EURUSD forecast: the pair reversed sharply upwards after the Fed decision

The EURUSD rate halted its downward correction and returned to the area above 1.0900 following the US Federal Reserve’s interest rate decision and comments from its chair. Find out more in our EURUSD analysis for 20 March 2025.

EURUSD forecast: key trading points

- Market focus: the US Federal Reserve left the interest rate unchanged at 4.50%, but the prospects for further cuts remain

- Current trend: an uptrend

- EURUSD forecast for 20 March 2025: 1.0860 and 1.0955

Fundamental analysis

The EURUSD pair reacted with gains to the outcome of the US Fed meeting. As expected, the Federal Reserve kept the interest rate unchanged at 4.50% and reiterated its forecast for two more rate cuts this year.

At the same time, the regulator revised its GDP growth expectations downwards and raised its inflation forecast, indicating concerns about the economic outlook.

During a press conference following the meeting, Federal Reserve Chairman Jerome Powell emphasised the impact of trade policies, immigration, fiscal measures, and regulation on economic conditions. Markets now expect two more rate cuts this year, with the first one scheduled for June or July.

EURUSD technical analysis

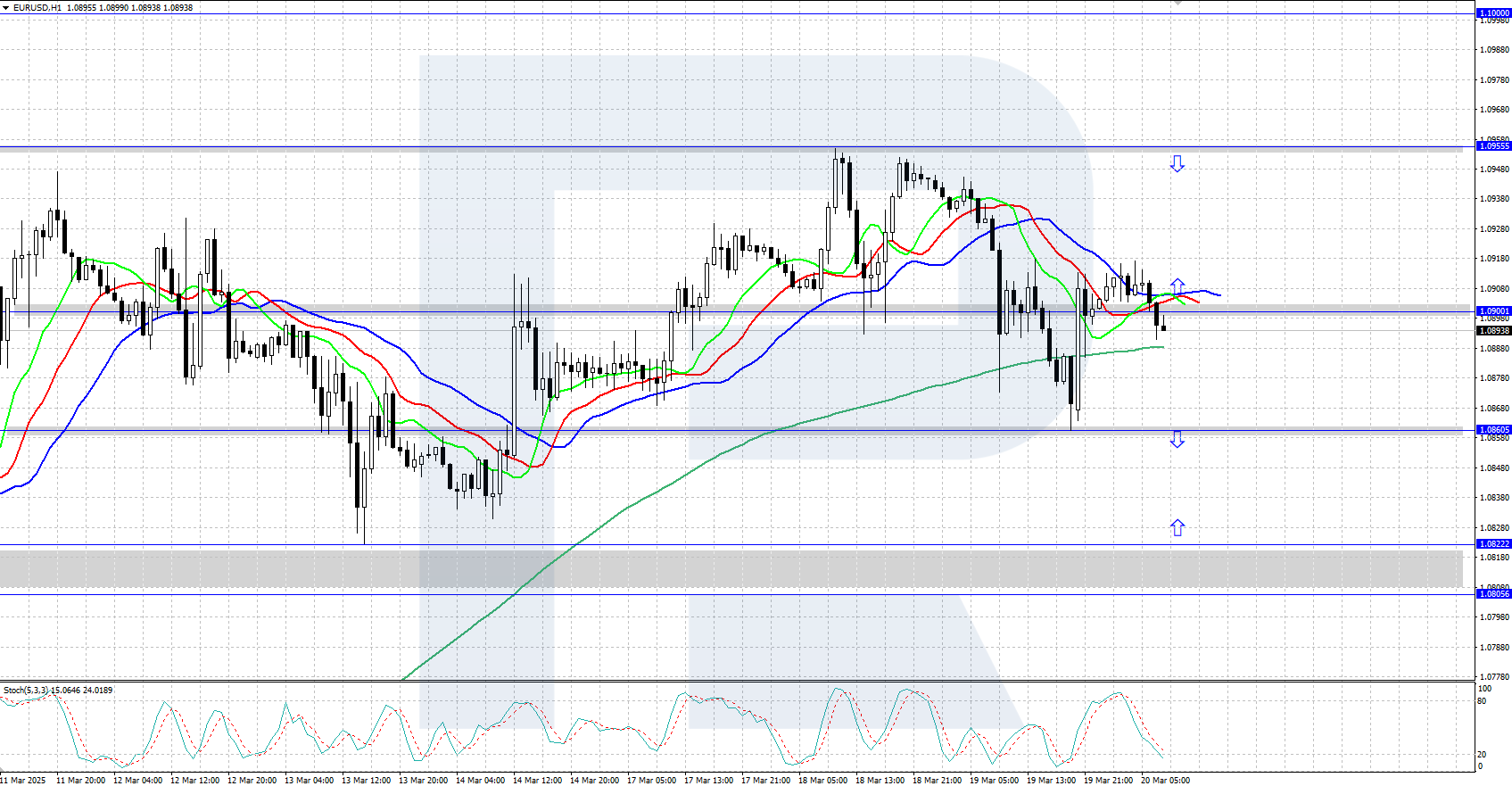

On the H4 chart, the EURUSD rate halted its downward correction following the Fed meeting and reversed upwards. The daily trend is upward, which is confirmed by the growing Alligator indicator. The direction of a price movement from the price range between 1.0860 and 1.0955 will determine further prospects for the pair’s moves.

The EURUSD forecast for today suggests that the pair will have the potential to decline to 1.0800 if the bears overcome the 1.0860 support level. Conversely, if the bulls keep the quotes above 1.0900, growth could continue to the 1.0955 resistance level.

Summary

The EURUSD pair reacted with gains to the results of the Fed meeting, returning to the price area above 1.0900. The direction of a price movement from the price range between 1.0860 and 1.0955 will determine further prospects for the asset moves.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.