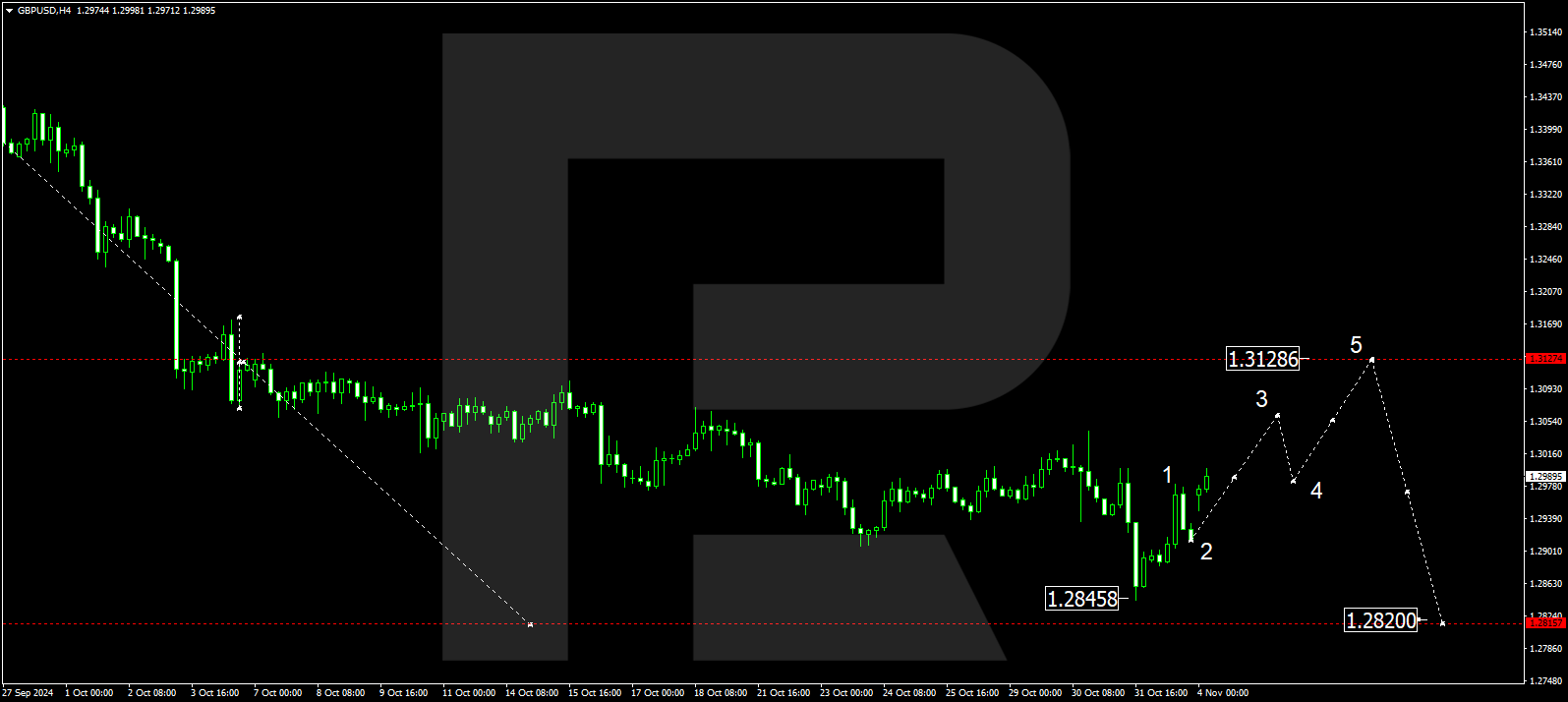

The GBPUSD H4 chart shows that the market has received support at 1.2914 and continues to correct towards 1.3060. The price could break above the 1.2989 level today, 4 November 2024, and continue to develop a new growth wave, aiming for 1.3060 as the local target. After reaching this level, the GBPUSD rate is expected to correct towards 1.2990 (testing from above). Subsequently, another growth structure could develop, aiming for 1.3128, followed by a corrective wave structure.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2898, technically confirm this scenario for the GBPUSD rate. The market maintains its upward momentum towards the upper boundary of the price envelope. Once the price reaches the 1.3060 level, a correction might begin, aiming for the centre of the price envelope at 1.2898. The price could then rise to the upper boundary of the price envelope at 1.3128.

Summary

The GBPUSD pair has declined as the weakening US dollar allowed the pound to recover. Technical indicators in today’s GBPUSD forecast suggest a further correction towards the 1.3060 and 1.3128 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.