EURUSD: investors expect a slowdown in Fed policy easing

The EURUSD rate rose after rebounding from the 1.0955 support level. More details and insights are available in our EURUSD analysis for today, 8 October 2024.

EURUSD forecast: key trading points

- The robust US labour market report reduced expectations of a 50-basis-point Federal Reserve rate cut

- Traders estimate the likelihood of a 25-basis-point Federal Reserve rate cut at 87.4%

- Total US consumer credit volume rose by 8.93 billion USD in August

- EURUSD forecast for 8 October 2024: 1.0919

Fundamental analysis

The EURUSD rate began to recover on Tuesday after declining for seven consecutive trading sessions. Last Friday’s strong US labour market report significantly changed market expectations. The odds of a 50-basis-point rate cut by the Federal Reserve at the next meeting have sharply diminished.

This report effectively ruled out the possibility of a substantial rate cut in November and sparked debates on whether there would be any cut. However, geopolitical tensions, particularly in the Middle East, remain a factor that could increase market volatility.

According to the CME FedWatch Tool, markets currently estimate the likelihood of a 25-basis-point rate cut in November at 87.4%. By December, traders price in only 50 basis points of easing, compared to over 70 points just a week ago. Analysts expect the Federal Reserve to lower interest rates two more times by the end of the year, each by 25 basis points. As per today’s EURUSD forecast, such expectations support the US dollar.

Additionally, US consumer credit data revealed an increase of 8.93 billion USD in August 2024, well below the sharp rise of 26.63 billion USD in July and market expectations of a 15.67 billion USD increase.

Investors remain focused on the Federal Reserve’s September meeting minutes, which are scheduled for release on Wednesday. Thursday’s inflation reports will also be crucial, providing September’s Consumer Price Index and Producer Price Index data. These indicators will offer clearer insights into US current inflation dynamics.

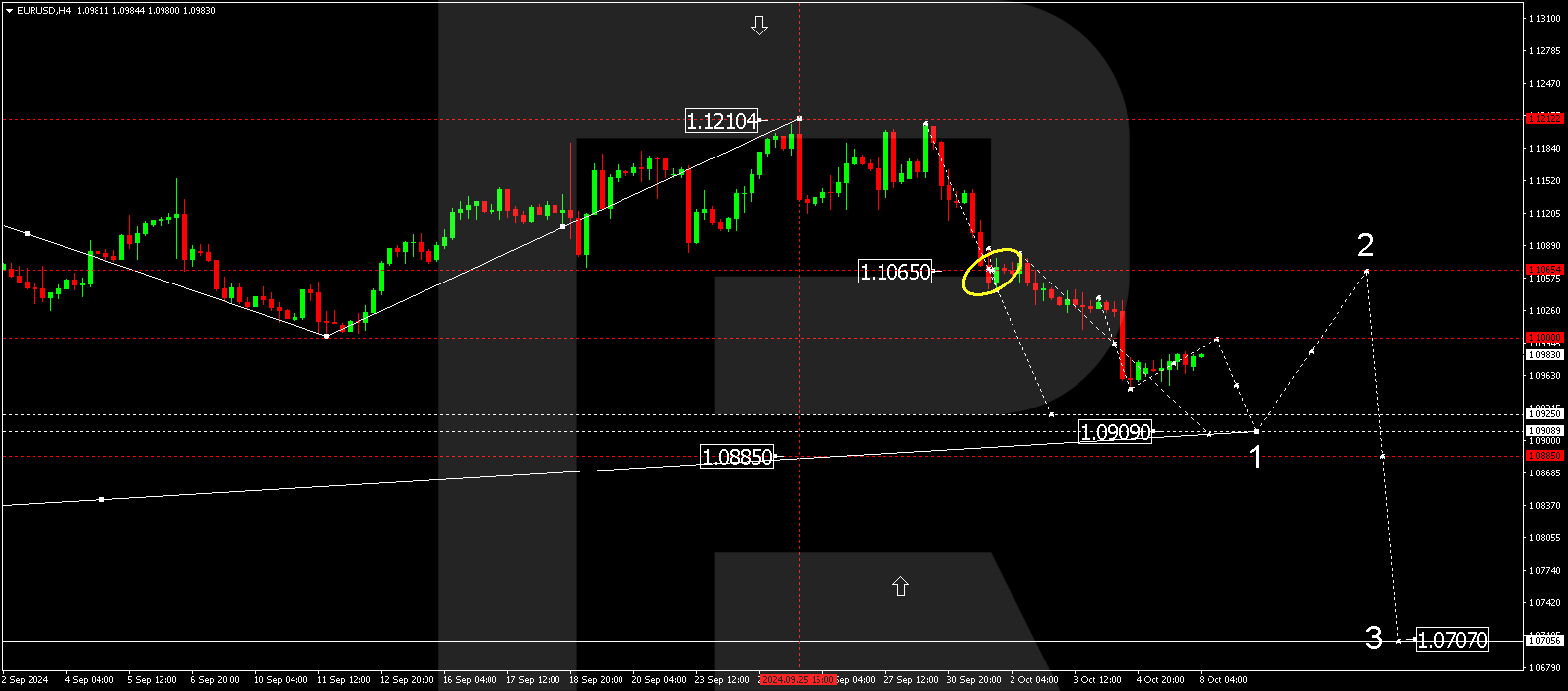

EURUSD technical analysis

The EURUSD H4 chart shows the market is forming a narrow consolidation range around 1.0975. This range could extend upwards to 1.1000 (testing from below) today, 8 October 2024. Subsequently, another downward wave in the EURUSD rate could take shape, aiming for 1.0919 as the first target. After reaching this target, the price might correct towards 1.1065. Subsequently, a new downward wave could develop, aiming for 1.0707 as the local target.

Summary

The robust US labour market report has significantly reduced expectations of aggressive Fed monetary policy easing in the coming months. The market now focuses on upcoming inflation data, which may influence future Federal Reserve decisions. Technical indicators in today’s EURUSD forecast suggest a downward wave may continue towards 1.0919.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.