EURUSD forecast: market shock – how the Fed decision and the eurozone’s CPI will change the EURUSD rate

The Federal Reserve interest rate change and the eurozone’s CPI data may trigger unpredictable fluctuations in the EURUSD rate, including growth to 1.1010. Find out more in our analysis for 19 March 2025.

EURUSD forecast: key trading points

- The eurozone’s Consumer Price Index (CPI): previously at 2.4%, projected at 2.4%

- FOMC economic forecasts

- US Federal Reserve interest rate decision: previously at 4.5%, projected at 4.5%

- EURUSD forecast for 19 March 2025: 1.1010 and 1.0850

Fundamental analysis

The eurozone’s CPI reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-forecast reading will have a positive effect on the European currency.

Fundamental analysis for 19 March 2025 suggests that the index could remain unchanged at 2.4%. A large divergence between expectations and actual data may significantly impact the EURUSD rate.

The EURUSD forecast takes into account that the two-day FOMC meeting will end today, at which the US economic outlook is updated. Recent economic indicators point to slowing GDP growth, with forecasts revised from 2.0-2.4% to 1.0-1.5%. This is due to concerns about a recession and the impact of US trade tariffs on the economy.

Federal Reserve Chairman Jerome Powell emphasised a cautious approach amid economic uncertainty due to the tariff policy of US President Donald Trump’s administration. The Fed intends to make decisions based on incoming data to maintain a balance between inflation and unemployment.

Today, the US Federal Reserve will publish its interest rate decision. Market participants are divided, and anticipation makes tensions run higher. The EURUSD forecast for today, 19 March 2025, takes into account that the interest rate may remain unchanged at 4.5%, but for now, it is only an assumption.

The release of the final interest rate decision is a serious challenge for investors, especially as it happens for the first time this year. The market is in for another big test, given the sharp changes in the EURUSD rate during the last trading session.

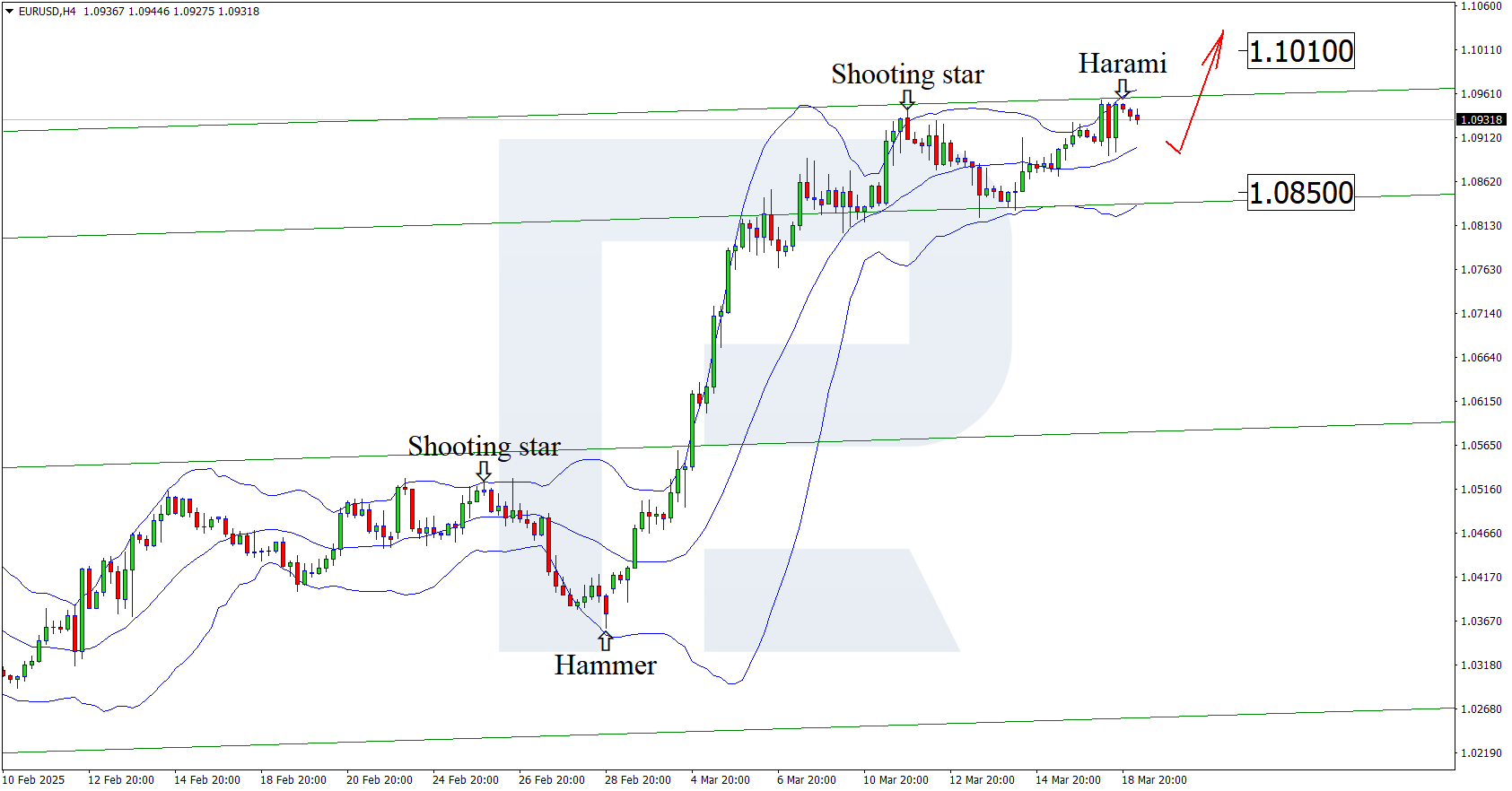

EURUSD technical analysis

On the H4 chart, the EURUSD pair formed a Harami reversal pattern near the upper Bollinger Band. At this stage, it continues a corrective wave following the received signal. Since the price is within the ascending channel, it could pull back to the nearest support at 1.0850. A rebound from this level may open the potential for a continued upward movement.

However, the EURUSD rate could rise to the 1.1010 resistance level and gain upward momentum without testing the support level.

Summary

Coupled with the EURUSD technical analysis, the FOMC economic forecasts and the US interest rate decision suggest growth to 1.1010 after the correction is completed.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.