GBPUSD is poised to recover with a rebound

The GBPUSD pair has halted its decline and is stabilising. The pound appears oversold. More details in our analysis for 21 October 2024.

GBPUSD forecast: key trading points

- The GBPUSD pair maintains its upward momentum

- Market focus is on the upcoming speeches by Bank of England monetary policymakers

- GBPUSD forecast for 21 October 2024: 1.2940

Fundamental analysis

The GBPUSD rate starts Monday with a rise to 1.3049.

Last week’s main news for the pound sterling was information on easing inflation control measures. Capital markets have rightly raised the likelihood that the Bank of England will accelerate the pace of future interest rate cuts. The focus will now be entirely on the new speeches from BoE officials, especially those with a hawkish stance. Some monetary policymakers have previously mentioned that the Monetary Policy Committee should adopt a more cautious stance.

At least four officials are scheduled to deliver a speech during the new October week. Two of them – Megan Greene and Catherine Mann – have yet to vote for an interest rate cut in this monetary cycle.

The GBPUSD forecast appears moderately positive.

GBPUSD technical analysis

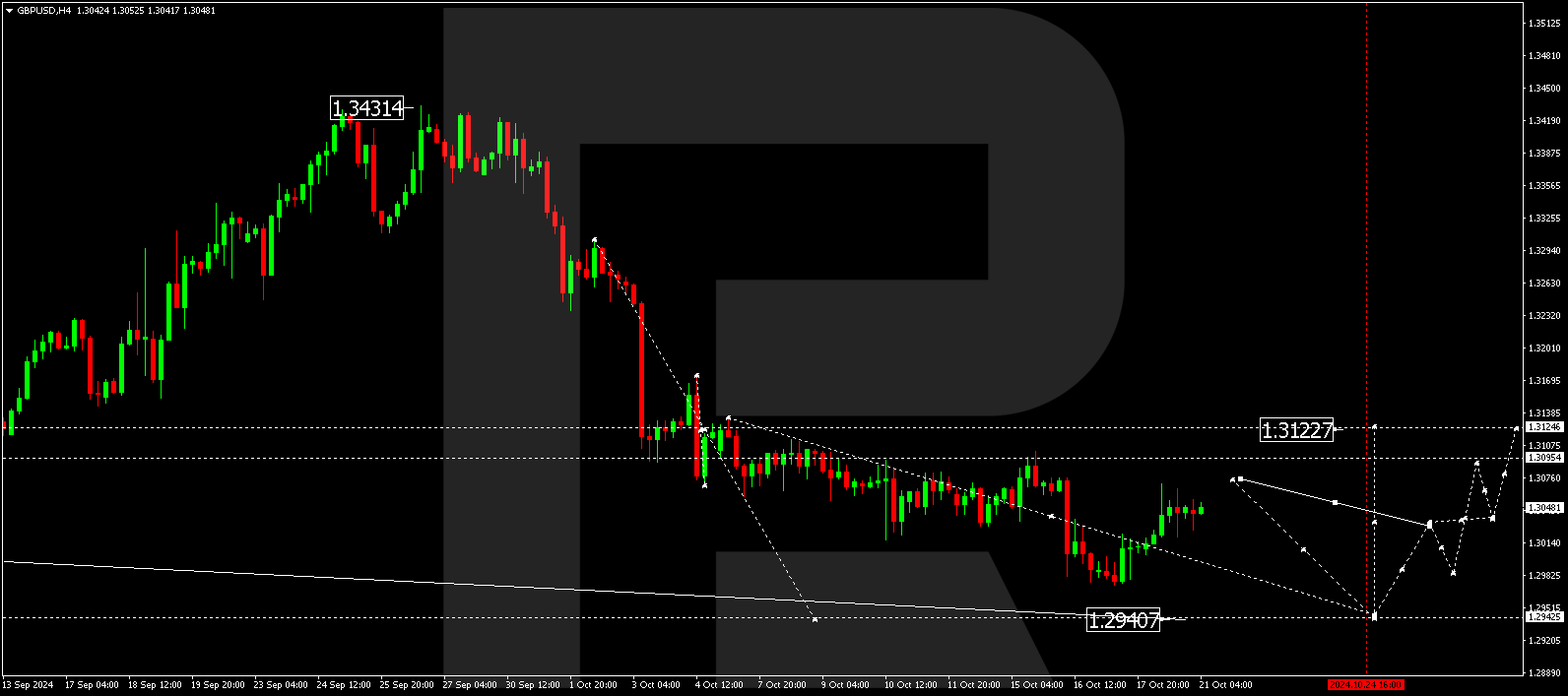

The GBPUSD H4 chart shows that the market has completed a corrective wave, reaching 1.3070. A consolidation range is forming below this level today, 21 October 2024, with the potential to extend up to 1.3074. A decline and a breakout below the 1.3019 level will open the potential for further movement towards 1.2940, the first target. If the price rises and breaks above the 1.3075 level, a correction could follow, aiming for 1.3125 (testing from below). Once the correction is complete, another downward wave in the GBPUSD rate could develop, aiming for 1.2900 and potentially further to 1.2830 as the local target.

Summary

The GBPUSD pair has rebounded, taking advantage of the stabilising US dollar and market expectations. Technical indicators in today’s GBPUSD forecast suggest that the correction could be complete at 1.3074, followed by a downward wave towards 1.2940.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.