EURUSD is correcting after growth

The eurozone’s trade balance and easing US inflation may help strengthen the US dollar. Find out more in our analysis dated 16 August 2024.

EURUSD forecast: key trading points

- The eurozone’s trade balance: previously at 13.9 billion, forecasted at 13.3 billion

- Michigan inflation expectations in the US: previously at 2.9%

- Italy’s consumer price index (CPI) (y/y): previously at 1.3%

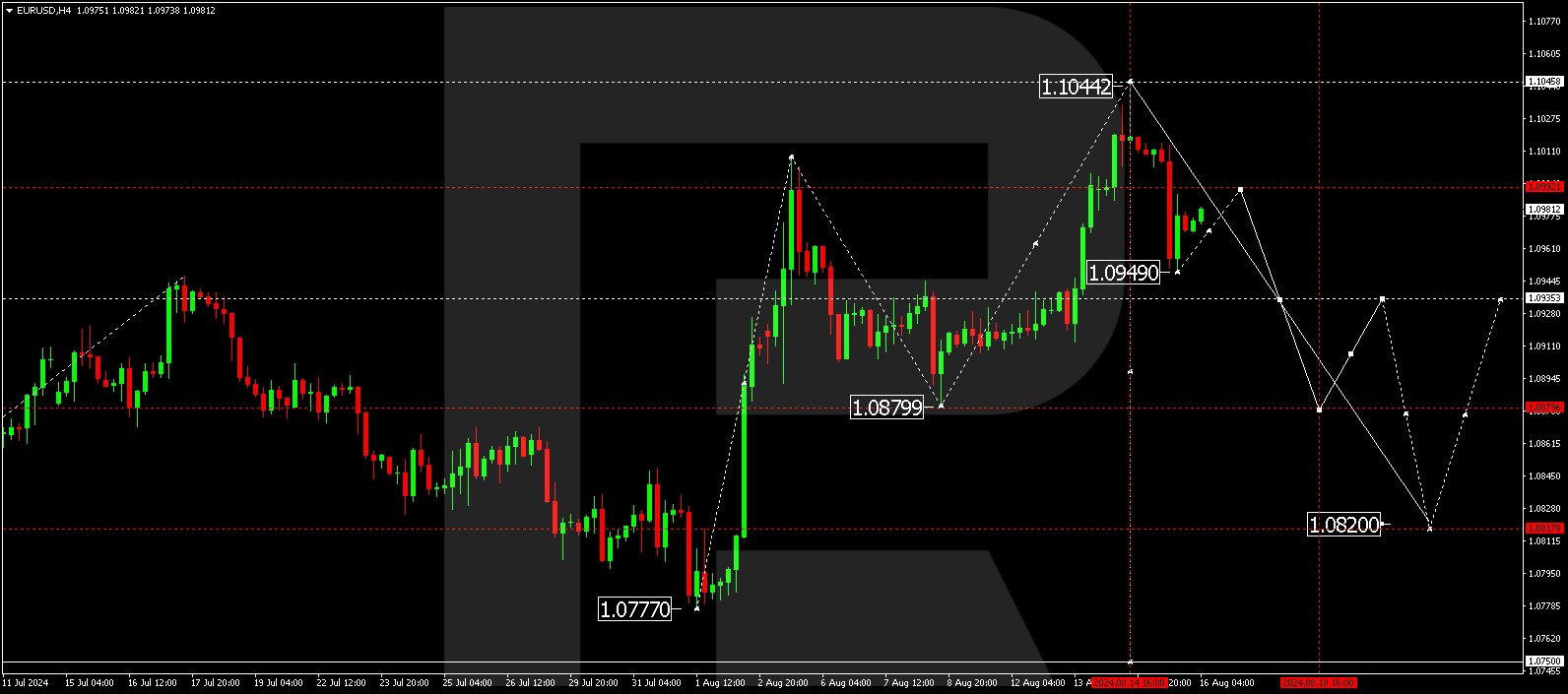

- EURUSD forecast for 16 August 2024: 1.0935, 1.0880, and 1.0820

Fundamental analysis

The balance of trade shows the difference between the value of a country’s exports and imports. A trade surplus indicates that the country exports more than it imports, while a negative trade balance means the opposite. The forecast for 16 August 2024 suggests that the trade balance could decrease to 13.3 billion from the previous 13.9 billion. A decrease in the trade balance may negatively impact the EURUSD rate.

The University of Michigan inflation expectations show the percentage change in prices of goods and services over the next 12 months. Inflation was about 3.0% in the previous periods. The current forecast suggests a 0.1% decrease to 2.9%, which may help strengthen the US dollar against the euro.

The consumer price index (CPI) reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-expected reading typically has a positive impact on the national currency. The forecast for Italy suggests an increase in the CPI from the previous value.

EURUSD technical analysis

On the EURUSD chart, the market has completed a downward impulse, reaching 1.0949. A correction is currently forming towards 1.0992. The price is expected to reach this level and decline to 1.0935 today, 16 August 2024. A breakout below this level will open the potential for a downward wave towards 1.0880, potentially continuing to 1.0820 as the first target.

Summary

Easing US inflation and the fundamental data align with the EURUSD technical analysis. The EURUSD forecast suggests a correction towards 1.0992, followed by a decline to the 1.0935,1.0880, and 1.0820 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.