EURUSD appears weak: US inflation data ahead

The EURUSD pair declined markedly. The market believes in the US dollar’s “exceptionalism”. Discover more in our analysis for 10 October 2024.

EURUSD forecast: key trading points

- The EURUSD pair fell to a low seen on 13 August

- The market increasingly favours the US dollar

- EURUSD forecast for 10 October 2024: 1.0905

Fundamental analysis

The EURUSD rate is consolidating around 1.0943 on Thursday.

This is the euro’s lowest level since 13 August. As they say on the stock market, investors were again drawn to the idea of the US currency’s “exceptionalism”.

According to the latest US Federal Reserve meeting minutes released yesterday, the regulator remains focused on maintaining the health of the labour market. The US economy is growing strongly, providing solid support for the USD position.

Interesting US inflation data for September will be released today. The weekly jobless claims report is also worth noting.

The EURUSD forecast remains cautious for now.

EURUSD technical analysis

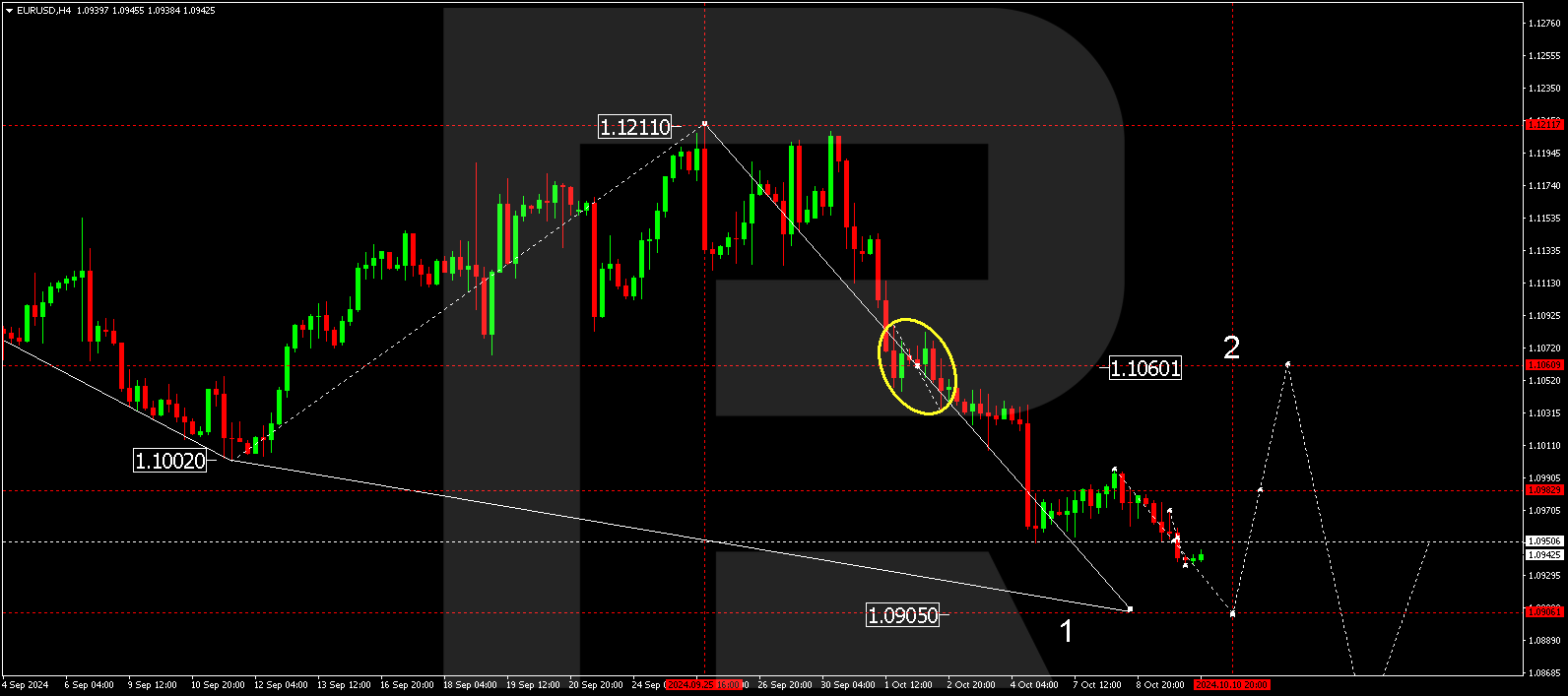

The EURUSD H4 chart shows that the market has formed a narrow consolidation range around 1.0965 and broken below it. A decline to 1.0933 is expected today, 10 October 2024. Once the price hits this level, it could reach to 1.0965 (testing from below) before declining to 1.0905, the first target. The EURUSD rate continues its trajectory within the downtrend channel. A correction might start if it breaks out of this range, targeting 1.1060.

Summary

Although the EURUSD pair has paused its sell-off, its outlook remains relatively weak. Technical indicators in today’s EURUSD forecast suggest a downward wave could continue to the 1.0905 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.