EURUSD forecast: the euro continues to strengthen after losing ground

The EURUSD pair may continue its ascent to 1.0915 ahead of the Nonfarm Payrolls release. Find out more in our analysis for 7 March 2025.

EURUSD forecast: key trading points

- Eurozone Q4 GDP: previously at 0.4%, projected at 0.1%

- Nonfarm Payrolls: previously at 143 thousand, projected at 159 thousand

- US unemployment rate: previously at 4.0%, projected at 4.0%

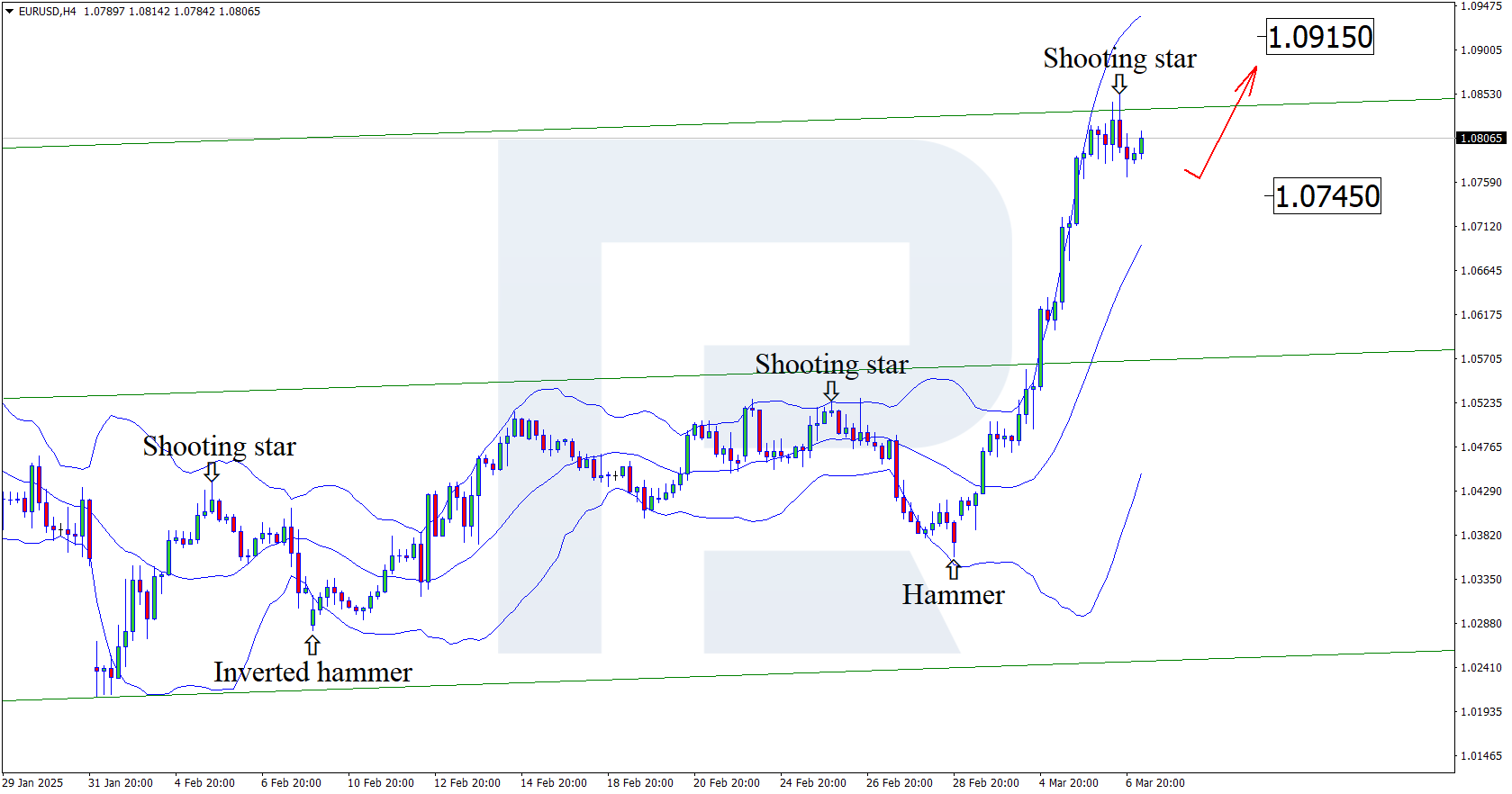

- EURUSD forecast for 7 March 2025: 1.0745 and 1.0915

Fundamental analysis

GDP is the total value of all goods and services produced in a country; it applies only to final products and does not include the cost of raw materials.

The forecast for 7 March 2025 does not appear very optimistic, suggesting that the EU GDP may decline to 0.1%. In the previous quarter, the indicator showed 0.4%. If the actual reading in the current reporting period is equal to or below the forecast, this may negatively impact the euro.

According to the forecast for 7 March 2025, US Nonfarm Payrolls may rise to 159 thousand from 143 thousand in the previous period. If expectations align with actual data, the market may see increased volatility and temporary strengthening of the US dollar. The release of Nonfarm Payrolls almost always causes excitement in the financial markets and can equally support the US dollar or cause it to lose ground.

The EURUSD forecast for today also takes into account that the US unemployment rate for February could remain flat at 4.0%. If there are no changes from the previous period, this will be a neutral factor for the USD.

EURUSD technical analysis

On the H4 chart, the EURUSD price formed a Shooting Star reversal pattern near the upper Bollinger band. At this stage, it continues to correct following the received signal. Since the quotes have left the ascending channel, they could rise further to the nearest resistance level at 1.0915. A breakout above this level will open the potential for the continuation of the uptrend.

However, the EURUSD rate could decline to the 1.0745 support level and gain its upward momentum after the correction.

Summary

In anticipation of the EU and US fundamental data release, the EURUSD technical analysis suggests growth to 1.0915.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.