USDJPY: the yen has the potential to strengthen

Bank of Japan Deputy Governor Ryozo Himino confirmed a September interest rate hike, subject to improved economic data. Find out more in our USDJPY analysis dated 28 August 2024.

USDJPY forecast: key trading points

- A speech by Bank of Japan Deputy Governor Ryozo Himino

- Japan’s leading economic index: previously at 111.2, currently at 109.0

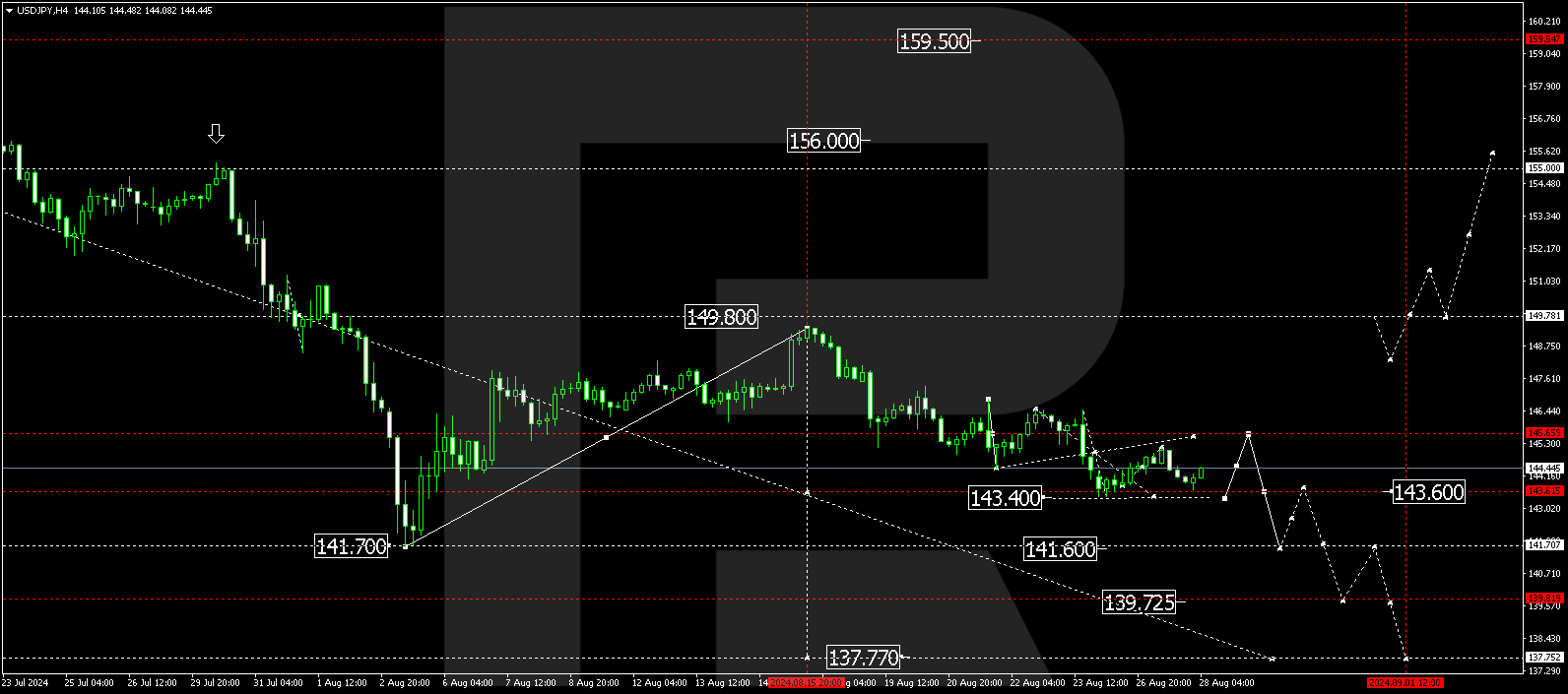

- USDJPY forecast for 28 August 2024: 143.40, 141.60, 139.70, and 137.77

Fundamental analysis

The Leading Economic Index estimates the overall state of the economy by combining 12 key indicators, including machinery orders and stock prices. A reading below 50 indicates prevailing negative trends, while a reading above 50 shows the prevalence of positive trends. The index decreased to 109.0 in the past period. Although the reading is above 50.0, the decline in the indicator could impact the USDJPY forecast.

Ryozo Himino confirmed a significant likelihood of an interest rate hike in September. Economic and price growth in Japan remains within the expected levels.

In its future monetary policy, the Bank of Japan will consider the impact of market trends and the July interest rate hike. In his speech before business leaders in Yamanashi prefecture, Himino stated that if confidence builds that the outlook for economic activity and prices will be realised, the bank will adjust its monetary policy.

Fundamental analysis for 28 August 2024 shows that the yen has a strong chance of strengthening against the US dollar in the near term.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a consolidation range around 145.70 and has extended the range down to 143.44. The price could rise to 145.60 today, 28 August 2024. Subsequently, the range is expected to expand to 143.40. A breakout below this level may signal a further movement towards 141.60, potentially continuing to the 139.70 and 137.77 levels, the latter being the main downtrend target for the USDJPY rate.

Summary

A speech by Bank of Japan Deputy Governor Ryozo Himino and the USDJPY technical analysis in today’s USDJPY forecast suggest a potential decline to the 143.40, 141.60, 139.70, and 137.77 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.