EURUSD forecast: the pair climbed to 1.0500 after inflation data

The EURUSD rate is rising, returning to 1.0500 amid slightly higher inflation in the eurozone in February. Discover more in our EURUSD analysis for 4 March 2025.

EURUSD forecast: key trading points

- Market focus: the eurozone’s statistics for February showed a 0.6% month-on-month uptick in inflation

- Current trend: consolidating in a sideways range

- EURUSD forecast for 4 March 2025: 1.0400 and 1.0530

Fundamental analysis

The eurozone’s inflation data released yesterday showed a moderate increase in February. The core Harmonized Index of Consumer Prices (HICP) rose by 0.6% month-on-month and 2.6% year-on-year. In January, the indicator was down by 0.9% month-on-month.

Rising inflation positively impacts the euro rate, as it may prompt the ECB to pause the current monetary easing cycle. The regulator will hold its next meeting on Thursday and is expected to lower the interest rate by 25 basis points to 2.50%. The market has already priced in this cut, with investors awaiting hints about the ECB’s further actions.

EURUSD technical analysis

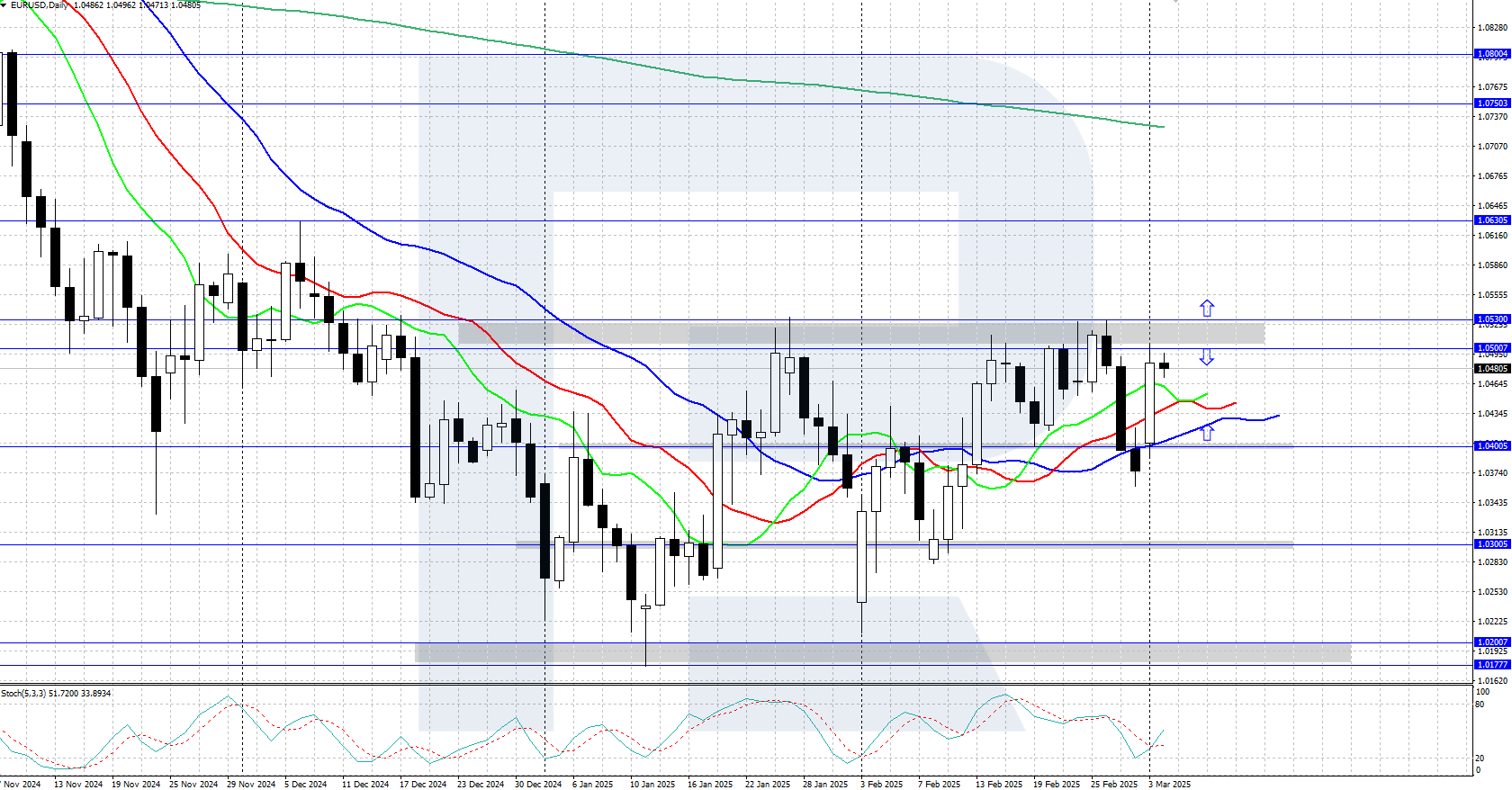

On the H4 chart, the EURUSD rate is moderately rising, reaching the 1.0500-1.0530 resistance area. Since the beginning of the year, the price has been consolidating in the sideways trading range between 1.0200 and 1.0530. The direction of the price movement out of the range will determine further prospects for the pair’s moves.

The EURUSD forecast for today suggests that the pair could rise further to 1.0600 and higher if the bulls surpass the 1.0500-1.0530 resistance area. However, if the bears seize the initiative and reverse the quotes downwards, the pair could decline to the 1.0400 support level.

Summary

The EURUSD pair climbed to 1.0500 amid rising inflation in the eurozone in February. The market is focused on the ECB interest rate decision on Thursday.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.