GBPUSD continues to rise: the pound is not afraid of trade wars

The GBPUSD pair rose to 1.2794 on Wednesday, marking a new three-month high. Discover more in our analysis for 5 March 2025.

GBPUSD forecast: key trading points

- The GBPUSD pair is hovering around a new three-month high of 1.2794 on Wednesday

- The UK was on the sidelines of the global trade confrontation, supporting the pound sterling

- GBPUSD forecast for 5 March 2025: 1.2809 and 1.2900

Fundamental analysis

The GBPUSD rate strengthened to 1.2794 on Wednesday.

The pound sterling is not in the market focus right now like the US dollar or the euro, but it is certainly one of the beneficiaries of what is happening. While the USD is falling amid concerns about rising inflation and slowing US GDP and the euro is rallying, driven by demand for risk, the pound is rapidly rising.

The US tariff plans do not affect the UK in any way as the share of mutual trade turnover is extremely small. Against this backdrop, the GBP feels confident.

The GBPUSD forecast is stable.

GBPUSD technical analysis

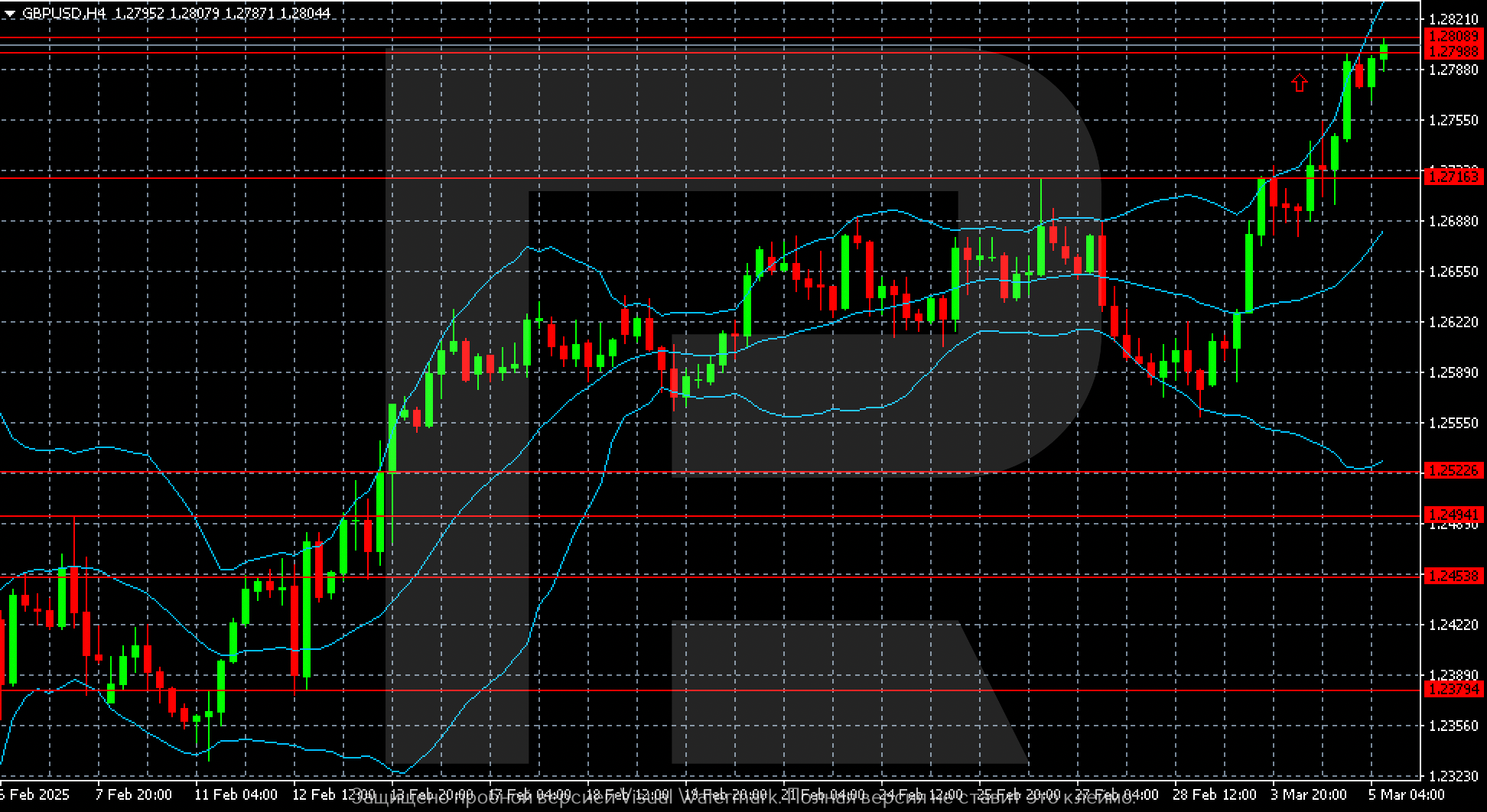

On the GBPUSD H4 chart, the nearest upside target is 1.2809.

The GBPUSD pair successfully tested the 1.2800 level yesterday. Against this background, the focus shifts to 1.2900. If the market moves higher, we could say that the pair’s movement has turned into a trend and is no longer just a recovery.

Summary

The GBPUSD pair continues to rise steadily and hits three-month highs, driven by the UK stable and diverse trade turnover and its isolation from the US. The GBPUSD forecast for today, 5 March 2025, expects further growth to 1.2809 and then to 1.2900.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.