EURUSD analysis: euro strengthens despite positive US data

The EURUSD rate is experiencing its third consecutive trading session of gains, although it remains below the critical resistance level of 1.1200. In this EURUSD analysis for 20 September 2024, we explore the latest market movements, provide a EURUSD forecast, and offer trading signals for the pair.

EURUSD forecast: key trading points

- US jobless claims: the number of new jobless claims in the US dropped to 219k, the lowest in four months, reflecting a robust labour market

- Secondary home sales: US home sales declined by 2.5% in August, but lower mortgage rates might drive sales shortly

- Philadelphia Fed Manufacturing Index: the index rose unexpectedly to 1.7 in September, surpassing forecasts and possibly supporting the USD

- EURUSD forecast for 20 September 2024: the outlook remains bullish for today, with the euro expected to continue its upward trend, targeting a potential rise to 1.1222

Fundamental analysis

The US dollar remains under pressure due to the start of the Federal Reserve’s rate-cut cycle, which may indicate a likely rise in the EURUSD pair. The 50 basis points cut, the first one since 2020, was more significant than expected by the market. Currently, the probability of the Fed lowering the interest rate by 50 basis points at the next meeting on 7 November 2024 is 42.9%, while the likelihood of a 25-basis point cut is 57.1%.

The number of Americans filing for unemployment benefits for the first time fell by 12,000 last week to 219,000, the lowest level in four months. Economists had expected the figure to remain at 230k, and the current decline indicates a robust US labour market.

Secondary home sales in the US fell 2.5% in August to 3.86 million homes at an annualised rate. Despite this decline, analysts believe that the recent reduction in mortgage rates could boost sales in the coming months.

The manufacturing activity index released by the Federal Reserve Bank of Philadelphia showed an unexpected increase in September after a sharp drop in August, which could support the US Dollar within the EURUSD forecast for today. According to the latest data, the index of general industrial activity rose from a seven-month low of -7.0 in August to 1.7, exceeding the forecasts of economists who expected the index at -1.0.

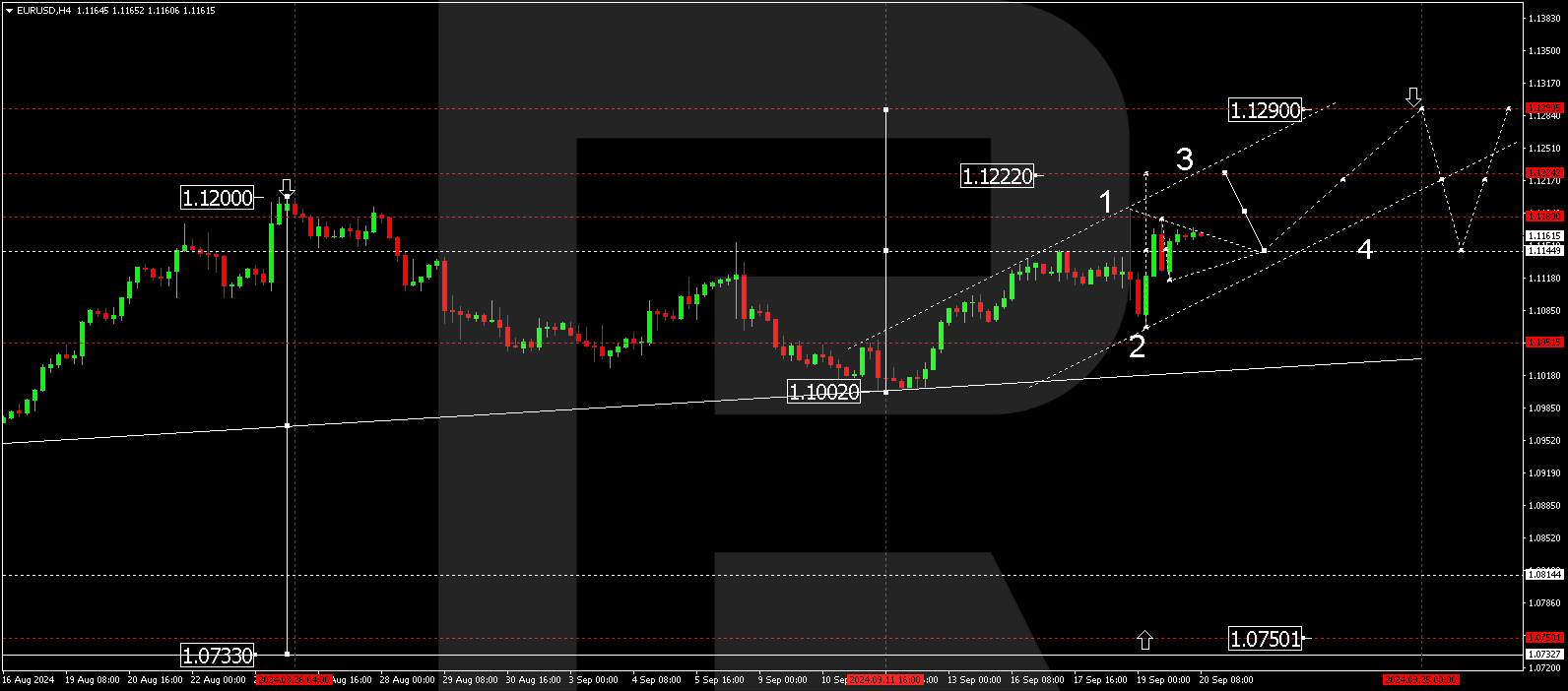

EURUSD technical analysis

According to the current EURUSD outlook, the H4 chart shows that the pair has broken above the 1.1145 level and is consolidating. Today’s technical EURUSD signal suggests a potential rise towards 1.1180, followed by a test of 1.1145 from above. If the pair successfully breaks through 1.1180, we could see a continuation of the bullish wave towards the forecasted 1.1222 level.

Conversely, a downside break of 1.1145 may open up the possibility for further declines, with a critical support level at 1.1055. Traders should watch for a breakout of these levels as potential signals for entering positions.

Summary

Despite encouraging US economic data, the EURUSD remains poised for further gains as market participants anticipate additional Fed rate cuts. Today’s EURUSD outlook highlights the potential for an upward movement towards 1.1222, supported by fundamental and technical indicators. Keep an eye on critical levels like 1.1180 and 1.1145, as they will provide essential signals for the EURUSD’s next move.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.