EURUSD forecast: the euro continues to put pressure on the USD

The ECB representative’s speech could strengthen the euro and propel the EURUSD pair to 1.0550 USD. Find out more in our analysis for 25 February 2025.

EURUSD forecast: key trading points

- Germany’s GDP: previously at -0.2%, projected at the same level of -0.2%

- A speech by European Central Bank official Isabel Schnabel

- US CB Consumer Confidence Index: previously at 104.1, projected at 102.7

- EURUSD forecast for 25 February 2025: 1.0550 and 1.0430

Fundamental analysis

GDP is the total value of all goods and services produced in a country; it applies only to final products and does not include the cost of raw materials.

The forecast for 25 February 2025 appears rather optimistic and suggests that Germany’s GDP may remain flat at -0.2%. In the previous period, the indicator showed the same value, and the actual reading will unlikely change in the current reporting period.

ECB Executive Board member Isabel Schnabel is expected to deliver a speech today, 25 February 2025. Her comments often provide insight into the future direction of ECB monetary policy. Below are possible issues she could address in her speech:

- Monetary policy: the ECB has already lowered interest rates five times since June 2024, and markets expect three more cuts this year due to easing inflationary pressures. However, hawkish representatives like Schnabel are calling for caution, pointing to the need to at least pause and, if necessary, abandon further rate cuts

- Inflation risks: recent energy price fluctuations may increase inflation risks, potentially impacting the ECB monetary policy decisions

- Economic growth: Schnabel may announce the current economic growth indicators in the eurozone and their impact on the ECB decisions

Fundamental analysis for 25 February 2025 shows that the US CB Consumer Confidence Index is projected to decline to 102.7 points if the actual data aligns with the forecast or is above it. This may drive up the EURUSD rate.

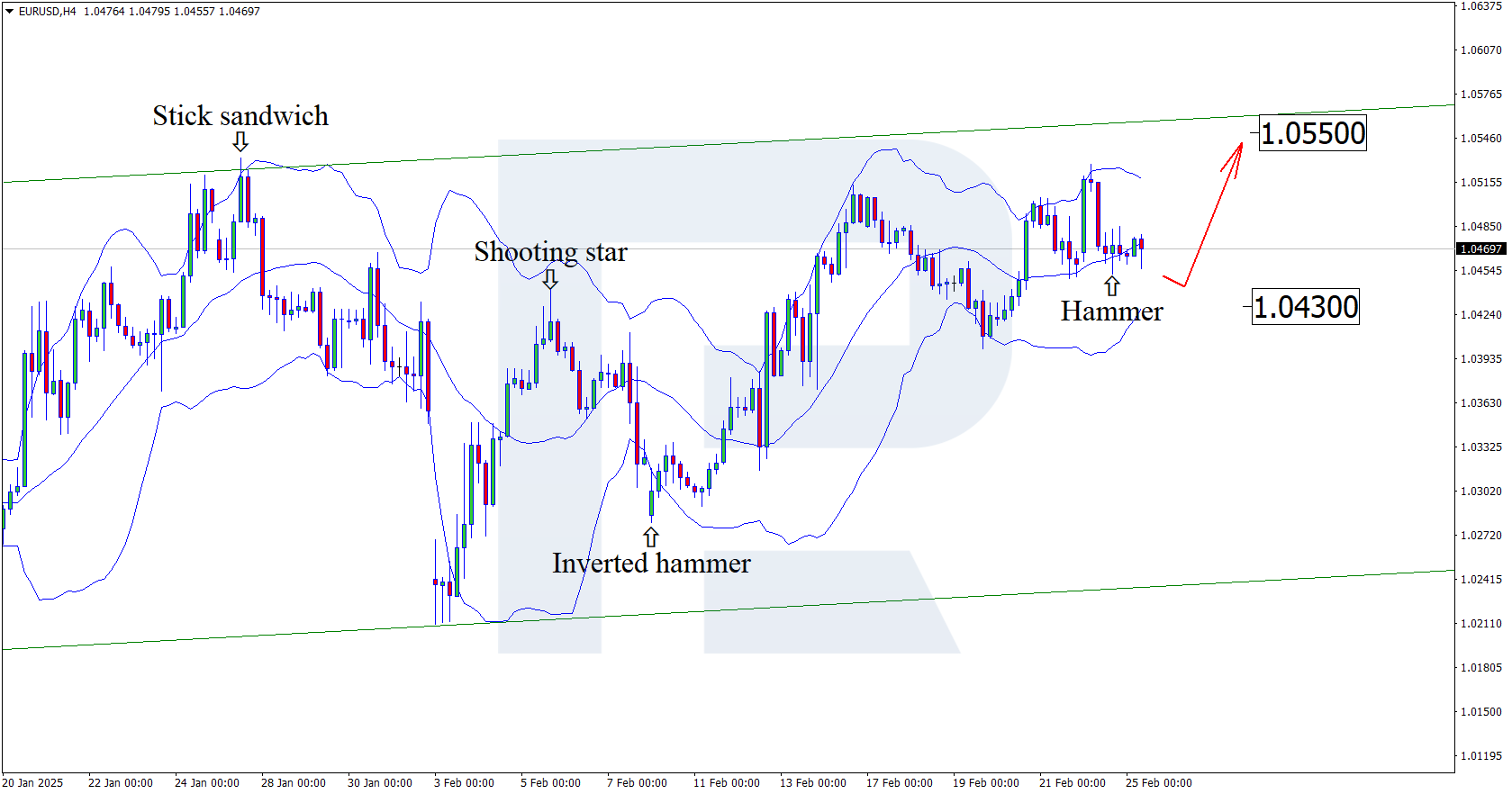

EURUSD technical analysis

On the H4 chart, the EURUSD price formed a Hammer reversal pattern near the middle Bollinger Band. At this stage, it continues its upward momentum following the signal received. The price will likely continue to rise to the nearest resistance level at 1.0550 as it remains within the ascending channel. A breakout above this level could open the potential for a continuation of the uptrend.

However, the price could plunge to the 1.0430 support level and gain its upward momentum after testing the support.

Summary

Amid Schnabel’s speech and the decline in US economic indicators, the EURUSD forecast for today appears rather optimistic, suggesting, together with the EURUSD technical analysis, growth to the 1.0550 USD level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.