EURUSD is expected to maintain its downward trajectory

According to the EURUSD analysis for 9 October 2024, the EURUSD rate is highly likely to continue declining, primarily driven by strong US labour market data, which raises doubts about further Federal Reserve rate cuts at the end of the year.

EURUSD forecast: key trading points

- Germany’s Consumer Price Index ( CPI) reached 1.6% year-on-year

- Inflation in the EU’s leading economy directly affects the ECB’s future interest rate decisions

- A fall in inflation below the 2.0% target allows the regulator to lower the key rate, which may weaken the EUR against the USD

- EURUSD forecast for 9 October 2024: 1.0905

Fundamental analysis

Easing inflationary pressures in the eurozone’s largest economy may indicate slowing price growth rates and sluggish consumer demand. This could raise investors’ concerns about the region’s economic recovery rates, making the euro less appealing.

Since inflation is below expectations, the European Central Bank (ECB) may continue pursuing a dovish monetary policy or even take additional stimulus measures, which may weaken the euro against the US dollar.

According to fundamental analysis, the most likely scenario is a further weakening of the euro against the US dollar in the short term.

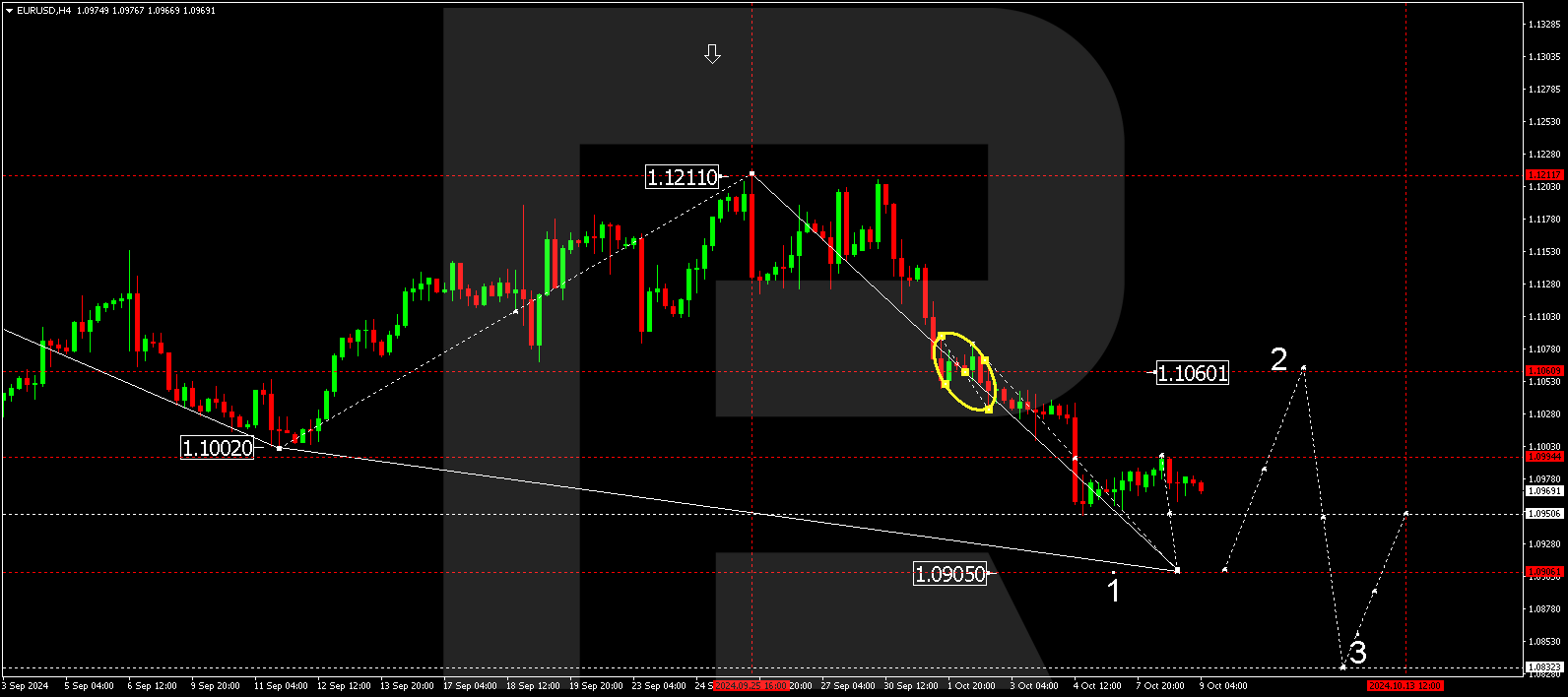

EURUSD technical analysis

The EURUSD H4 chart shows that the market has risen to 1.0996. A decline to the range’s lower boundary at 1.0950 is expected today, 9 October 2024. A breakout below the lower boundary of the consolidation range will open the potential for a downward wave towards 1.0905, the first target. Once the price reaches this level, a correction in the EURUSD rate towards 1.1060 is expected. Subsequently, a new downward wave could develop, aiming for 1.0833 as the local target.

Summary

Technical indicators in today’s EURUSD forecast suggest that a downward wave could continue towards the 1.0905 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.