EURUSD: the euro attempts to regain ground after a decline

Speeches by ECB officials and the Federal Reserve’s interest rate decision may add to market volatility. Discover more in our analysis for 7 November 2024.

EURUSD forecast: key trading points

- A speech by European Central Bank official Isabel Schnabel

- US initial jobless claims: previously at 216,000, projected at 223,000

- The US Federal Reserve’s interest rate decision

- EURUSD forecast for 7 November 2024: 1.0814

Fundamental analysis

ECB officials, including Isabel Schnabel, will deliver speeches today. Their statements may provide further clarity on the European Union’s monetary policy. While no major global announcements are expected, there may still be positive developments for the euro.

US initial jobless claims reflect the number of individuals filing for unemployment benefits for the first time during the previous week. The indicator reflects labour market conditions, with an increase in initial claims signalling a rise in unemployment. The previous reading was 216,000, and the forecast for 7 November 2024 does not appear overly optimistic, predicting an increase to 223,000.

Based on historical data, a change in claims of less than 35,000 typically does not significantly impact the USD. Given the current volatility, this delta can be considered an inaccuracy, to which the EURUSD rate typically reacts very rarely.

The US Federal Reserve will announce its interest rate decision today. Market participants are divided, with anticipation further intensifying the atmosphere. The forecast for 7 November 2024 suggests that the interest rate could be reduced again by 0.25%. However, a 0.50% interest rate cut could not be ruled out. The release of the rate decision is a significant challenge for investors, particularly in the aftermath of the US presidential election. This decision will be a significant test for the market, especially considering the sharp decline in the EURUSD rate during the previous trading session.

It is hoped that the common sense of market participants and regulators will result in more restrained actions over the next trading sessions.

EURUSD technical analysis

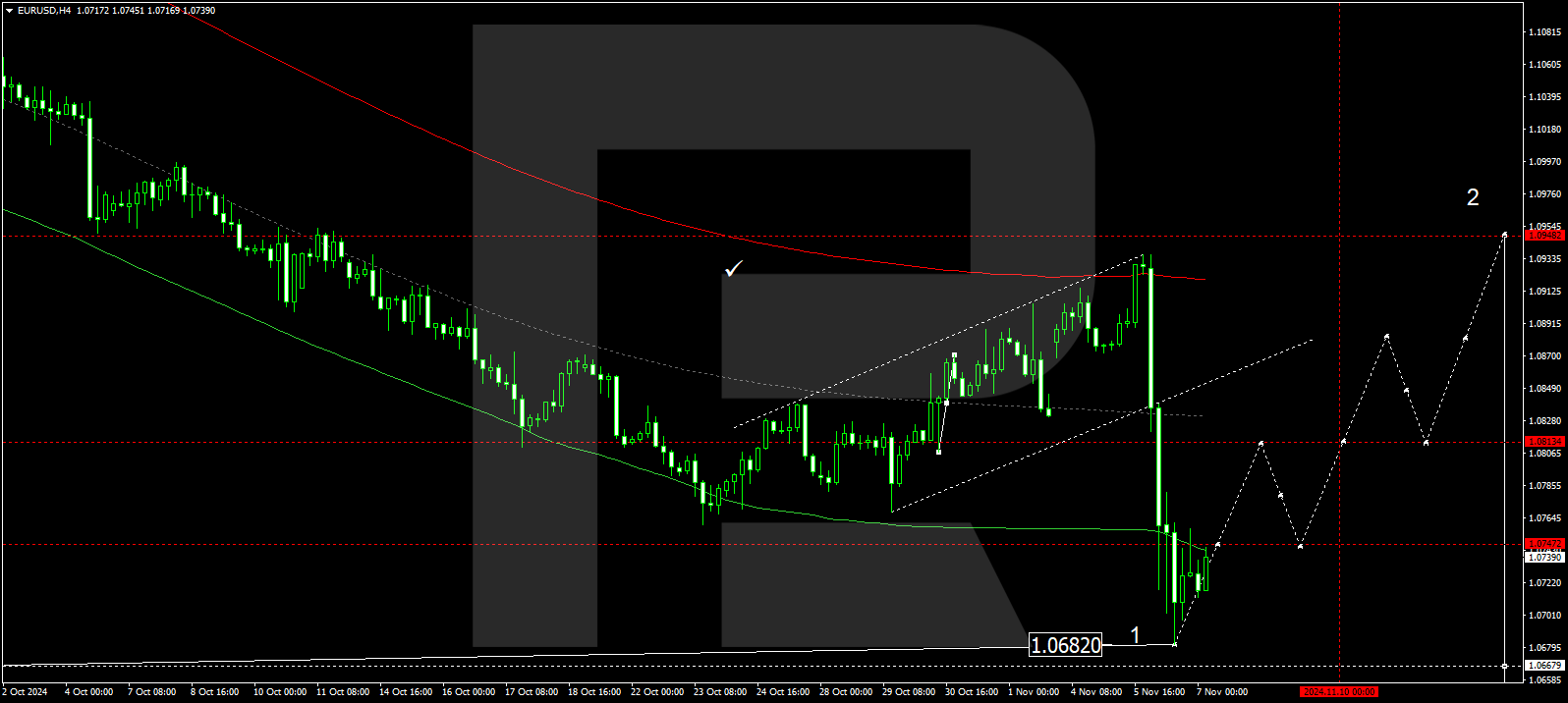

The EURUSD H4 chart shows that the market has reached the first target of the downward wave at 1.0682. A consolidation range is currently forming above this level. The price may break above the range today and begin correcting towards 1.0814, the first target. After reaching this level, a decline towards 1.0747 may follow.

The Elliott Wave structure and corrective matrix, with a pivot point at 1.0814, technically confirm this scenario. This level is considered crucial for a corrective wave in the EURUSD rate. The market has reached the lower boundary of a price envelope and is forming a consolidation range at the lows of the downward wave. It is relevant to consider the potential rise to the envelope’s central line at 1.0814 today will be relevant. Subsequently, the price may decline to its lower boundary at 1.0740.

Summary

Together with technical analysis for today’s EURUSD forecast, the increase in initial jobless claims and the US interest rate decision suggests a potential growth wave towards 1.0814.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.