EURUSD hits a new six-month low: all sympathies are with the US dollar

The EURUSD pair continues its decline, with the market positive about Trump. Find out more in our analysis for 13 November 2024.

EURUSD forecast: key trading points

- The EURUSD pair continues to fall

- The market favours the US dollar and sympathises with President-elect Trump

- EURUSD forecast for 13 November 2024: 1.0540

Fundamental analysis

The EURUSD rate fell to 1.0619.

Inventors continue to show enthusiasm following Donald Trump’s victory in the US presidential election. His policy of lower taxes, reduced import duties, and extensive economic stimulus inspire US dollar supporters.

Trump will take office in January.

Today, the focus will shift to fundamentals, particularly the October US inflation data release. Prices are expected to show a 0.2% rise m/m last month, unchanged from the previous month.

The EURUSD forecast remains in favour of the US dollar.

EURUSD technical analysis

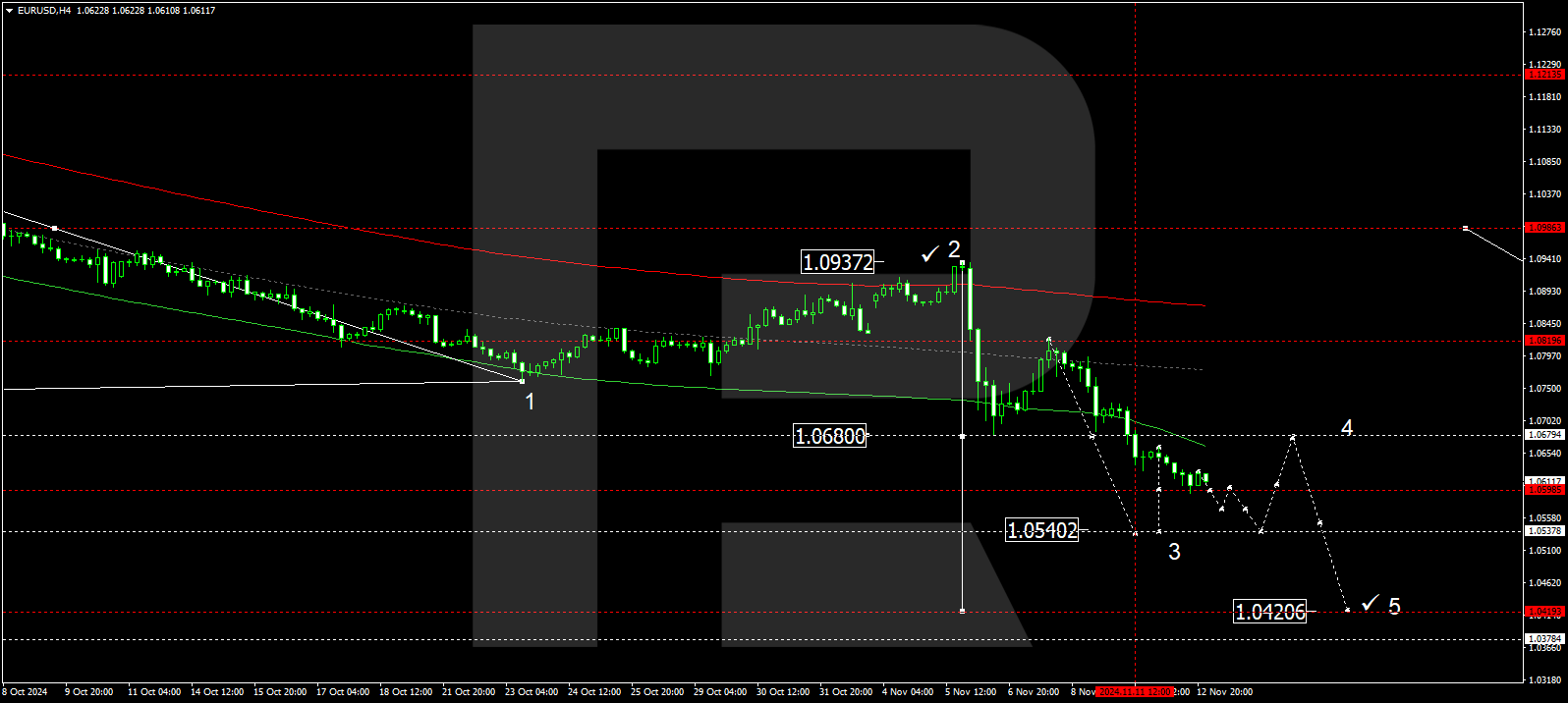

The EURUSD H4 chart shows that the market has breached the 1.0680 level and continues its downward momentum, aiming towards 1.0540, the local target. The price is expected to fall to 1.0570 today, 13 November 2024. After reaching this level, a technical retracement to 1.0600 (testing from below) is possible. Subsequently, a further downward wave is anticipated, targeting 1.0540, followed by a more substantial corrective wave towards 1.0680.

The Elliott Wave structure and matrix of the third downward wave, with a pivot point at 1.0680, technically confirm this scenario. This level is crucial for the third downward wave in the EURUSD rate. A break below it has opened the potential for continuing the trend towards 1.0540. After reaching this level, the price is expected to rise to the central line of a price envelope. The wave could then continue towards the envelope’s lower boundary at 1.0420.

Summary

The EURUSD pair has plunged to a new six-month low. Technical indicators for today’s EURUSD forecast suggest that the downward wave could continue to the 1.0540 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.