EURUSD hits a 2-month low: the US dollar regains favour

The EURUSD pair continues to decline, with the market increasingly favouring the US dollar. Find out more in our analysis for 7 October 2024.

EURUSD forecast: key trading points

- The EURUSD pair has fallen to a two-month low

- US dollar advocates no longer expect the Federal Reserve to cut interest rates rapidly

- EURUSD forecast for 7 October 2024: 1.0946

Fundamental analysis

The EURUSD rate dropped to 1.0971 on Monday.

The robust US employment report for September provided strong support for the US currency. Nonfarm payrolls increased by 254,000, exceeding expectations. The unemployment rate unexpectedly decreased to 4.1% from the previous 4.2%. September hourly earnings rose faster than anticipated.

In this context, the likelihood of rapid monetary policy easing by the US Federal Reserve had diminished. The baseline forecast currently suggests two rate cuts by the end of the year, each by 25 basis points.

At the same time, the Federal Reserve policymakers say that monetary policy should be cautious and measured, which lends additional support for the USD rate.

The EURUSD forecast remains negative.

EURUSD technical analysis

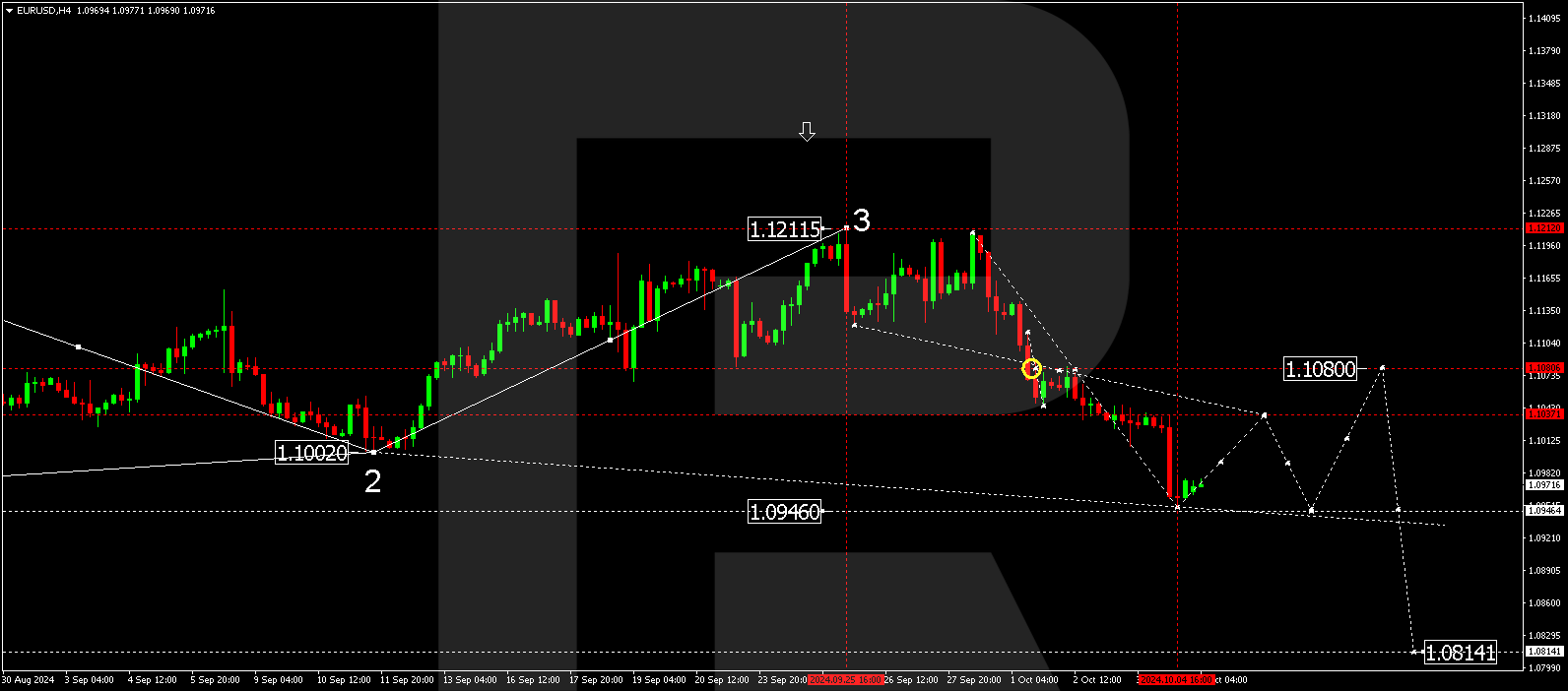

The EURUSD H4 chart shows that the market has reached the downward wave’s local target of 1.0951. A correction towards 1.1037 (testing from below) is possible today, 7 October 2024. Subsequently, another decline in the EURUSD rate could follow, with 1.0946 as the first target. After reaching this level, the price is expected to correct towards 1.1080. Another downward wave could develop later, targeting 1.0814.

Summary

The EURUSD pair remains under intense pressure due to the growing market preference for the US dollar. Technical indicators in today’s EURUSD forecast suggest that the downward wave could continue towards 1.0946.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.