EURUSD: the euro exerts further pressure on the US dollar ahead of the FOMC minutes release

Declining US crude oil stocks and the upcoming FOMC minutes release may further strengthen the euro. Find out more in our analysis dated 21 August 2024.

EURUSD forecast: key trading points

- Germany’s 10-year government bond auction: previously at 2.43%

- US crude oil inventories: previously at 1.357 million barrels, projected to decrease by 2.000 million

- The FOMC minutes release

- EURUSD forecast for 21 August 2024: 1.1080 and 1.0980

Fundamental analysis

The actual 10-year bond yield represents the average return that all investors holding these bonds will generate. The purpose of issuing government bonds is to raise funds to cover the gap between taxes and the costs of refinancing the government debt. Bond proceeds can be considered an indicator of government debt. Germany’s 10-year bond yield decreased to 2.43% in the last period, falling short of the projected value. If this trend continues, investors risk seeing no profit.

US crude oil inventories may decrease by 2.000 million barrels following a short-term rise, which will not benefit the USD. However, this is just a forecast at this stage – based on previous data, the actual outcome may also positively impact the US dollar. Negative news could trigger a correction in the EURUSD rate and further weaken the US dollar against the euro, driving the pair higher.

The FOMC minutes due at the end of the US trading session, may provide more insights into potential changes in the US interest rates. While the Federal Reserve is currently expected to lower the interest rate by 0.25%, these are only forecasts and speculation. The release of the minutes may increase market volatility and support the EUR.

EURUSD technical analysis

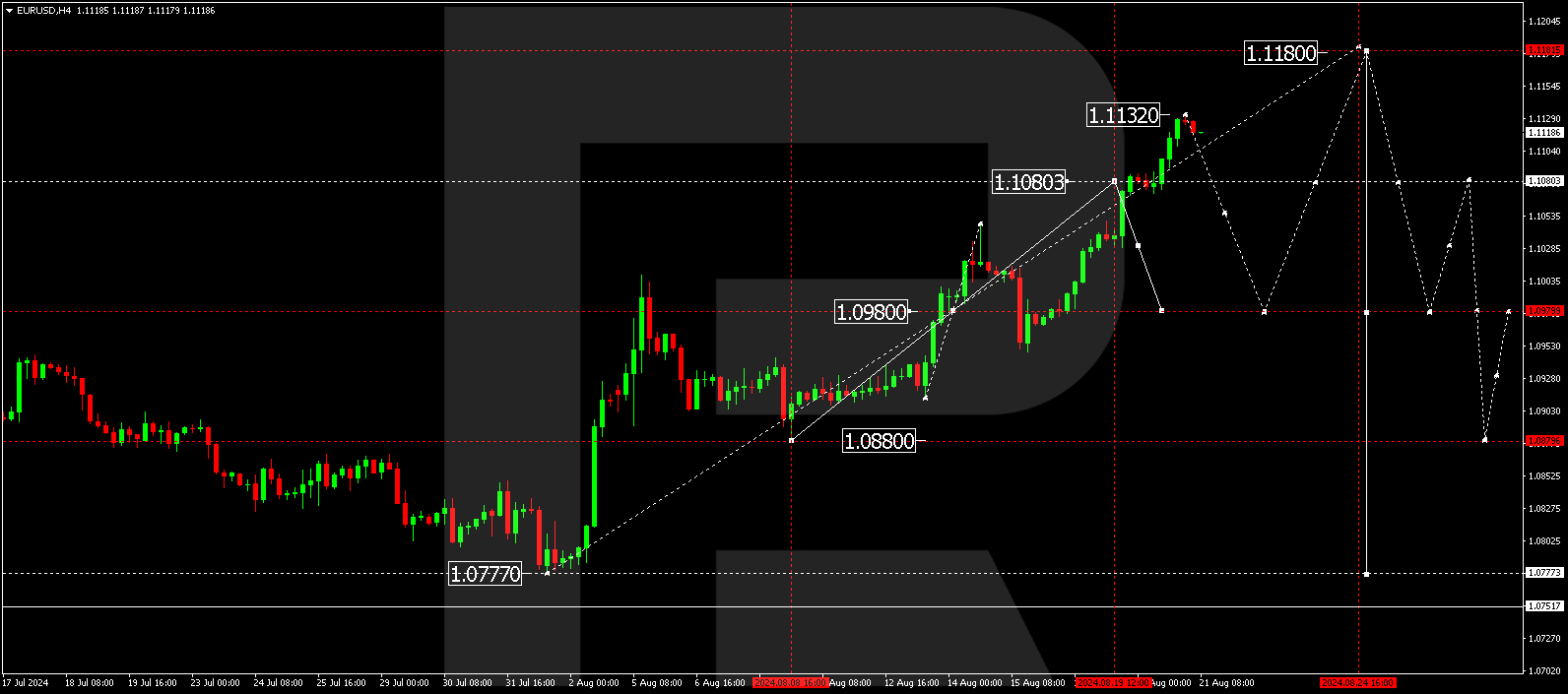

On the EURUSD H4 chart, the market has formed a consolidation range around 1.1080. After breaking above this level, the EURUSD pair maintained its upward momentum towards 1.1135. The current EURUSD analysis for today, 21 August 2024, suggests a decline to 1.1080 (testing from above). If this level is breached, the price is projected to dip further to 1.0980, the first target. A further EURUSD forecast expects a correction towards 1.1080. If the price breaks above this level, the EURUSD analysis shows the potential for a new upward movement to 1.1180. Subsequently, the quotes could pull back, with a decline target at 1.0980 and the prospect of the downtrend continuing to 1.0880.

Summary

The FOMC minutes release, the preliminary data on US interest rate changes, and the EURUSD technical analysis in today’s EURUSD forecast suggest the development of a downward wave towards the 1.1080 and 1.0980 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.