EURUSD analysis: weak economic data from Europe limits the pair’s growth

The EURUSD rate is correcting after testing a four-week high. Read more in our detailed EURUSD analysis for 25 September 2024, including key signals and market outlook.

EURUSD forecast: key trading points

- Expectations of a Fed interest rate cut have intensified, causing a sharp rise in the euro

- Weak economic data from Europe, including a drop in Germany’s IFO business climate index, is restraining EURUSD growth

- EURUSD forecast for 25 September 2024: 1.1222 and 1.1290

Fundamental analysis

EURUSD is approaching the 1.1200 key resistance level, which buyers have attempted to break since late August. The recent sharp rise in the euro has been driven by growing expectations of significant interest rate cuts from the Federal Reserve.

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, remarked on faster-than-expected progress in reducing inflation and a weakening labour market, raising expectations for more aggressive rate cuts. There is now a 60.3% probability of a 50-basis-point cut at the Fed’s next meeting, up from 52.9%. Conversely, the odds of a 25-basis-point cut have dropped to 39.7% from 47.1%.

Key market signals are now focused on upcoming US data releases, including new home sales, weekly unemployment statistics, and the crucial PCE price index report. These indicators will provide further insights into the Fed’s future actions. Additionally, pressure on the US dollar has intensified following China’s announcement of a comprehensive stimulus package to support its economy, which has boosted equities and strengthened the yuan.

Meanwhile, expectations of an ECB interest rate cut have grown amid ongoing weak European economic data. Germany’s IFO business climate index unexpectedly fell to 85.4 points in September, down from 86.6 in August, well below the forecast of 88.3 points. This marks the fourth consecutive month of declining business activity. These developments are shaping today’s EURUSD forecast, suggesting that a breakout above the key resistance level of 1.1200 may be delayed.

EURUSD technical analysis

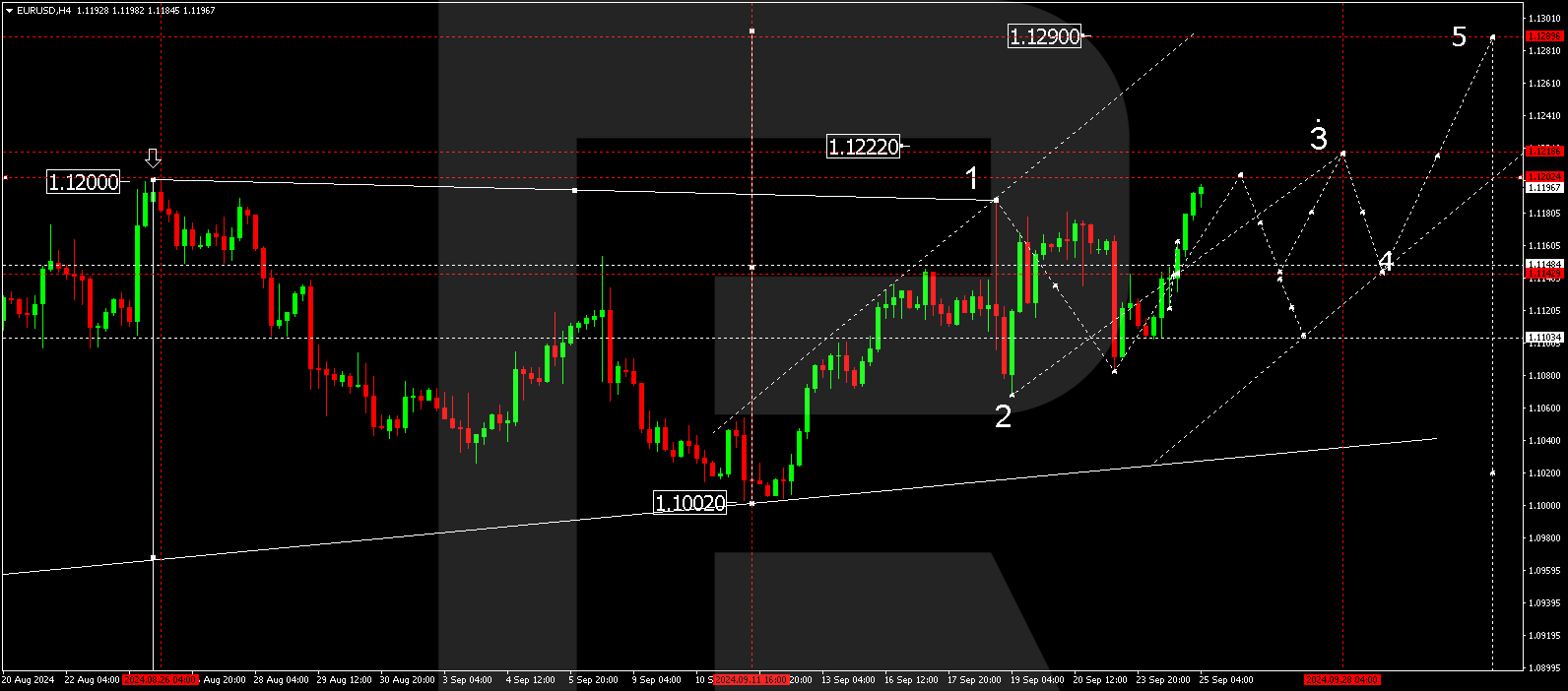

On the H4 chart, EURUSD broke through the 1.1180 level and continues its upward trajectory towards 1.1222, which represents a local target. Based on the technical EURUSD outlook for today, 25 September 2024, we anticipate a potential correction to 1.1144 after reaching this target. A subsequent growth wave could drive the pair towards the main target at 1.1290. Following this, a decline to 1.1111 is expected.

Summary

EURUSD’s growth, driven by Fed rate cut expectations, could be limited by weak European economic data, which has heightened fears of a potential economic slowdown. Breaking through the key resistance level at 1.1200 remains uncertain due to declining business activity in Germany. Today’s EURUSD forecast suggests the possibility of continued growth towards 1.1222 and 1.1290, but caution is warranted given the economic signals from Europe.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.