GBPUSD is in equilibrium: the US dollar came under pressure

The GBPUSD pair has strengthened its position. The market is disappointed in the outlook following Friday’s US employment statistics. Find out more in our analysis for 9 September 2024.

GBPUSD forecast: key trading points

- The GBPUSD pair has a stable start to the week

- The pound will respond to the Bank of England’s monetary strategy

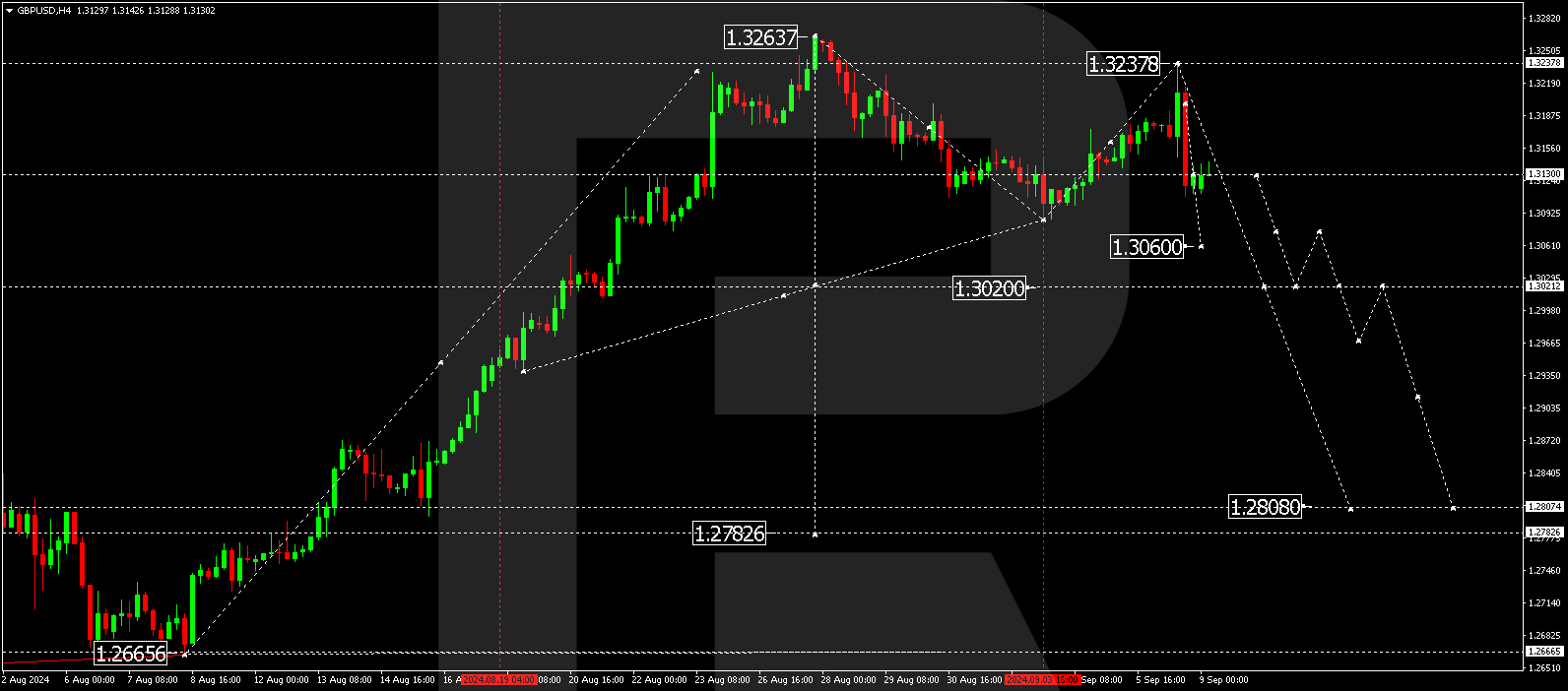

- GBPUSD forecast for 9 September 2024: 1.3060, 1.3020, and 1.2808

Fundamental analysis

The GBPUSD pair started the new week of September at 1.3121.

Last week’s US data gave investors much to reflect on. The reports showed that the employment market is weaker than previously thought. Investors are now anticipating a more significant and rapid Federal Reserve interest rate cut, which put the US dollar in a vulnerable position and enabled other currencies to strengthen.

At the same time, pound bulls are overly cautious. This year, the Bank of England’s stance has been as moderately aggressive as the Federal Reserve’s. The BoE does not rush to lower borrowing costs, allowing inflation to stabilise on its own.

Interestingly, market participants expect a significant difference in interest rates between the Federal Reserve and the Bank of England. The British regulator may prefer a more peaceful and cautious strategy than its US counterpart.

The GBPUSD forecast appears neutral from the fundamental perspective.

GBPUSD technical analysis

The GBPUSD H4 chart shows that the market has completed a corrective wave, reaching 1.3237. Following the news, it declined to 1.3147 before rising to 1.3198. The GBPUSD rate is expected to fall to 1.3110 and form a consolidation range around this level today, 9 September 2024. A downward breakout of the range will open the potential for a wave towards 1.3060, potentially continuing the trend to 1.3020. Conversely, a breakout below the 1.3110 level may signal the downward wave to continue to the local target of 1.2808.

Summary

Investors in the GBPUSD pair are preoccupied with assessing risks and monitoring the news landscape. Technical indicators in today’s GBPUSD forecast suggest a potential decline in the GBPUSD rate to the 1.3060, 1.3020, and 1.2808 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.