EURUSD is on the rise: investors bet on Fed’s softness

The EURUSD pair is rising to 1.1041 on Monday. The market is convinced of the Federal Reserve’s soft tone. Find out more in our analysis dated 19 August 2024.

EURUSD forecast: key trading points

- The rally in the EURUSD pair is accelerating

- The Federal Reserve’s minutes are expected to refer to an imminent interest rate cut

- EURUSD forecast for 19 August 2024: 1.0980, 1.0930, and 1.0880

Fundamental analysis

The EURUSD rate continues its ascent. The primary currency pair is developing a real rally, driven by a relatively soft tone of the US Federal Reserve. Investors hope to find confirmation of this in the last meeting minutes due this Wednesday. Federal Reserve Chair Jerome Powell is also expected to deliver a speech on Friday.

Powell will have the opportunity to confirm stock market expectations for the monetary policy outlook or refute them. Investors currently estimate the likelihood of a 25-basis-point interest rate cut in September at almost 100%, while the possibility of a 50-basis-point interest rate reduction is estimated at 24.5%.

Stock market emotions have returned to normal, although investors repeatedly start arguing about the Federal Reserve’s too sluggish actions. Some US statistics indicate that the economy may be moving towards recession. In this environment, market participants believe that the Federal Reserve plans to lower interest rates more slowly than required by the circumstances. As a result, the EURUSD forecast shows that the focus will be on interest rates and the trajectory of the Federal Reserve’s monetary policy this week.

EURUSD technical analysis

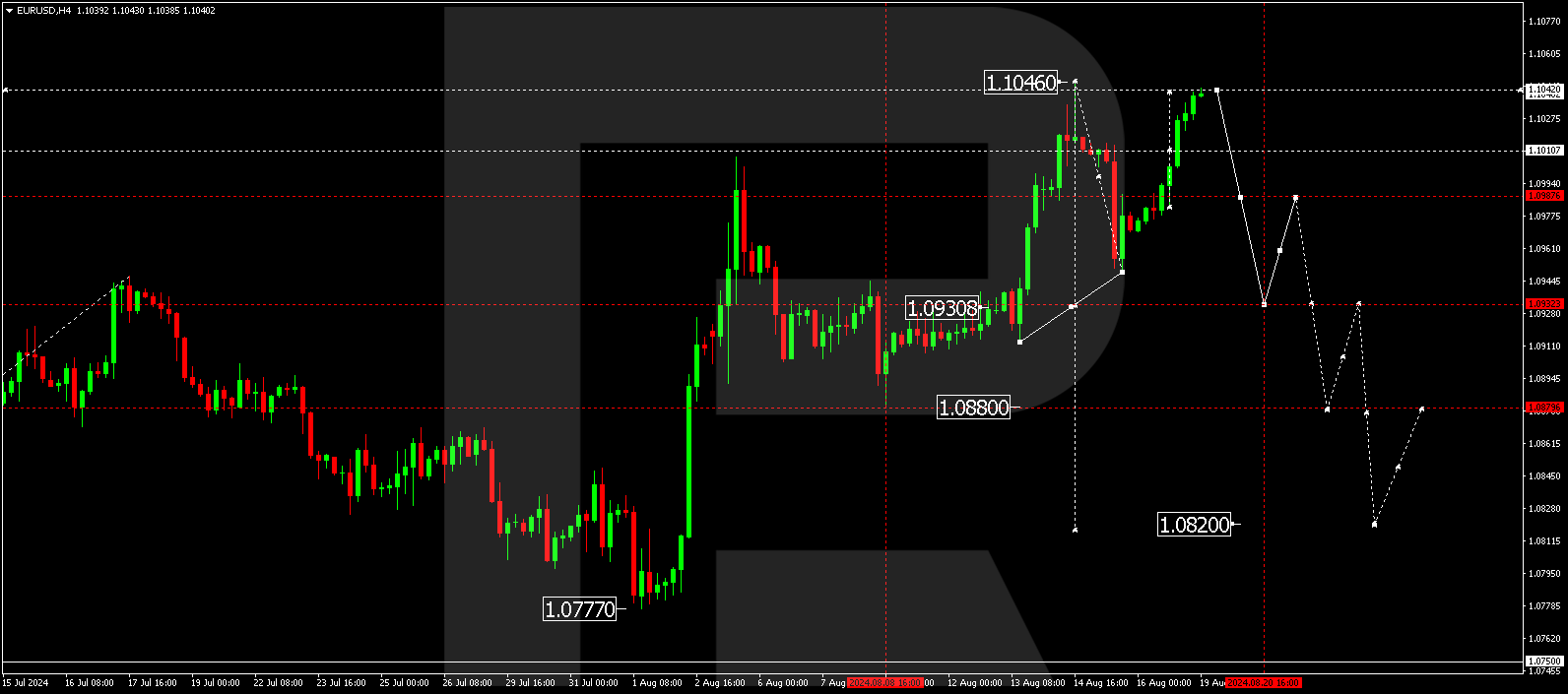

The EURUSD H4 chart shows that the market has completed a growth structure at 1.1012 and formed a consolidation range. After breaking above the range, the market maintains its upward trajectory, aiming for 1.1042. The EURUSD rate is expected to reach this level and form a new consolidation range at the current highs today, 19 August 2024. The range could extend to 1.1046. A downward breakout of the range will open the potential for a decline to 1.0980, potentially continuing to 1.0930, the first target.

Summary

The EURUSD pair maintains upward momentum. Technical indicators in today’s EURUSD forecast suggest that the growth wave will be complete at 1.1042, followed by a decline to the 1.0980, 1.0930, and 1.0880 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.