EURUSD: the euro continues to lose ground against the US dollar

The EURUSD pair is expected to experience increased volatility today due to speeches by the ECB president and officials. Find out more in our analysis for 22 October 2024.

EURUSD forecast: key trading points

- A speech by Bundesbank’s Burkhard Balz

- A speech by member of the Supervisory Board (ECB representative) Elizabeth McCaul

- A report by ECB President Christine Lagarde

- A statement from ECB official Philip R. Lane

- EURUSD forecast for 22 October 2024: 1.0777

Fundamental analysis

Bundesbank’s representative, Burkhard Balz, will deliver a speech that is expected to clarify the German central bank’s future monetary policy.

Speeches and statements from German central bank officials typically have a short-term impact on EURUSD. Balz’s speech will be followed by statements from ECB officials, which will likely address future monetary policy in the eurozone and potential decisions on planned ECB interest rate changes.

The speech by ECB President Christine Lagarde may, to some extent, summarise the reports by ECB officials and clarify the European Central Bank’s future economic development scenarios. Fundamental analysis for 22 October 2024 suggests that Lagarde’s speech could significantly influence the EURUSD rate.

The EURUSD forecast for today, 22 October 2024, is unfavourable: following a minor correction, the pair has every chance to decline further.

EURUSD technical analysis

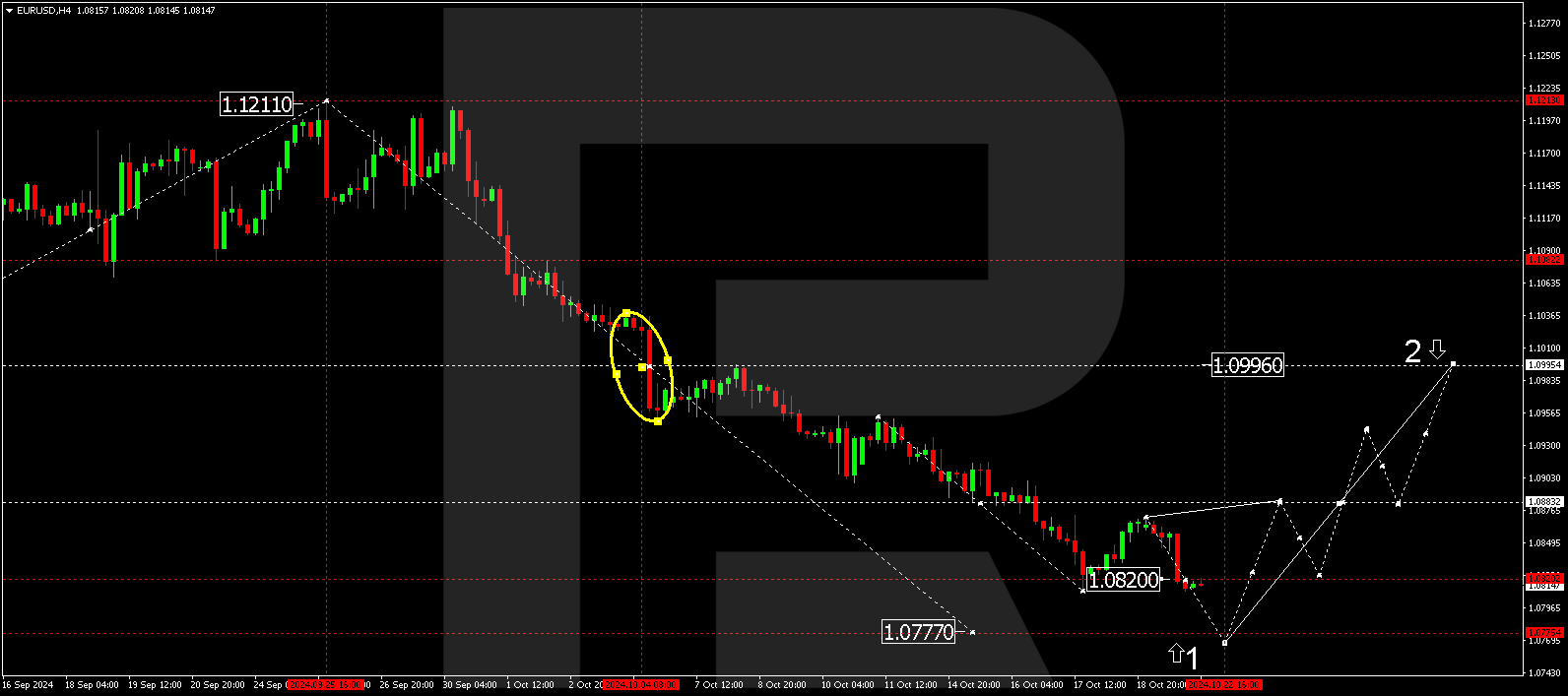

The EURUSD H4 chart shows the market has completed a downward wave, reaching 1.0810. A consolidation range could develop at today’s current low, 22 October 2024. The price is expected to break below this range, with the downward wave continuing to 1.0777, the first target. Subsequently, a more significant corrective structure could form in the EURUSD rate, aiming for 1.0996. The first target for this correction is expected to be at 1.0888.

Summary

Along with today’s EURUSD technical analysis, potential negative comments from ECB officials suggest a possible decline to the 1.0777 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.