EURUSD: euro continues to lose ground against the dollar

Falling Eurozone indices become a trigger for the euro weakening - read more in our analysis for 1 October 2024.

EURUSD forecast: key trading points

- Eurozone Consumer Price Index (y/y) for September: previous value - 2.2%, forecasted - 1.8%

- ISM US Manufacturing PMI: previous value - 47.9, forecasted - 47.0

- US Job Openings in the Labour Market (JOLTS): previous value - 7.673 million, forecast - 7.640 million

- EURUSD forecast for 1 October 2024: 1.1090

Fundamental analysis

The Consumer Price Index reflects changes in the cost of goods and services for consumers, which helps to assess the dynamics of purchasing tendencies and the degree of stagnation in the economy. As a rule, an indicator below the forecast has a negative impact on the national currency. The forecast for 1 October 2024 suggests that the index will be lower than the previous value of 2.2%, the forecasted one may come out around 1.8%. Fundamental analysis for 1 October 2024 shows that the CPI may decrease compared to the previous period and have a negative impact on the euro.

The Manufacturing Business Activity Index (PMI) measures the activity of purchasing managers in the industrial sector. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this index, as purchasing managers are the first to receive information about the performance of their companies, which makes PMI an important indicator for assessing the overall economic situation. Values above 50.0 indicate an increase in production, while values below it indicate a decline.

The forecast for today, 1 October 2024, suggests that the index could fall by 0.9 points. Given that the value is below 50.0 and the expected data may come in below the previous value, there are not many positive factors for the US Dollar.

The number of open job openings in the US labour market (JOLTS) is forecast to decline, which is a two-factor indicator. On the one hand, it indicates a decrease in unemployment, and on the other hand, it indicates job cuts in companies.

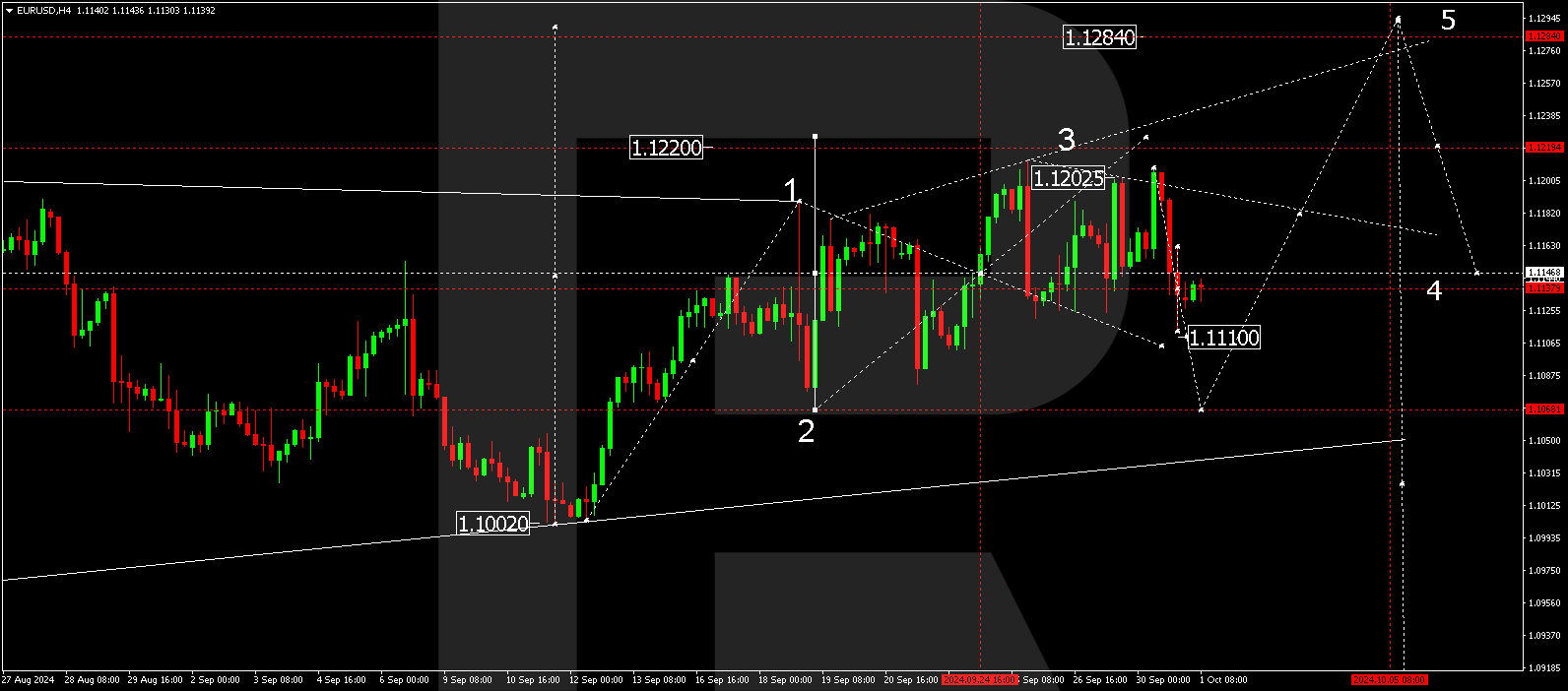

EURUSD technical analysis

On the H4 EURUSD chart, the market continues to develop a wide consolidation range around the level of 1.1145. At the moment the market performed a growth wave to the level of 1.1208. The target is local. Today, on the 1st of October 2024, the structure of the decline wave to the level of 1.1133 is executed. At the moment, a narrow consolidation range is formed above this level. In case EURUSD rate leaves this range downwards, the continuation of the wave to the level of 1.1090 (test from above) is not excluded. If we go up, we will consider the development of the growth wave structure to the level of 1.1166. Further development of a wide consolidation range around the level of 1.1144 remains relevant.

Summary

Falling indices in the Eurozone in combination with technical analysis of EURUSD for today's forecast on EURUSD pair suggest to consider the probability of the continuation of the downward wave to the level of 1.1090.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.