EURUSD forecast: the euro continues to lose ground against the dollar

Job growth and the projected unemployment rate in the US may put pressure on the euro. Read more in our EURUSD analysis for today, 4 October 2024.

EURUSD forecast: key trading points

- Speech by European Central Bank Vice President Luis de Guindos

- Change in the number of employed in US nonfarm payrolls: previously 142 thousand, forecasted 147 thousand

- US unemployment rate: previously 4.2%, forecasted 4.2%

- EURUSD forecast for 4 October 2024: 1.0983 and 1.0966

Fundamental analysis

Luis De Guindos, Vice President of the European Central Bank since 2018, is a key player in shaping EURUSD's outlook with his speeches, which are considered highly influential among ECB public statements. The Vice President's speeches often include forecasts on the future development of the EU monetary policy. If De Guindos' speech signals a tightening of ECB monetary policy, it would be positive news for EURUSD.

The US Nonfarm Payrolls report shows the number of people employed last month. While the previous figure was 142 thousand, the forecast for 4 October 2024 suggests an increase to 147 thousand, which is a positive factor for the US dollar. The indicator is quite volatile and can change significantly, thus having a substantial impact on the EURUSD rate.

Fundamental analysis for 4 October 2024 shows that the forecast for the US unemployment rate is expected to remain unchanged, which could be positive for the US currency.

A significant news release from the Eurozone, the projected increase in employment in the non-agricultural sector, and the potential stabilisation of unemployment in the US could collectively support the USD. At the same time, increased volatility and unpredictable price movements in the market should be expected at the time of data publication.

EURUSD technical analysis

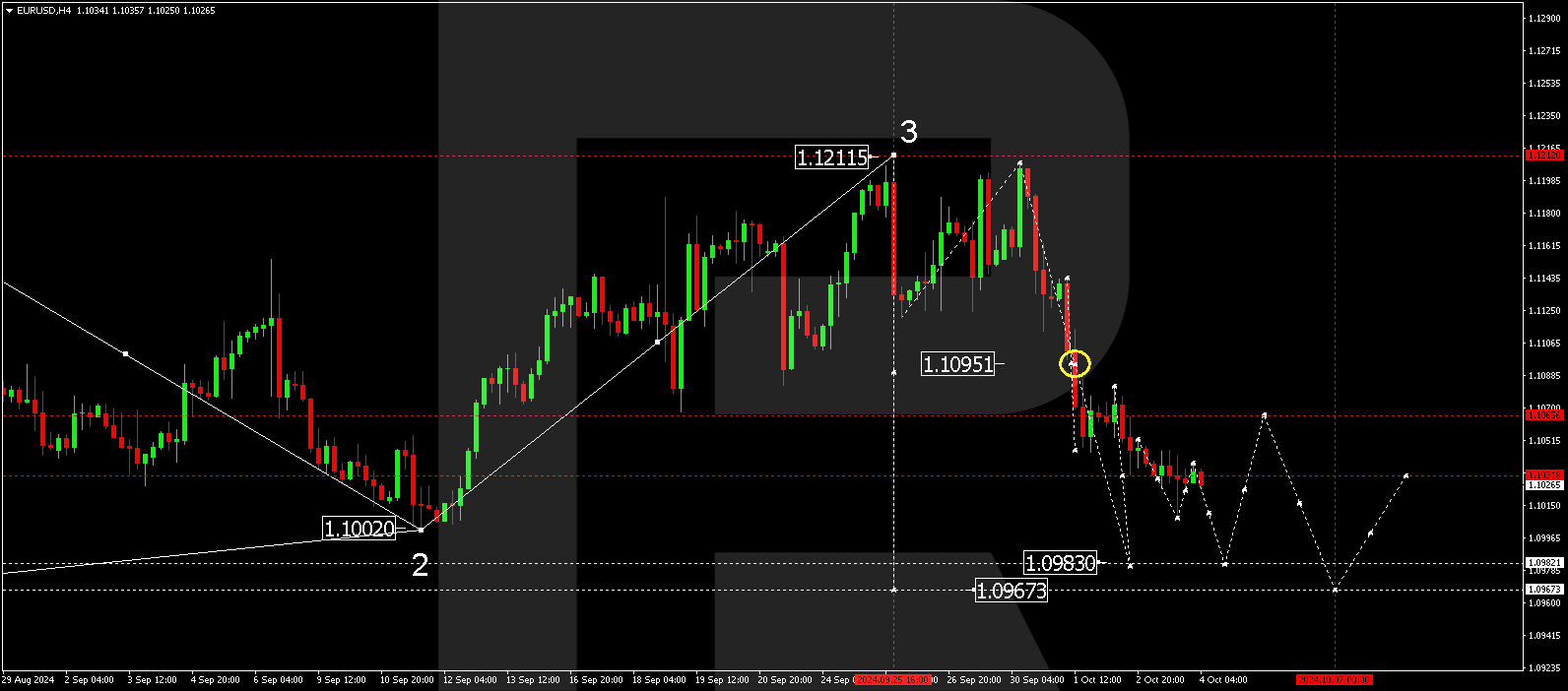

On the H4 chart of EURUSD, the market has completed a wave structure decline to 1.1008, followed by a correction to 1.1039. Today, 4 October 2024, the market continued to develop a downward wave, with a likely breakdown of the 1.1008 level. The local target is 1.0983. After reaching this level, a correction to 1.1066 (test from below) is possible, followed by a continuation of the decline toward 1.0966. This level represents the primary target for the current EURUSD forecast.

Summary

Fundamental and technical analyses suggest that the EURUSD downward trend continues, with forecasted levels at 1.0983 and 1.0966. Given the strength of the US dollar, supported by the latest economic data, traders should consider positioning for further declines in the pair in today's EURUSD forecast.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.