EURUSD declines for the third consecutive week

The EURUSD rate continues to edge down, falling below 1.0900. Discover more in our analysis for 15 October 2024.

EURUSD forecast: key trading points

- Markets estimate the likelihood of a 25-basis-point Federal Reserve rate cut in November at 86.8%

- The ECB is expected to lower the interest rate by 25 basis points to 3.25%

- EURUSD forecast for 15 October 2024: 1.0890 and 1.0850

Fundamental analysis

The euro continues to trade under pressure from strong US labour market data as markets expect the Fed to reduce interest rates at a more measured pace.

At its Thursday meeting, the ECB is expected to lower the interest rate from 3.50% to 3.25%. The projected rate cut pressures the European currency, pushing the EURUSD pair down.

Today, the market will focus on the euro area Bank Lending Survey (BLS), industrial production growth rates, and the ZEW Economic Sentiment Index. Depending on the data released, volatility in the EURUSD pair may increase sharply.

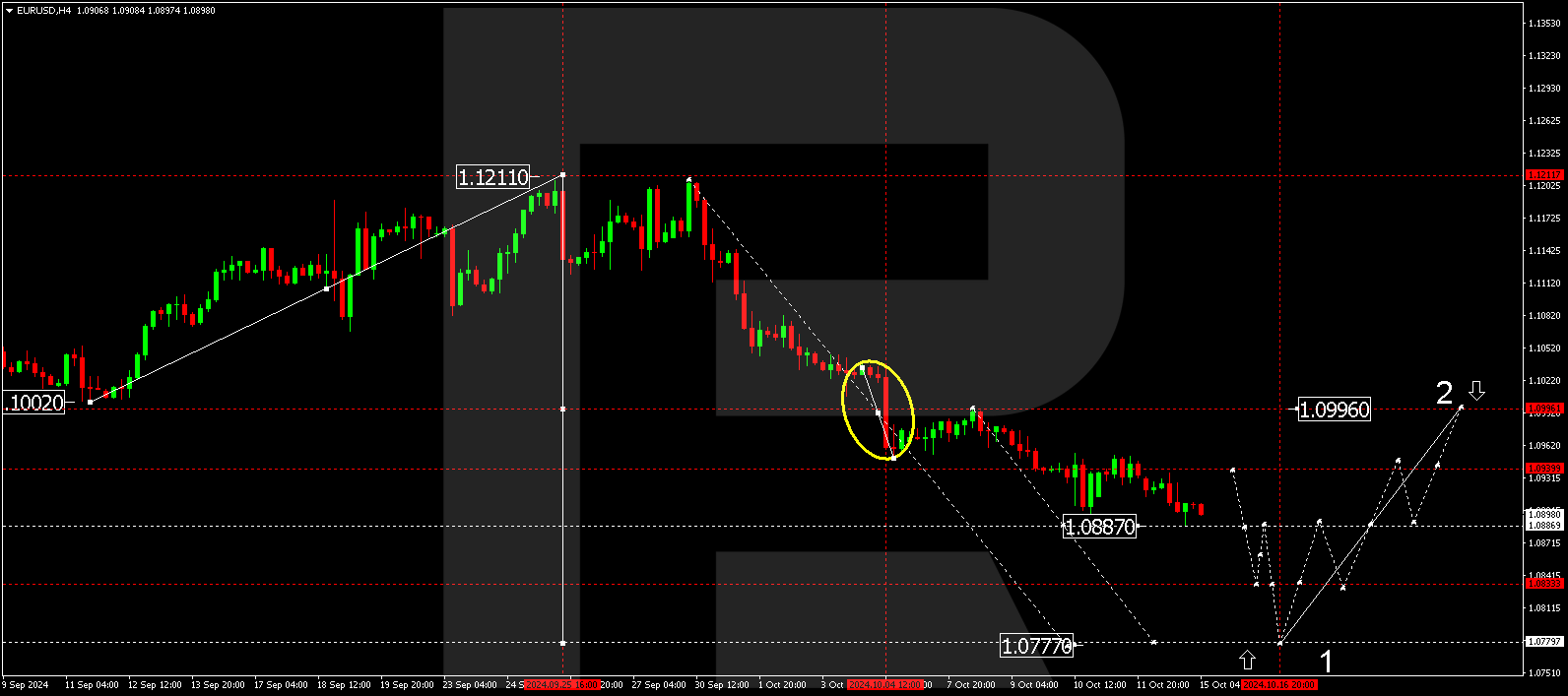

EURUSD technical analysis

The EURUSD H4 chart shows the market has completed a downward wave towards 1.0887. The boundaries of the consolidation range around the level of 1.0940 have been extended. The price could rise to 1.0940 today, 15 October 2024 (testing from below). After reaching this level, it might decline to 1.0887. A decline and a breakout below the 1.0880 level will open the potential for an onward movement towards 1.0830 and potentially further towards 1.0777. If the EURUSD rate rises and breaks above the 1.0950 level, this could lead to a further correction towards 1.0996, followed by a downward wave, aiming for 1.0777 as the first target.

Summary

The EURUSD rate has been declining for the third consecutive week, with expectations of an ECB interest rate reduction to 3.25% at Thursday’s meeting. Technical indicators in today’s EURUSD forecast suggest a potential fall to the 1.0830 and 1.0777 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.