EURUSD reaches a new annual high: the US dollar suffers heavy losses

The EURUSD pair has skyrocketed to levels last seen in December 2023. The US dollar remains under tremendous pressure. Find out more in our analysis dated 22 August 2024.

EURUSD forecast: key trading points

- The EURUSD pair continues its rally

- The US dollar weakens rapidly amid the dovish tone of the Federal Reserve and mixed signals from the employment market

- EURUSD forecast for 22 August 2024: 1.1195 and 1.1073

Fundamental analysis

The EURUSD rate rose to 1.1105 on Thursday. The market last saw these levels in December last year. The primary reason for the US dollar’s weakness is the Federal Reserve’s dovish stance. New signs of a weakening employment market also argue against the USD. Investors perceive all these factors as a reason to expect the Federal Reserve to lower interest rates.

The latest Federal Reserve minutes show that monetary policymakers were inclined to cut interest rates at the September meeting, with some ready to reduce borrowing costs immediately. The meeting was held on 30-31 July, and its tone was unexpectedly soft.

The Department of Labor data released yesterday revealed that fewer jobs were created in the economy than previously reported.

According to the CME FedWatch signals, the market expects the Federal Reserve to lower the interest rate by 25 basis points with a probability of 62%. The likelihood of a 50-basis-point interest rate cut is estimated at 38%, up from 33% the day before. Overall, the EURUSD forecast remains unchanged.

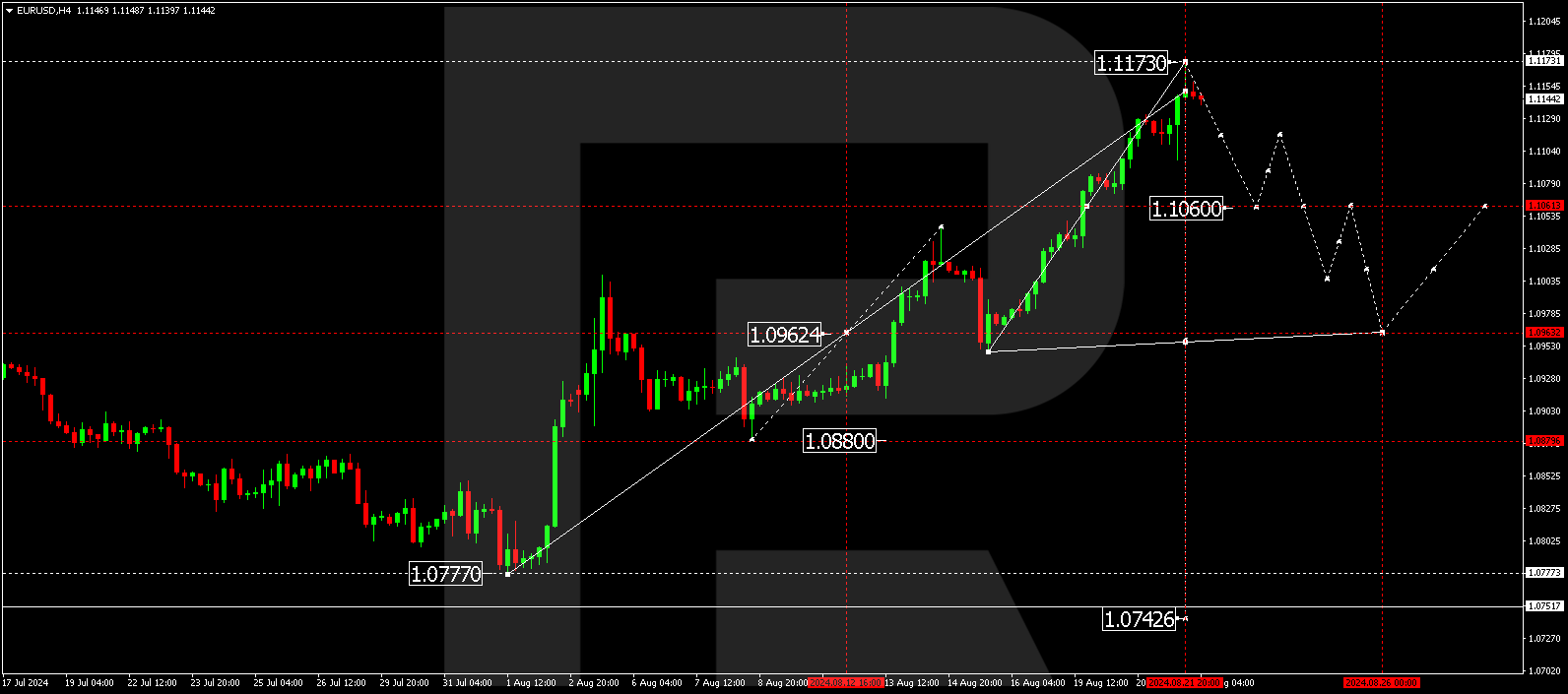

EURUSD technical analysis

The EURUSD H4 chart shows that the market has broken above the 1.1135 level and completed a growth wave, reaching 1.1173. The EURUSD rate is expected to decline to 1.1135 (testing from above) today, 22 August 2024. If this level breaks, it will open the potential for a decline to 1.1073. A breakout above this range will open the potential for another growth structure towards 1.1195, followed by a decline to 1.1073, with the trend potentially continuing to 1.0980, the first target.

Summary

The EURUSD pair is reaching 2024 highs and continues to climb. Technical indicators in today’s EURUSD forecast suggest that the growth wave could extend to 1.1195, marking the completion of growth potential. A new downward wave towards 1.1073 is expected.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.