EURUSD may correct before rising

Declining euro indicators and improving financial climate in the US may lead to a correction in the EURUSD pair. Find out more in our analysis dated 26 August 2024.

EURUSD forecast: key trading points

- Germany’s business expectations index: previously at 86.9, projected at 86.5

- The IFO business climate index for Germany: previously at 87.0, projected at 86.0

- US durable goods orders (m/m): previously at -6.6%, projected at 4.0%

- EURUSD forecast for 26 August 2024: 1.1150 and 1.0980

Fundamental analysis

Germany’s business expectations index, a subindex of the overall indicator that assesses the business climate in Germany, reflects the expectations of German businesses for the next six months. The indicator is projected to decrease to 86.5, which is not critical and will unlikely significantly impact the EURUSD rate.

The IFO business climate index for Germany measures business sentiment and conditions in the country based on data from a survey of approximately 7,000 companies. A stronger-than-expected reading is considered a positive signal for the EUR, indicating a bullish trend, while a reading below expectations is a negative factor. The forecast for 26 August 2024 suggests a decrease in the index to 86.0 points, which may impact the current EURUSD pair in terms of correction.

US durable goods orders reflect changes in the number of new applications for durable goods. A high reading suggests increased activity among manufacturers. This highly volatile data may be revised when factory order reports are published in about a week. According to the analysis for 26 August 2024, the indicator is projected to rise to 4.0%, indicating growth in production over the previous period. Such positive data benefits the US dollar.

EURUSD technical analysis

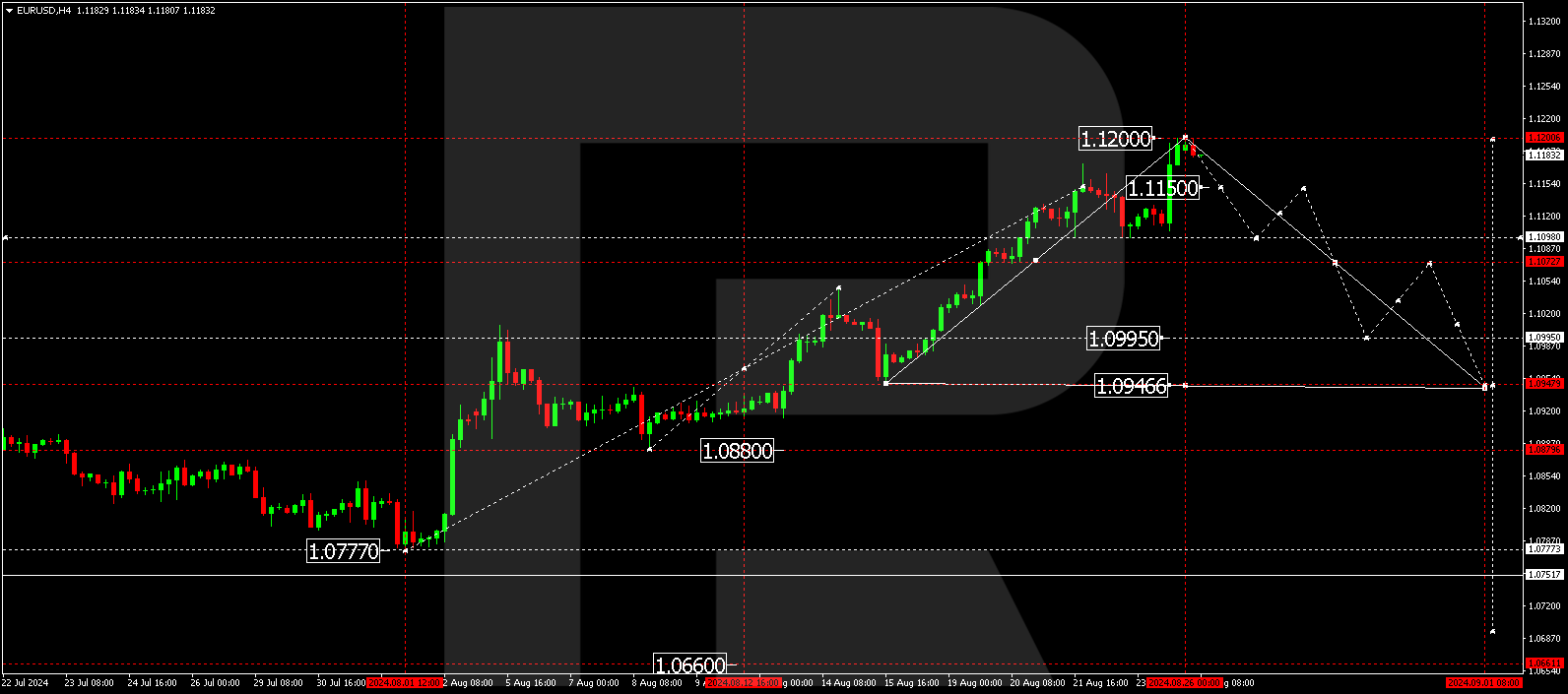

The EURUSD H4 chart shows that the market has breached the 1.1150 level and completed a growth wave, reaching 1.1200. A downward wave is expected to begin today, 26 August 2024, aiming for 1.1150 (testing from above). Subsequently, the EURUSD rate might rise to 1.1175. A new consolidation range could form at the top of the growth wave. A breakout below this range will be considered a signal for further movement towards 1.1122, with the trend potentially continuing to 1.0980, the first target.

Summary

An increase in US economic indicators, combined with the EURUSD technical analysis in today’s EURUSD forecast, suggests a possible decline to 1.1150, with the trend potentially continuing to 1.0980.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.