EURUSD attempts to regain ground after a correction

A decline in the eurozone’s indices may weaken the euro against the US dollar. Find out more in our analysis dated 13 August 2024.

EURUSD forecast: key trading points

- Spain’s Consumer Price Index for July (y/y): previously at 3.4%, forecasted at 2.8%

- The ZEW economic sentiment index for the eurozone: previously at 43.7, forecasted at 35.4

- The US Producer Price Index for July (m/m): previously at 0.2%, forecasted at 0.2%

- EURUSD forecast for 13 August 2024: 1.0944, 1.0880, and 1.0820

Fundamental analysis

Fundamental analysis for 13 August 2024 shows that the EU index data is due today. Almost all indicators are projected to be lower than the previous readings, which may impact the EURUSD rate.

The Consumer Price Index (CPI) reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-forecasted reading typically has a positive effect on the national currency. The forecast for Spain suggests a decline in the CPI to 2.8%.

The ZEW economic sentiment index measures sentiment among Germany’s institutional investors. A reading above zero indicates optimistic expectations, while a reading below zero points to investor pessimism. Although the index stands above zero, today’s forecast for the euro is not promising. It suggests an index decline to 43.7, which may, in turn, impact the EURUSD pair.

The Producer Price Index (PPI) is an inflation indicator that gauges average changes in prices of local manufacturers’ goods and services. The index captures price changes from the sellers’ perspective and covers three industrial sectors, particularly the manufacturing industry, commodities, and processing. Given that increased producer costs for goods and services may be passed on to consumers, the PPI is often considered the leading indicator of consumer inflation. US PPI data is projected to remain unchanged compared to the previous period. The EURUSD forecast and today’s news suggest a correction ahead of a decline.

EURUSD technical analysis

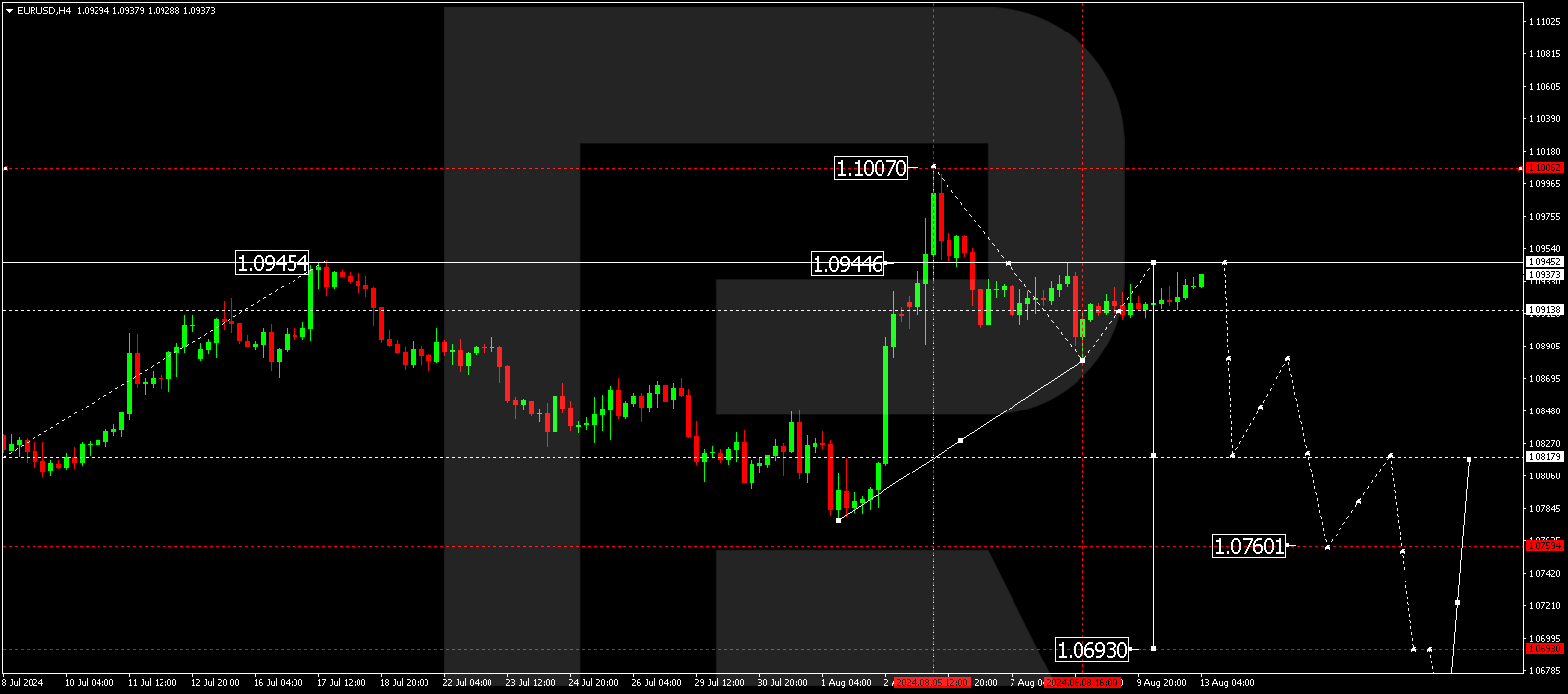

The H4 EURUSD chart shows that the market has received support at 1.0914. The EURUSD rate is expected to continue its ascent towards (at least) 1.0944 today, 13 August 2024. This growth is considered a correction of the initial downward wave. The EURUSD technical analysis shows that a new downward wave could start once the correction is complete, aiming for 1.0880. A breakout below this level might open the potential for a further decline towards 1.0820, the local estimated target.

Summary

A decline in the eurozone’s indices may weaken the euro against the US dollar. From a technical analysis perspective, the EURUSD forecast for today suggests a correction towards 1.0944, followed by a potential decline to the 1.0880 and 1.0820 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.