EURUSD is in anticipation: the market preserves strength ahead of the US inflation release

The EURUSD pair is consolidating around 1.0300 ahead of crucial US statistics. Find out more in our analysis for 15 January 2025.

EURUSD forecast: key trading points

- The EURUSD pair is neutral in anticipation of the US CPI data

- Any deviation from the forecast will force the market to adjust its projections regarding Federal Reserve interest rates

- EURUSD forecast for 15 January 2025: 1.0317

Fundamental analysis

The EURUSD rate is neutral, hovering around 1.0300 on Wednesday. The market faces a nervous day as the US releases the CPI statistics for December during the second half of the session. Considering this, investors are hesitant to open new positions.

The main forecast suggests a 0.2% m/m rise in inflation last month. Any surprise in the report may limit the potential for US Federal Reserve interest rate cuts this year.

The US economy is assessed as stable, as confirmed by last week’s employment releases. This support has caused market participants to adjust their expectations regarding reductions in US borrowing costs. The interest rate may remain unchanged in February and March.

The EURUSD forecast is cautious.

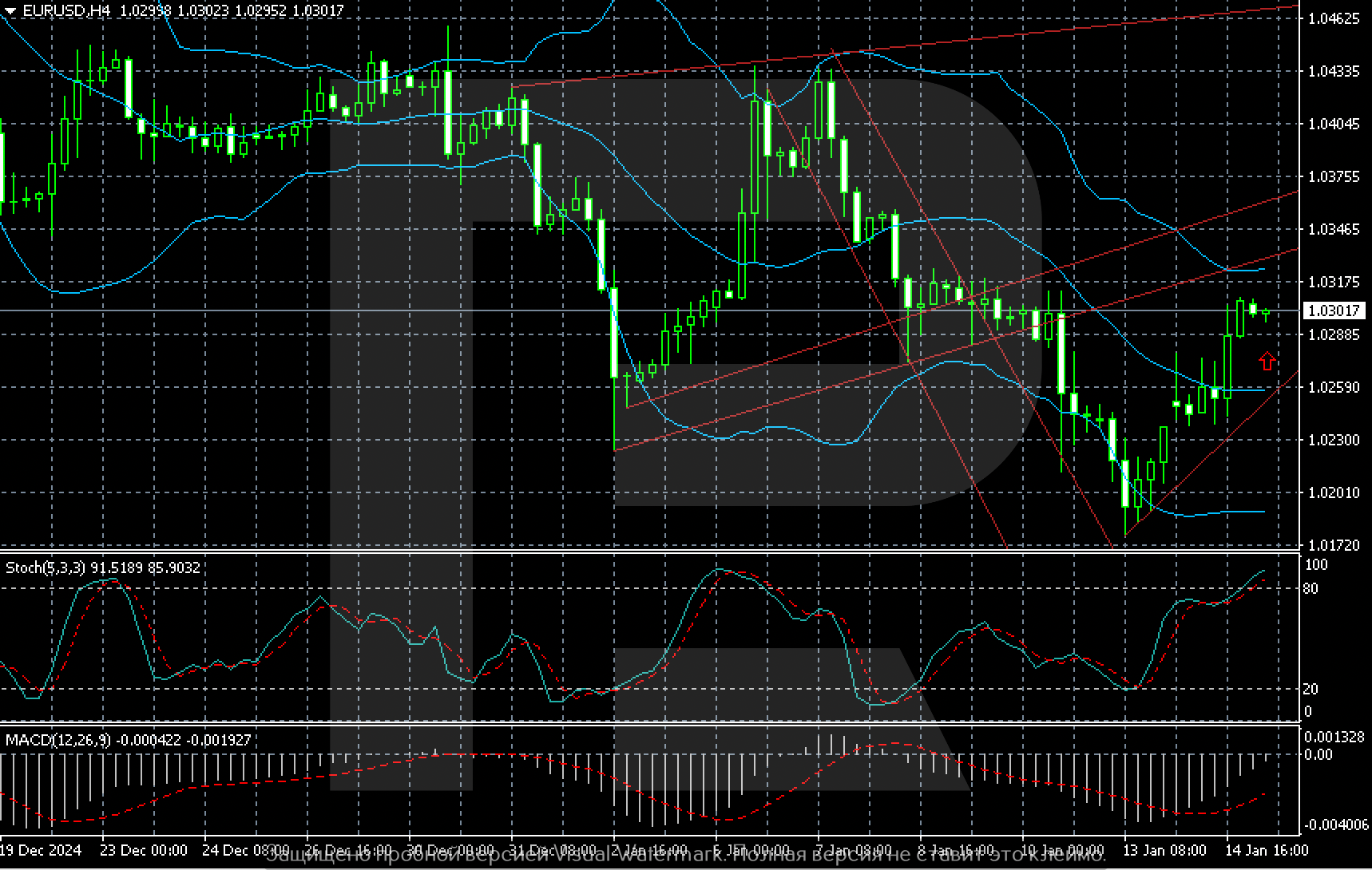

EURUSD technical analysis

On the H4 chart, the EURUSD pair still has a reason for a local rise to 1.0317 if the pair consolidates above 1.0302. The forecast for today, 15 January 2025, does not rule out a rise to the range between 1.0315 and 1.0317.

The EURUSD pair is just 0.61% higher than its low of 1.0246 on 13 January 2025. It is now 7.91% lower than the high of 1.1194 it hit on 23 August 2024.

Summary

The EURUSD pair is neutral at the beginning of Wednesday’s session. However, volatility will increase in the afternoon as the market awaits the US CPI statistics for December. If the pair consolidates above 1.0302, today’s EURUSD forecast does not rule out a rise to 1.0317.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.