EURUSD falls: the market bets on ECB policy easing

The EURUSD pair has declined for the third consecutive trading day. Investors await an ECB interest rate cut in September, with inflation supporting the forecast. Find out more in our analysis dated 3 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair has reached its lowest level since mid-August

- Investors believe the ECB will continue to actively cut rates until the end of the year

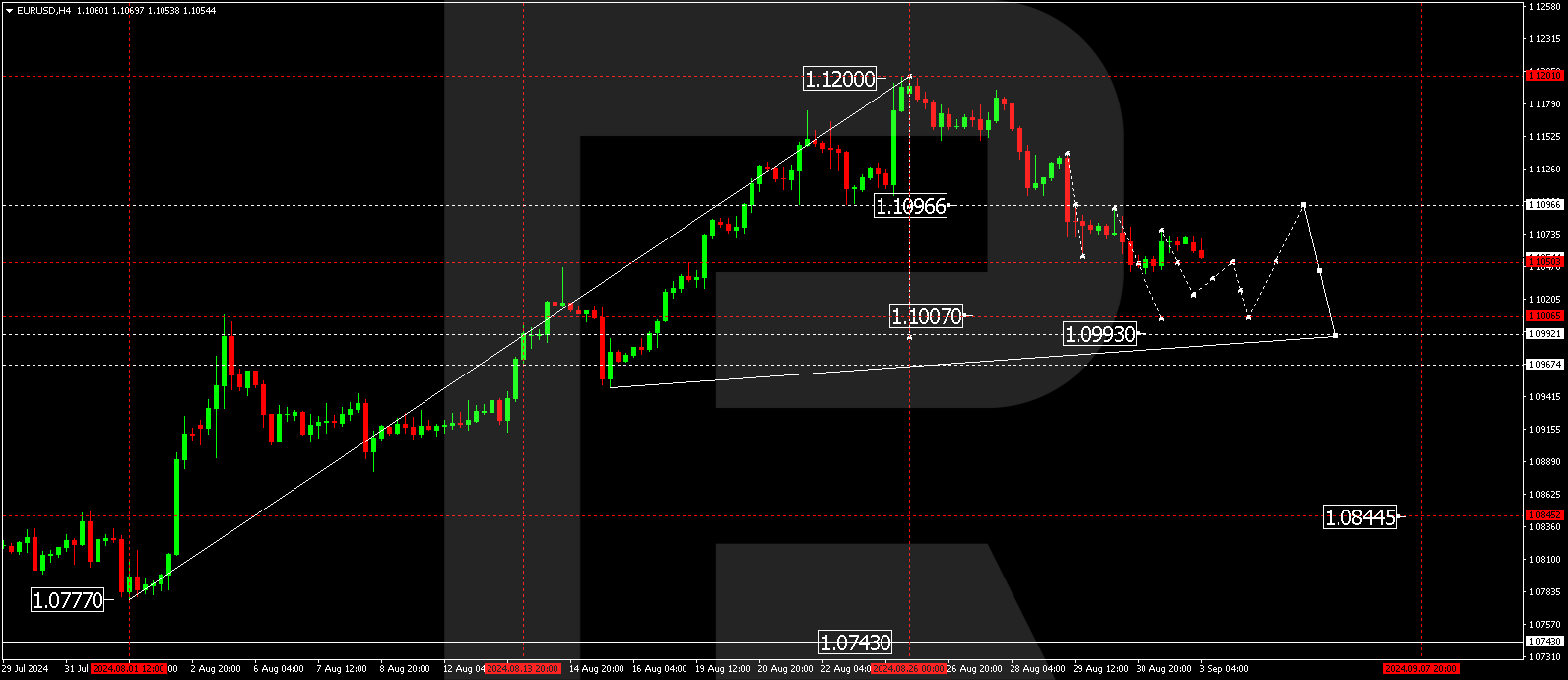

- EURUSD forecast for 3 September 2024: 1.1007 and 1.1096

Fundamental analysis

The EURUSD rate declined to 1.1058 on Tuesday, with sell-offs continuing nonstop for the third trading day. The instrument has plunged to its lowest levels since mid-August. Investors believe that the European Central Bank will make a second consecutive decision to lower interest rates this month at a meeting scheduled for 12 September.

The likelihood of an interest rate cut has increased after the eurozone’s new inflation reports were released. A preliminary estimate shows that inflation in the region fell to 2.2% in August, marking the lowest level since July 2021. The core consumer price index declined to 2.8% after holding at 2.9% for three months.

The market believes the ECB could reduce interest rates two or three more times by the end of the year. The EURUSD forecast suggests continued pressure on the euro rate.

EURUSD technical analysis

The EURUSD H4 chart shows that the market has formed a consolidation range around 1.1050 and extended it to 1.1076. The price is expected to decline to 1.1050 and break below the range today, 3 September 2024, expanding the wave towards 1.1025. A breakout below the 1.1050 level may signal a continuation of the trend towards 1.1007, the local estimated target. After reaching this level, the EURUSD rate could correct towards 1.1096 (testing from below). Subsequently, another downward wave is expected to develop, aiming for 1.0990 as the first estimated target.

Summary

The EURUSD pair remains under selling pressure, with the market focusing on the upcoming ECB meeting. Technical indicators in today’s EURUSD forecast suggest a potential decline to 1.1007, followed by a correction towards 1.1096.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.